Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As marketing head at Berries Ltd, Mr. Nasir received the following salary/benefits for the tax year 2019: 1. Salary: Rs.450,000 per month 2. A special

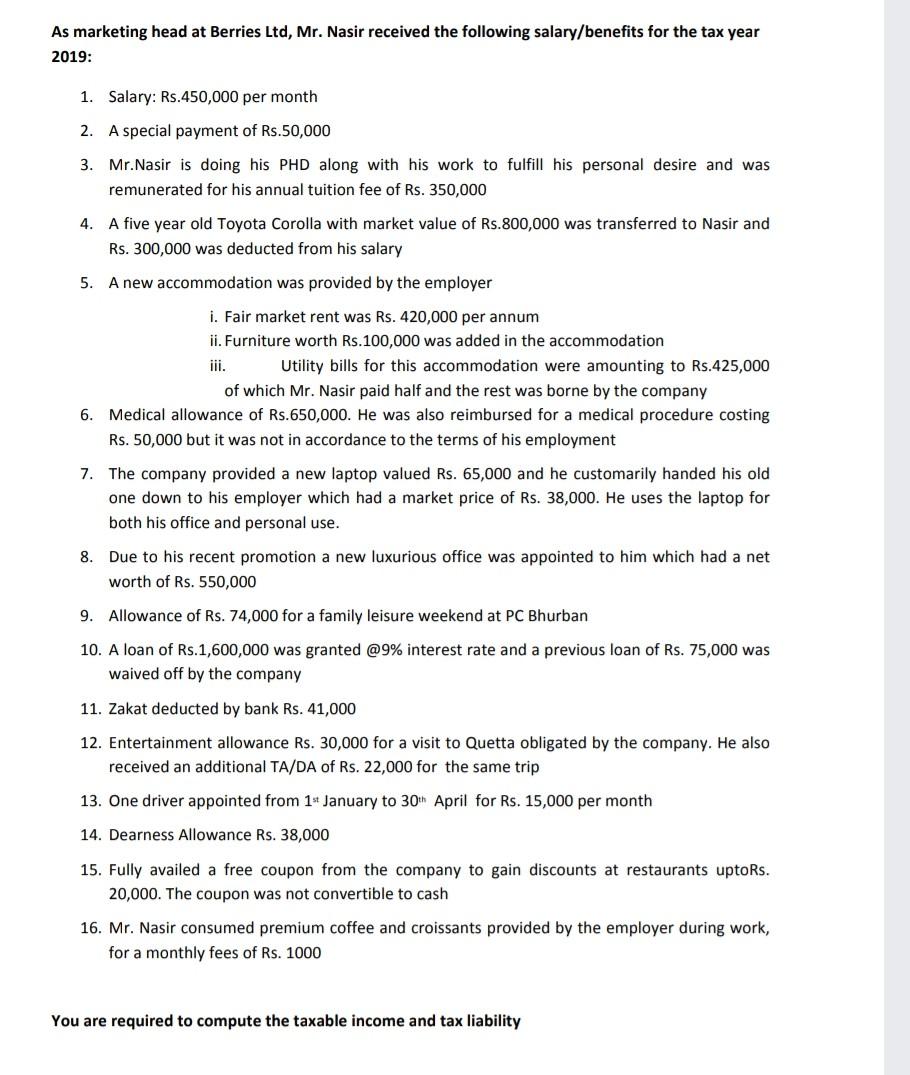

As marketing head at Berries Ltd, Mr. Nasir received the following salary/benefits for the tax year 2019: 1. Salary: Rs.450,000 per month 2. A special payment of Rs.50,000 3. Mr. Nasir is doing his PHD along with his work to fulfill his personal desire and was remunerated for his annual tuition fee of Rs. 350,000 4. A five year old Toyota Corolla with market value of Rs.800,000 was transferred to Nasir and Rs. 300,000 was deducted from his salary 5. A new accommodation was provided by the employer i. Fair market rent was Rs. 420,000 per annum ii. Furniture worth Rs.100,000 was added in the accommodation Utility bills for this accommodation were amounting to Rs.425,000 of which Mr. Nasir paid half and the rest was borne by the company 6. Medical allowance of Rs.650,000. He was also reimbursed for a medical procedure costing Rs. 50,000 but it was not in accordance to the terms of his employment 7. The company provided a new laptop valued Rs. 65,000 and he customarily handed his old one down to his employer which had a market price of Rs. 38,000. He uses the laptop for both his office and personal use. 8. Due to his recent promotion a new luxurious office was appointed to him which had a net worth of Rs. 550,000 9. Allowance of Rs. 74,000 for a family leisure weekend at PC Bhurban 10. A loan of Rs.1,600,000 was granted @9% interest rate and a previous loan of Rs. 75,000 was waived off by the company 11. Zakat deducted by bank Rs. 41,000 12. Entertainment allowance Rs. 30,000 for a visit to Quetta obligated by the company. He also received an additional TA/DA of Rs. 22,000 for the same trip 13. One driver appointed from 1st January to 30th April for Rs. 15,000 per month 14. Dearness Allowance Rs. 38,000 15. Fully availed a free coupon from the company to gain discounts at restaurants upto Rs. 20,000. The coupon was not convertible to cash 16. Mr. Nasir consumed premium coffee and croissants provided by the employer during work, for a monthly fees of Rs. 1000 You are required to compute the taxable income and tax liability

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started