Question

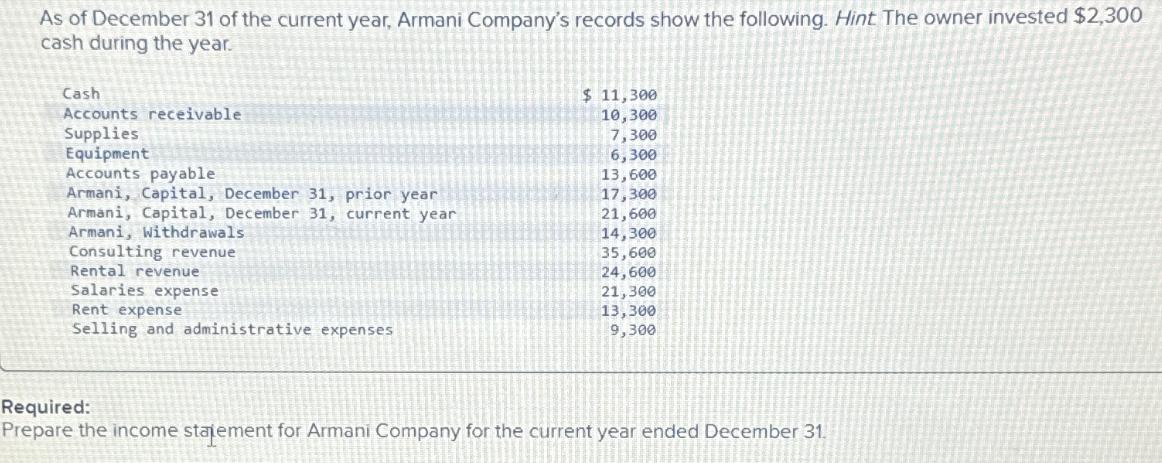

As of December 31 of the current year, Armani Company's records show the following. Hint. The owner invested $2,300 cash during the year Cash

As of December 31 of the current year, Armani Company's records show the following. Hint. The owner invested $2,300 cash during the year Cash Accounts receivable Supplies Equipment $ 11,300 10,300 7,300 6,300 Accounts payable 13,600 Armani, Capital, December 31, prior year 17,300 Armani, Capital, December 31, current year 21,600 Armani, Withdrawals 14,300 Consulting revenue 35,600 Rental revenue 24,600 Salaries expense 21,300 Rent expense 13,300 Selling and administrative expenses 9,300 Required: Prepare the income statement for Armani Company for the current year ended December 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the income statement for Armani Company for the current ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan E. Duchac

22nd Edition

324401841, 978-0-324-6250, 0-324-62509-X, 978-0324401844

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App