Question

As of December 31, 2001, PT Sukses Makmur with outstanding ordinary shares of Rp 30,000 had the following assets and liabilities: During 2001, retained earnings

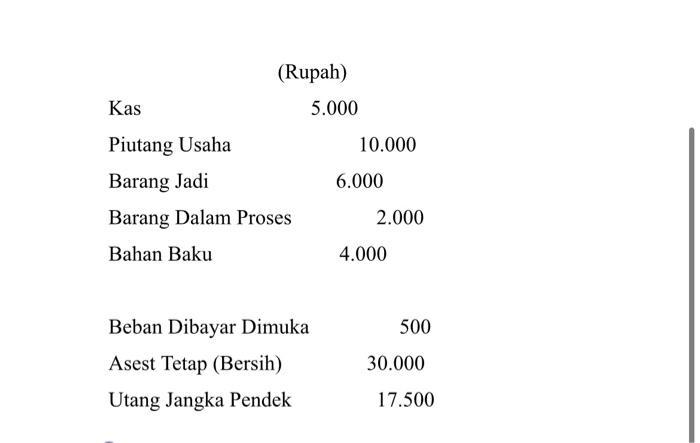

As of December 31, 2001, PT Sukses Makmur with outstanding ordinary shares of Rp 30,000 had the following assets and liabilities:

During 2001, retained earnings increased by 50% as a result of business for the year. No dividends were paid during the year. The balance of trade receivables, prepaid expenses, short-term payables and ordinary share capital as of December 31, 2002 is the same as the balance as of December 31, 2001.

Inventories are reduced by 40% except for finished goods, which are reduced by 30%. Fixed assets (net) were reduced due to depreciation of Rp 4,000, was charged to factory overhead and was charged to administrative expenses. Sales of 60,000 were made on credit with a cost of Rp. 38,000. The direct labor cost is Rp. 9,000. Factory overhead is charged at a rate of 100% of direct labor costs and an understated overhead balance of CU2,000 where this amount is closed to the cost of goods sold account. Total marketing and administrative expenses (including depreciation) accounted for 10% and 15% of gross sales, respectively.

Requested:

a. Prepare a balance sheet as of December 31, 2002.

b. Prepare an income statement for 2002 including details of cost of goods manufactured and cost of goods sold.

(Rupah) Kas 5.000 Piutang Usaha 10.000 Barang Jadi 6.000 Barang Dalam Proses 2.000 Bahan Baku 4.000 Beban Dibayar Dimuka 500 Asest Tetap (Bersih) 30.000 Utang Jangka Pendek 17.500

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Balance Sheet As of December 312001 Assets Cash 5000 Accounts Receiva...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started