Question

As of today, you have money to make a down payment on a house which you expect to buy in five years. You are considering

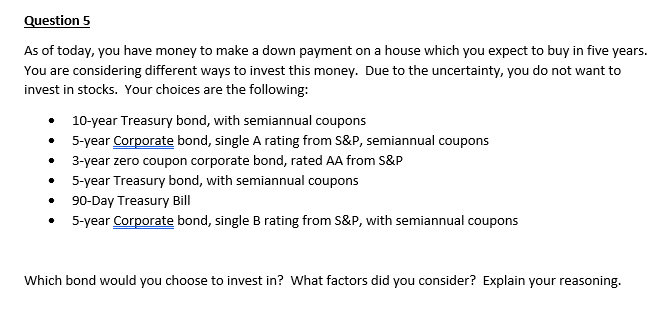

As of today, you have money to make a down payment on a house which you expect to buy in five years. You are considering different ways to invest this money. Due to the uncertainty, you do not want to invest in stocks. Your choices are the following: 10-year Treasury bond, with semiannual coupons 5-year Corporate bond, single A rating from S&P, semiannual coupons 3-year zero coupon corporate bond, rated AA from S&P 5-year Treasury bond, with semiannual coupons 90-Day Treasury Bill 5-year Corporate bond, single B rating from S&P, with semiannual coupons Which bond would you choose to invest in? What factors did you consider? Explain your reasoning.

As of today, you have money to make a down payment on a house which you expect to buy in five years. You are considering different ways to invest this money. Due to the uncertainty, you do not want to invest in stocks. Your choices are the following: 10-year Treasury bond, with semiannual coupons 5-year Corporate bond, single A rating from S&P, semiannual coupons 3-year zero coupon corporate bond, rated AA from S&P 5-year Treasury bond, with semiannual coupons 90-Day Treasury Bill 5-year Corporate bond, single B rating from S&P, with semiannual coupons Which bond would you choose to invest in? What factors did you consider? Explain your reasoning.

Please answer in detail.

Question 5 As of today, you have money to make a down payment on a house which you expect to buy in five years. You are considering different ways to invest this money. Due to the uncertainty, you do not want to invest in stocks. Your choices are the following: 10-year Treasury bond, with semiannual coupons 5-year Corporate bond, single A rating from S&P, semiannual coupons 3-year zero coupon corporate bond, rated AA from S&P 5-year Treasury bond, with semiannual coupons 90-Day Treasury Bill 5-year Corporate bond, single B rating from S&P, with semiannual coupons . Which bond would you choose to invest in? What factors did you consider? Explain your reasoning. Question 5 As of today, you have money to make a down payment on a house which you expect to buy in five years. You are considering different ways to invest this money. Due to the uncertainty, you do not want to invest in stocks. Your choices are the following: 10-year Treasury bond, with semiannual coupons 5-year Corporate bond, single A rating from S&P, semiannual coupons 3-year zero coupon corporate bond, rated AA from S&P 5-year Treasury bond, with semiannual coupons 90-Day Treasury Bill 5-year Corporate bond, single B rating from S&P, with semiannual coupons . Which bond would you choose to invest in? What factors did you consider? Explain your reasoningStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started