Answered step by step

Verified Expert Solution

Question

1 Approved Answer

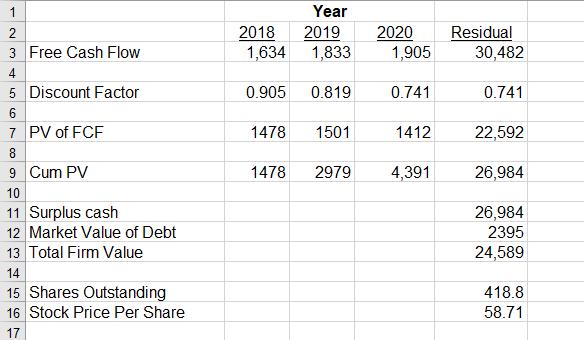

As of today, Best Industries' stock was trading at about $29 per share, with approximately 418.8 million shares outstanding. Based on your FCF analysis, would

As of today, Best Industries' stock was trading at about $29 per share, with approximately 418.8 million shares outstanding. Based on your FCF analysis, would you recommend purchasing the stock? Why or why not?

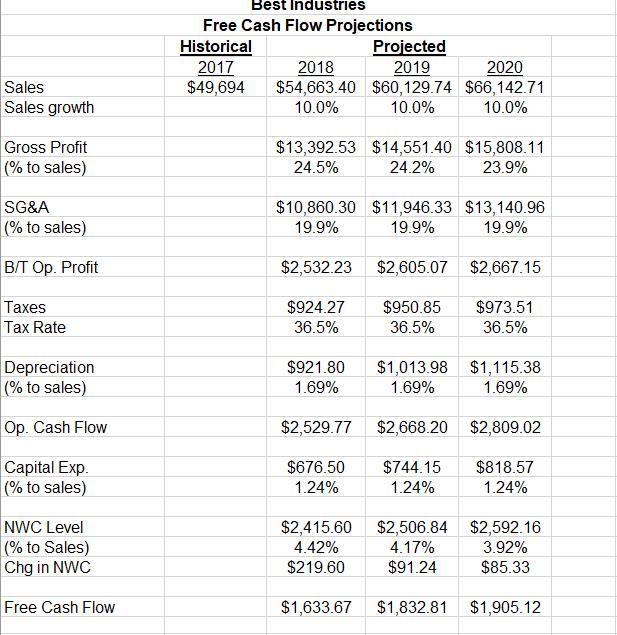

Sales Sales growth Gross Profit (% to sales) SG&A (% to sales) B/T Op. Profit Taxes Tax Rate Depreciation (% to sales) Op. Cash Flow Capital Exp. (% to sales) NWC Level (% to Sales) Chg in NWC Free Cash Flow Best Industries Free Cash Flow Projections Historical 2017 $49,694 Projected 2019 2018 2020 $54,663.40 $60,129.74 $66,142.71 10.0% 10.0% 10.0% $13,392.53 $14,551.40 $15,808.11 24.5% 24.2% 23.9% $10,860.30 $11,946.33 $13,140.96 19.9% 19.9% 19.9% $2,532.23 $2,605.07 $924.27 $950.85 36.5% 36.5% $921.80 1.69% $2,529.77 $676.50 1.24% $1,013.98 1.69% $2,668.20 $744.15 1.24% $2,667.15 $973.51 36.5% $1,115.38 1.69% $2,809.02 $818.57 1.24% $2,415.60 $2,506.84 $2,592.16 4.42% 4.17% 3.92% $219.60 $91.24 $85.33 $1,633.67 $1,832.81 $1,905.12

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether to recommend purchasing Best Industries stock based on the Free Cash Flow FCF a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started