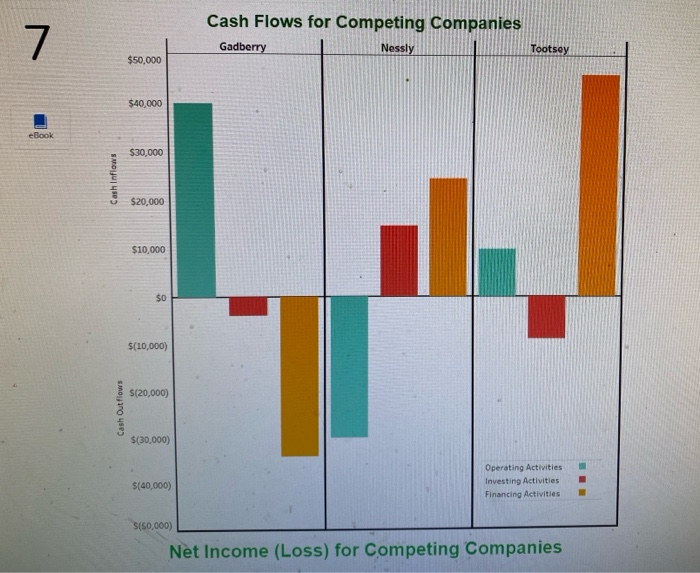

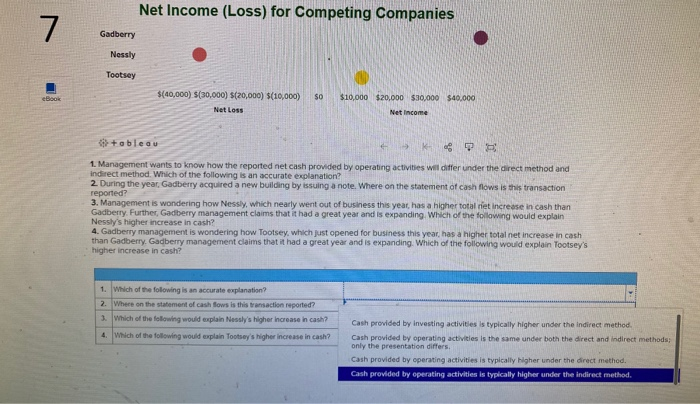

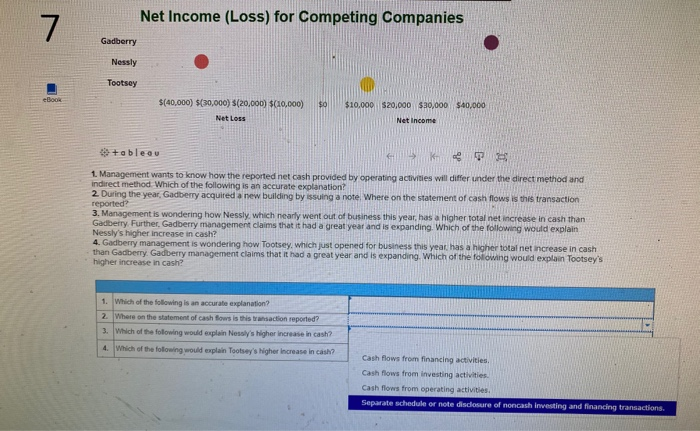

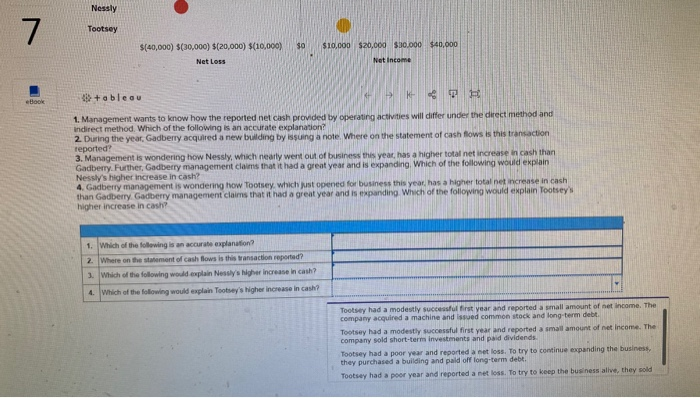

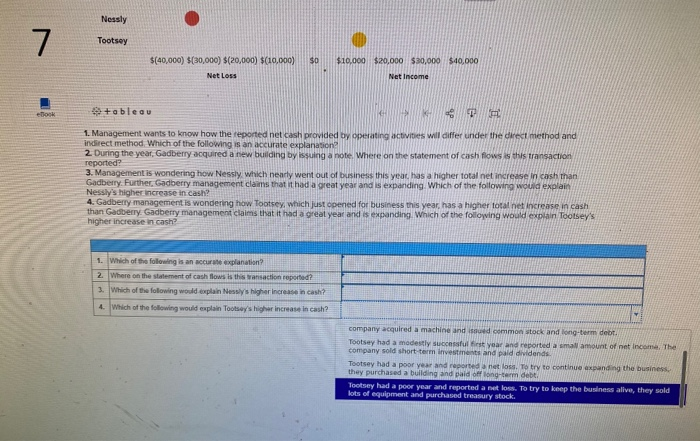

As consultants in advisory services at an accounting firm, we are hired by management of Gadberry to advise on cash flow reporting Management is concerned about the relatively small net increase in cash, and how the company is doing compared to competitors Nessly and Tootsey. The following Tableau Dashboard will assist in our analysis Cash Flows for Competing Companies Gadberry Nessly Tootsey $50,000 $40,000 $30,000 Cash now $10,000 S(10,000) S(20,000) $(30,000) Operating Activities Cash Flows for Competing Companies Gadberry Tootsov $50,000 $40,000 $30,000 Cash inflows $20,000 $10,000 S(10,000) & $(20,000) Cash Outflows $(30,000) S(40,000) Operating Activities Investing Activities Financing Activities S(50,000) Net Income (Loss) for Competing Companies Net Income (Loss) for Competing Companies Gadberry Nessly Tootsey $(40,000) $(30,000) $(20,000) $(10,000) $0 $10,000 $20.000 $10,000 $40.000 tableau 1. Management wants to know how the reported net cash provided by operating activities wil differ under the direct method and indirect method. Which of the following is an accurate explanation? 2. During the year, Gadberry acquired a new building by issuing a note. Where on the statement of cash flows is this transaction reported? 3. Management is wondering how Nessly, which nearly went out of business this year, has a higher total niet increase in cash than Gadberry Further Gadberry management claims that it had a great year and is expanding Which of the following would explain Nessly's higher increase in cash? 4. Gadberry management is wondering how Tootsey, which just opened for business this year, has a higher total net increase in cash than Gadberry. Gadberry management claims that it had a great year and is expanding. Which of the following would explain Tootsey's higher increase in cash 1. Which of the following is an accurate explanation? 2. Where on the statement of cash flows is this transaction reported? 3. Which of the following would wplain Nessly's higher increase in cash? 4. Which of the following would explain Tootsey's higher increase in cash? Cash provided by investing activities is typically higher under the Indirect method Cash provided by operating activities is the same under both the direct and indirect methods only the presentation offers Cash provided by operating activities is typicy her under the direct method Cash provided by operating activities is typically higher under the indirect method Net Income (Loss) for Competing Companies Gadberry Nessly Tootsey $0 $10,000 $20,000 $30,000 $40,000 $(40,000) (10,000) (20,000) $10,000) Net Loss tableau P 1 Management wants to know how the reported net cash provided by operating activities will differ under the direct method and Indirect method Which of the following is an accurate explanation? 2. During the year, Gadbery acquired a new building by issuing a note Where on the statement of cash flows this transaction reported 3. Management is wondering how Nessly, which nearly went out of business this year, has a higher total net increase in cash than Gadbetry. Further, Gadberry management claims that it had a great year and is expanding. Which of the following would explain Nessly's higher increase in cash? 4. Gadbery management is wondering how Tootsey, which just opened for business this year has a higher total net increase in cash than Gadberry. Gadberry management claims that it had a great year and is expanding. Which of the following would explain Tootsey's higher increase in cash 1. Which of the following is an accurate explanation? 2. Where on the statement of cash flows is this ansaction reported 3. Which of the following would explain Nessly's higher increase in cash? 4. Which of the following would explain Tootsey's Nigher increase in cash? Cash flows from financing activities. Cash flows from investing activities Cash flows from operating activities Separate schedule or note disclosure of noncash investing and financing transactions. Nessly Tootsey $0 $(40,000) $(30,000) $(20,000) $(10,000) Net Loss $10,000 $20,000 $30,000 $40,000 Net Income - tableau 1. Management wants to know how the reported net cash provided by operating activities will differ under the direct method and indirect method. Which of the following is an accurate explanation? 2. During the year, Gadbery acquired a new building by issuing a note Where on the statement of cash flows is this transaction reported? 3. Management is wondering how Nessly which nearly went out of business this year, has a higher total net increase in cash than Gadberry. Further, Gadberry management claims that it had a great year and is expanding Which of the following would explain Nessly's higher increase in cash? 4. Gadberry management is wondering how Tootsey, which just opened for business this year, has a higher total net increase in cash than Gadberry. Gadberry management claims that it had a great year and is expanding. Which of the following would explain Tootsey's higher increase in cash? 1. Which of the following is an accurate explanation? 2. Where on the statement of cash flows is this transaction reported? 3. Which of the following would explain Nessly's higher increase in cash? 4. Which of the following would explain Tootsey's higher increase in cash? Nessly had a great year and reported high net income. The company purchased new Intangible assets and acquired treasury stock. Nessly had a great year and reported high net income. The company purchased new Intangible assets and issued more common stock Nessly had a poor year and reported a netow To keep the business afloat, they sold equipment and issued long-term debt Nessly had a poor year and reported a net loss. To try to expand the business, they acquired Wenn man santhalten Nessly Tootsey $0 $10,000 (40,000) (10,000) $20,000) $10,000) Net Loss $20,000 $80.000 $40,000 + ableau >