Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As part of her year-end responsibilities, Sharon prepared the company's variable costing income statement as follows. Sales Variable expenses: $418,700 COGS $142,200 Operating expenses

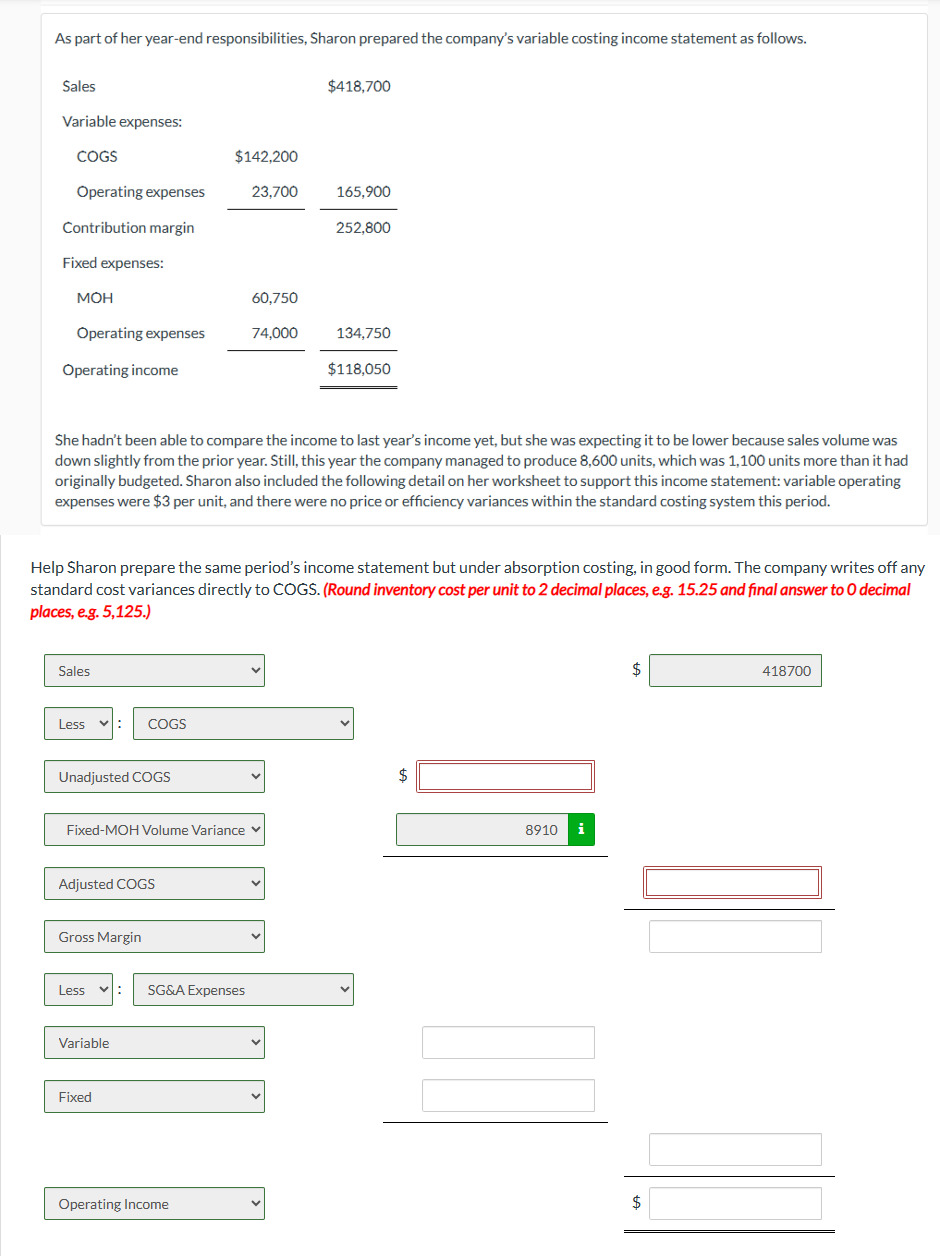

As part of her year-end responsibilities, Sharon prepared the company's variable costing income statement as follows. Sales Variable expenses: $418,700 COGS $142,200 Operating expenses 23,700 165,900 Contribution margin 252,800 Fixed expenses: MOH 60,750 Operating expenses 74,000 134,750 Operating income $118,050 She hadn't been able to compare the income to last year's income yet, but she was expecting it to be lower because sales volume was down slightly from the prior year. Still, this year the company managed to produce 8,600 units, which was 1,100 units more than it had originally budgeted. Sharon also included the following detail on her worksheet to support this income statement: variable operating expenses were $3 per unit, and there were no price or efficiency variances within the standard costing system this period. Help Sharon prepare the same period's income statement but under absorption costing, in good form. The company writes off any standard cost variances directly to COGS. (Round inventory cost per unit to 2 decimal places, e.g. 15.25 and final answer to O decimal places, e.g. 5,125.) Sales Less COGS Unadjusted COGS Fixed-MOH Volume Variance Adjusted COGS Gross Margin Less SG&A Expenses Variable Fixed Operating Income $ 8910 i $ 418700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the income statement under absorption costing we need to include all manufacturing costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started