Answered step by step

Verified Expert Solution

Question

1 Approved Answer

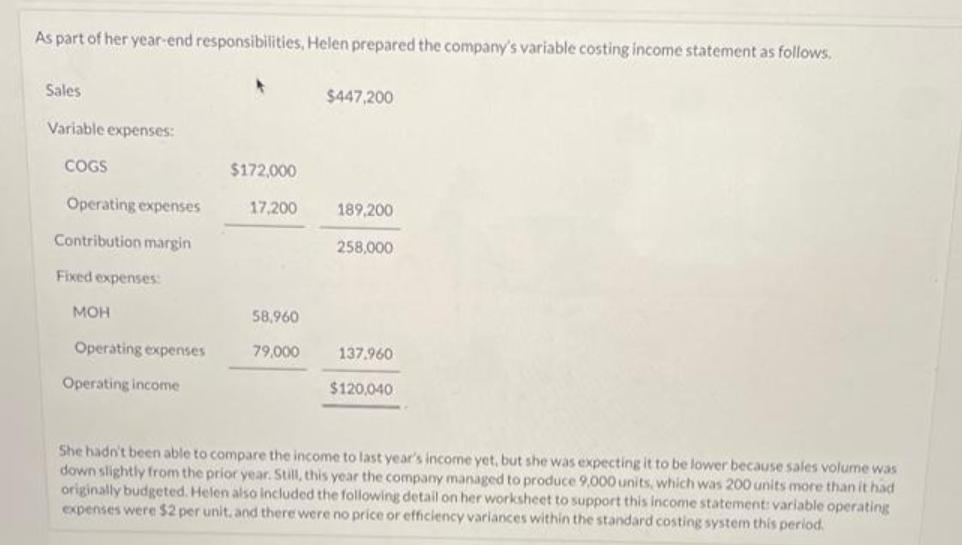

As part of her year-end responsibilities, Helen prepared the company's variable costing income statement as follows. Sales Variable expenses: $447,200 COGS $172,000 Operating expenses

As part of her year-end responsibilities, Helen prepared the company's variable costing income statement as follows. Sales Variable expenses: $447,200 COGS $172,000 Operating expenses 17,200 189,200 Contribution margin 258,000 Fixed expenses: MOH 58,960 Operating expenses 79,000 137.960 Operating income $120,040 She hadn't been able to compare the income to last year's income yet, but she was expecting it to be lower because sales volume was down slightly from the prior year. Still, this year the company managed to produce 9,000 units, which was 200 units more than it had originally budgeted. Helen also included the following detail on her worksheet to support this income statement: variable operating expenses were $2 per unit, and there were no price or efficiency variances within the standard costing system this period

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Sales were 447200 Contribution margin was 258000 Fixed expenses were 137960 Operating income was 120...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d717c8317a_966928.pdf

180 KBs PDF File

663d717c8317a_966928.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started