Answered step by step

Verified Expert Solution

Question

1 Approved Answer

as fast as you can with formulas please and thank you The Crunchcorn company manufactures three types of snacks: 1. Popped corn - offering a

as fast as you can with formulas please and thank you

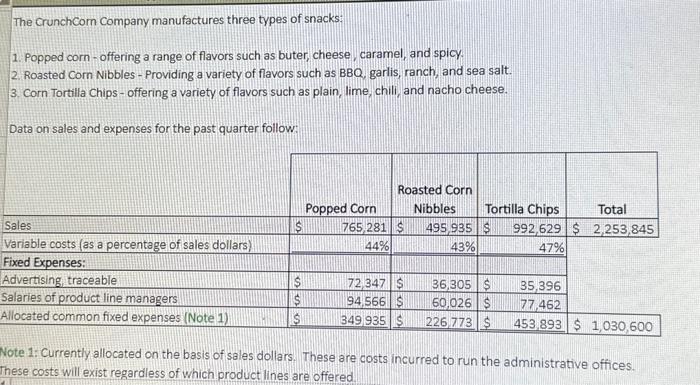

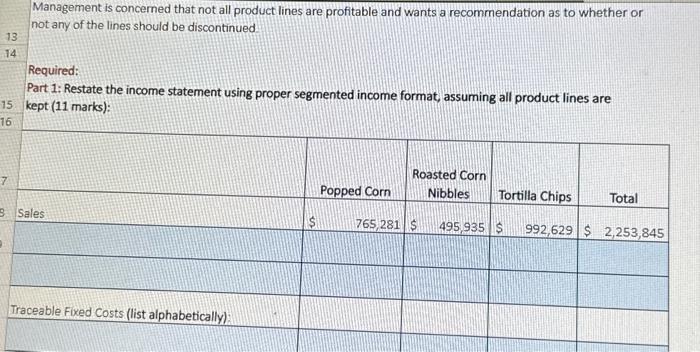

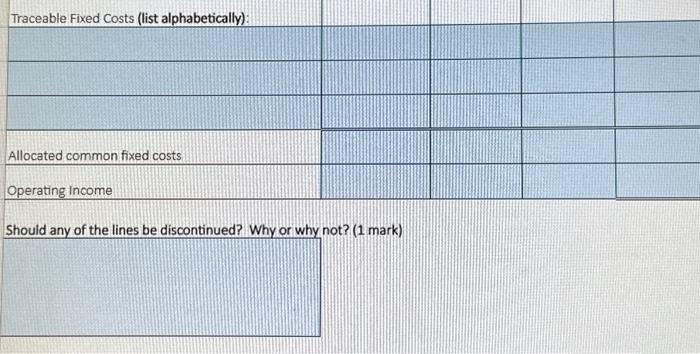

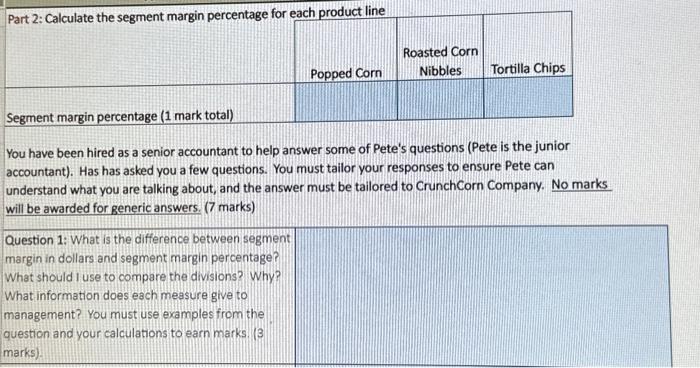

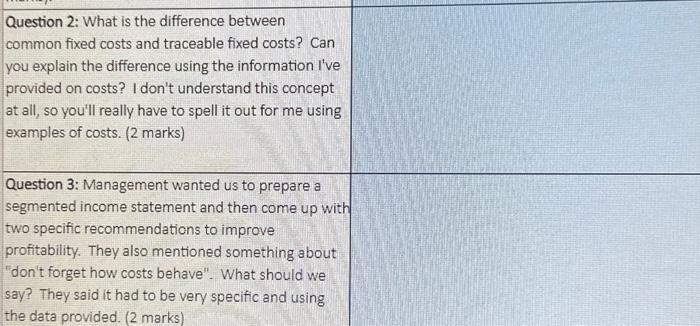

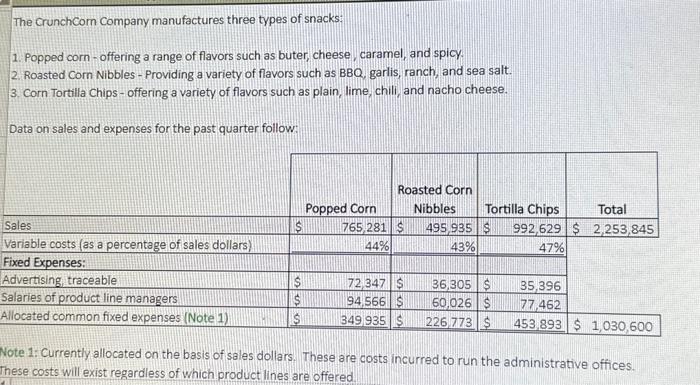

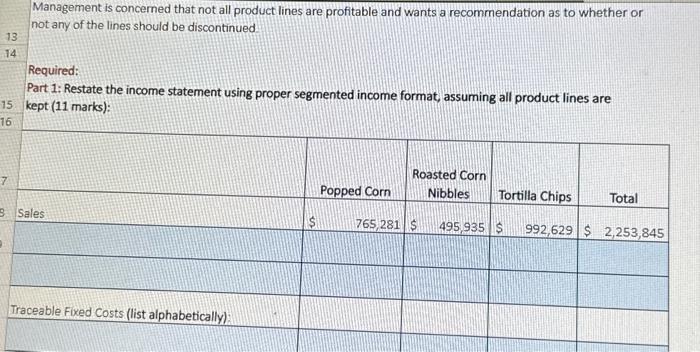

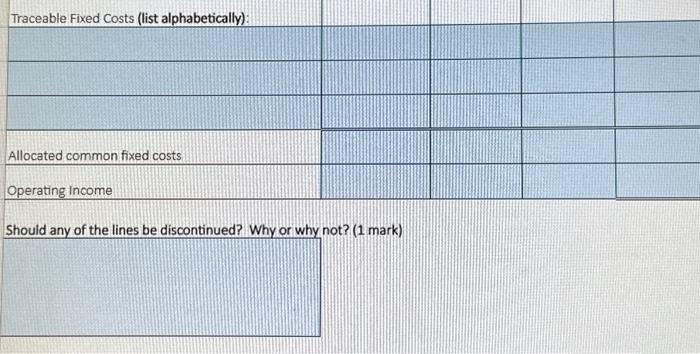

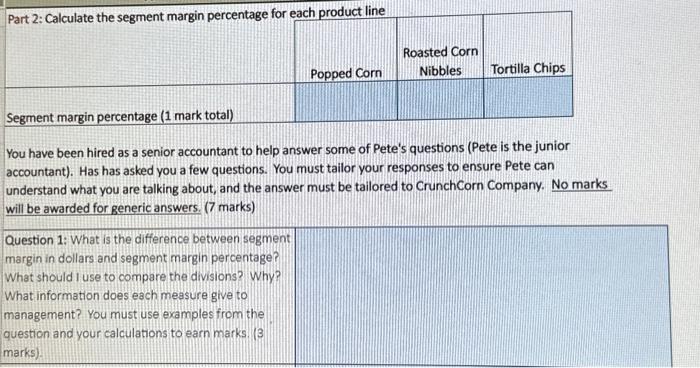

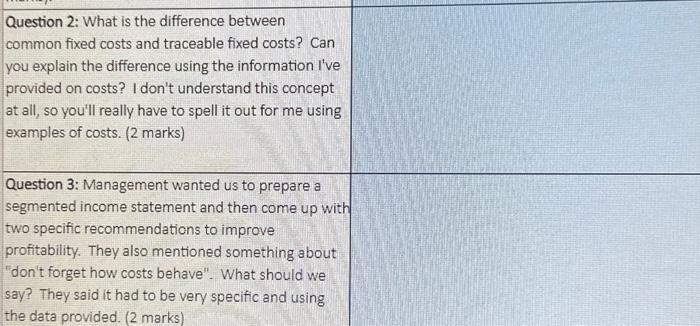

The Crunchcorn company manufactures three types of snacks: 1. Popped corn - offering a range of flavors such as buter, cheese, caramel, and spicy. 2. Roasted Com Nibbles - Providing a variety of flavors such as BBQ, garlis, ranch, and sea salt. 3. Corn Tortilla Chips - offering a variety of flavors such as plain, lime, chili, and nacho cheese. Data on sales and expenses for the past quarter follow: Note 1: Currently allocated on the basis of sales dollars. These are costs incurred to run the administrative offices. hese costs will exist regardless of which product lines are offered. Management is concerned that not all product lines are profitable and wants a recommendation as to whether or not any of the lines should be discontinued Required: Part 1: Restate the income statement using proper segmented income format, assuming all product lines are kept (11 marks): \begin{tabular}{l} Traceable Fixed costs (list alphabetically): \\ \hline Ollocated common fixed costs \\ Operating income \end{tabular} Should any of the lines be discontinued? Why or why not? (1 mark) Part 2: Calculate the segment margin percentage for each product line Segment margin percentage ( 1 mark total) You have been hired as a senior accountant to help answer some of Pete's questions (Pete is the junior accountant). Has has asked you a few questions. You must tailor your responses to ensure Pete can understand what you are talking about, and the answer must be tailored to CrunchCorn Company. No marks will be awarded for generic answers. ( 7 marks) Question 1: What is the difference between segment margin in dollars and segment margin percentage? What should I use to compare the divisions? Why? What information does each measure give to management? You must use examples from the question and your calculations to earn marks. (3 marks). Question 2: What is the difference between common fixed costs and traceable fixed costs? Can you explain the difference using the information I've provided on costs? I don't understand this concept at all, so you'll really have to spell it out for me using examples of costs. ( 2 marks) Question 3: Management wanted us to prepare a segmented income statement and then come up with two specific recommendations to improve profitability. They also mentioned something about "don't forget how costs behave". What should we say? They said it had to be very specific and using the data provided. ( 2 marks) The Crunchcorn company manufactures three types of snacks: 1. Popped corn - offering a range of flavors such as buter, cheese, caramel, and spicy. 2. Roasted Com Nibbles - Providing a variety of flavors such as BBQ, garlis, ranch, and sea salt. 3. Corn Tortilla Chips - offering a variety of flavors such as plain, lime, chili, and nacho cheese. Data on sales and expenses for the past quarter follow: Note 1: Currently allocated on the basis of sales dollars. These are costs incurred to run the administrative offices. hese costs will exist regardless of which product lines are offered. Management is concerned that not all product lines are profitable and wants a recommendation as to whether or not any of the lines should be discontinued Required: Part 1: Restate the income statement using proper segmented income format, assuming all product lines are kept (11 marks): \begin{tabular}{l} Traceable Fixed costs (list alphabetically): \\ \hline Ollocated common fixed costs \\ Operating income \end{tabular} Should any of the lines be discontinued? Why or why not? (1 mark) Part 2: Calculate the segment margin percentage for each product line Segment margin percentage ( 1 mark total) You have been hired as a senior accountant to help answer some of Pete's questions (Pete is the junior accountant). Has has asked you a few questions. You must tailor your responses to ensure Pete can understand what you are talking about, and the answer must be tailored to CrunchCorn Company. No marks will be awarded for generic answers. ( 7 marks) Question 1: What is the difference between segment margin in dollars and segment margin percentage? What should I use to compare the divisions? Why? What information does each measure give to management? You must use examples from the question and your calculations to earn marks. (3 marks). Question 2: What is the difference between common fixed costs and traceable fixed costs? Can you explain the difference using the information I've provided on costs? I don't understand this concept at all, so you'll really have to spell it out for me using examples of costs. ( 2 marks) Question 3: Management wanted us to prepare a segmented income statement and then come up with two specific recommendations to improve profitability. They also mentioned something about "don't forget how costs behave". What should we say? They said it had to be very specific and using the data provided. ( 2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started