Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As of 12/31/X1, the company's cash balance per its bank statement was $1,099 and its balance per its books was $1,125. In addition, in

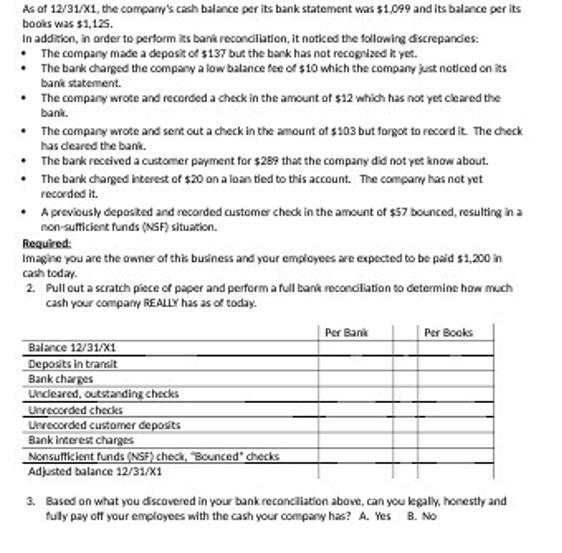

As of 12/31/X1, the company's cash balance per its bank statement was $1,099 and its balance per its books was $1,125. In addition, in order to perform its bank reconciliation, it noticed the following discrepancies: The company made a deposit of $137 but the bank has not recognized it yet. The bank charged the company a low balance fee of $10 which the company just noticed on its bank statement. The company wrote and recorded a check in the amount of $12 which has not yet cleared the bank. The company wrote and sent out a check in the amount of $103 but forgot to record it. The check has cleared the bank. The bank received a customer payment for $289 that the company did not yet know about. The bank charged interest of $20 on a loan tied to this account. The company has not yet recorded it. A previously deposited and recorded customer check in the amount of $57 bounced, resulting in a non-sufficient funds (NSF) situation. Required: Imagine you are the owner of this business and your employees are expected to be paid $1,200 in cash today. 2. Pull out a scratch piece of paper and perform a full bank reconciliation to determine how much cash your company REALLY has as of today. Balance 12/31/X1 Deposits in transit Bank charges Uncleared, outstanding checks Unrecorded checks Unrecorded customer deposits Bank interest charges Nonsufficient funds (NSF) check, "Bounced" checks Adjusted balance 12/31/X1 Per Bank Per Books 3. Based on what you discovered in your bank reconciliation above, can you legally, honestly and fully pay off your employees with the cash your company has? A. Yes B. No

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Let me perform the bank reconciliation on a scratch piece of paper Balance 1231X1 Per B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started