Question

As Michael O'Leary reflected on his two decades at the helm of Ryanair, he was pleased with the results of his strategy for the airline.

As Michael O'Leary reflected on his two decades at the helm of Ryanair, he was pleased with the results of his strategy for the airline. When he assumed the position of CEO in 1994, Ryanair was a small airline with less than ?10M in profits. By fiscal 2014, Ryanair had posted over ?523M in profits on a sales base of over ?5B, carrying over 80M passengers a year all achieved with a record of no major accidents. During his tenure, he saw several failed attempts at mimicking his low cost strategy including by deep-pocketed incumbents such as British Airways and Virgin. As he surveyed the competitive landscape in 2014, however, he saw new threats on the horizon. Looking at the stock performance of Ryanair (see Exhibit 1) he saw that Ryanair had generated more than twice the value for its shareholders in the 2000-14 time period as compared with British Airways. However, he was not too pleased that EasyJet, another low cost airline that was less than a third the size of Ryanair in 2000, had grown by 2014 to a ?5B business generating profits of ?474M. Adding to this was the stunning shareholder value that EasyJet appears to have created. An investment of ?10,000 in 2000 in EasyJet stock was worth ?62,000 in 2014, just under twice the value that Ryanair generated over the same period.

O'Leary understood that he had to pay more attention to EasyJet as a credible competitor. However, he was puzzled why the stock market return was so much higher for EasyJet in spite of being less profitable on a similar sales base. Later that afternoon he was scheduled to welcome their newest hire, an MBA from a top business school in London. He decided that the new hire should come up with answers to the following three questions: (1) what explains the performance of EasyJet over the last decade; (2) how is the strategy of EasyJet similar to or different from Ryanair; and, (3) how should Ryanair respond to the threat from EasyJet.

Airline Industry in Europe

The airline industry in Europe, as in other advanced economies, is segmented along the service quality dimension. The full service carriers (FSCs) focused on convenience, comfort, and higher quality service. In contrast, the low cost carriers (LCCs) sought to pare costs as much as possible and offer customers affordable, no-frills service. In recent years, however, the market trend toward LCCs is unmistakable. Over 2003-14, the CAGR forLondonBusiness School The Case Centre:

Copyright 2015 London Business School London experience. World impact. 2

passenger volume growth was about 6 percent for the industry as a whole. Of this, LCCs accounted for 13.5 percent and the FSCs for 1.3 percent (Exhibit 2).

The European airline industry as a whole was still dominated by the FSCs with only two LCCs (Ryanair and EasyJet) in the top five airlines by passenger volume (Exhibit 3). The long-haul travel market (i.e., flights to Africa, Asia, and North America) explains much of this difference in volumes.

Three interconnected trends are affecting the European Airline Market. First, there has been a strong consolidation pressure in the FSC segment; most prominently, Air France merged with KLM in 2004; Lufthansa acquired Swiss in 2007 and Austrian Airlines in 2009; and British Airways merged with Iberia in 2011. Second, spearheaded by Turkish Airlines and Emirates, Middle Eastern airlines have begun an aggressive push into the European market, putting additional competitive pressure on the full-service segment. Third, driven by an increasing acceptance of the LCC business model and higher price sensitivity, there has been a strong pressure for FSCs to move closer to the LCC business model. At the same time, the LCCs are moving closer to the full-service business model; for example, EasyJet introduced allocated seating and Ryanair now allows for a small second carry-on bag, both efforts to differentiate themselves from other LCCs.

Customer segments

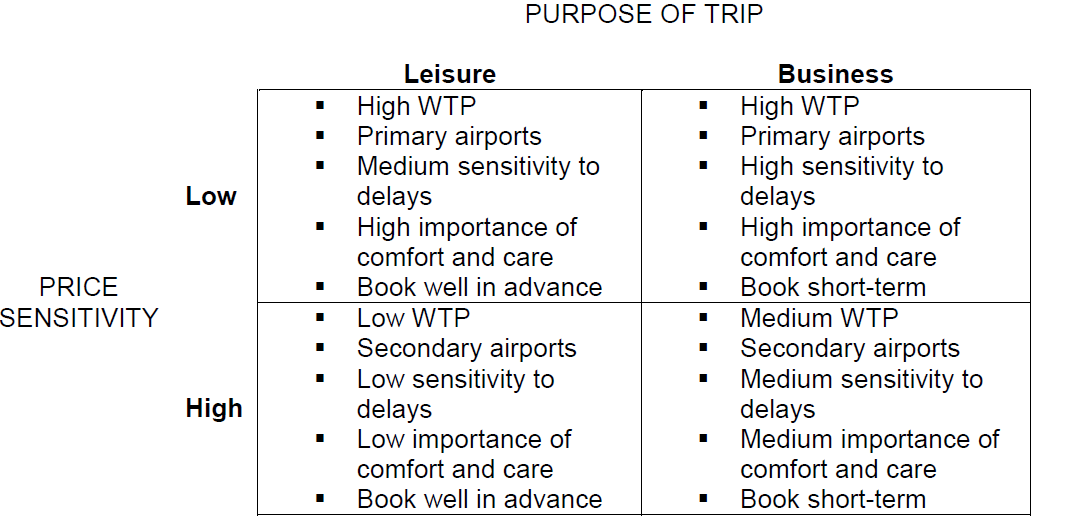

The intra-European air travel market can be segmented along two dimensions: price sensitivity and purpose of the trip; producing four coarse-grained segments with different needs. The chart below summarizes the preferences in each of the four quadrants. The main differences in the segments were around: (1) willingness to pay, (2) primary or secondary airports, (3) sensitivity to schedules, (4) comfort, and, (5) planned versus unplanned travel. While the LCCs certainly dominated the lower left quadrant, they were gradually expanding into the lower right quadrant as well.

PRICE SENSITIVITY Low Leisure " High WTP Primary airports PURPOSE OF TRIP Business High WTP Primary airports High sensitivity to delays Medium sensitivity to delays High importance of comfort and care High importance of Book well in advance Book short-term . Low WTP Secondary airports comfort and care Medium WTP Secondary airports High Low importance of comfort and care Book well in advance Low sensitivity to delays Medium sensitivity to delays Medium importance of comfort and care Book short-term

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started