Question

As part of its ongoing restructuring effort, FaykeM Conglomerate just spun off its speciality-steel division (LySheetSteel, NYSE: LSSX) to its shareholders. Consensus opinion among steel

As part of its ongoing restructuring effort, FaykeM Conglomerate just spun off its speciality-steel division (LySheetSteel, NYSE: LSSX) to its shareholders. Consensus opinion among steel analysts is that the newly independent firm will experience no growth for the next two years as it restructures its operations, identifies new markets, and builds up inventory. However, LSSX is expected to grow at an annual rate of 2% in the third, fourth and fifth years. Beginning in the sixth year, the firm should attain a 4% growth rate which it hopes to sustain into the indefinite future. The last dividend declared to its former parent was USD 0.80 per share.

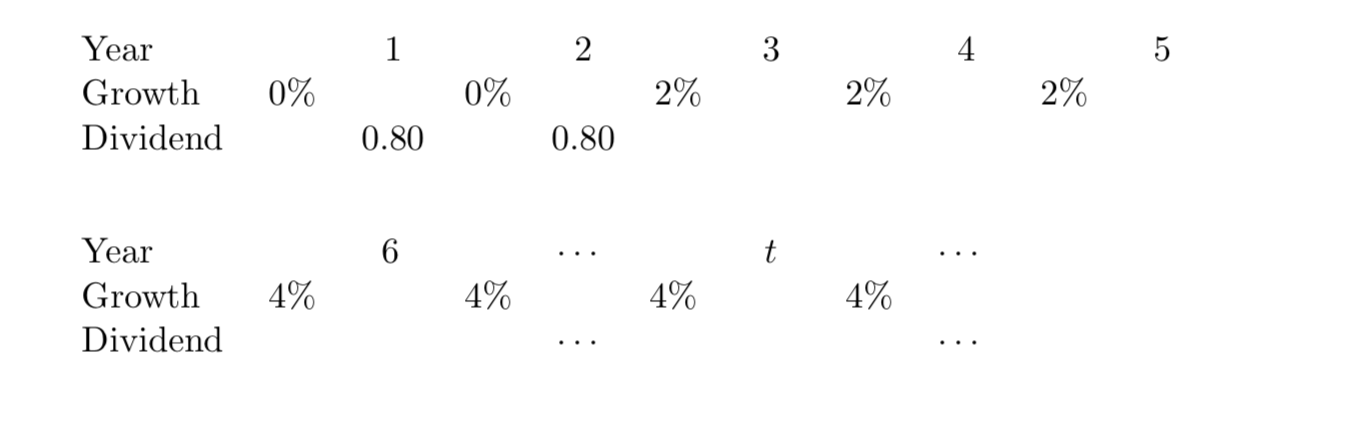

(a) Complete the below diagram of the expected dividends and growth rates.

(b) If the appropriate risk-adjusted rate of return on equity (ROE) for comparable firms in this sector is 11% what should the present price of the stock be?

(c) What share price would you expect at the end of two years?

(d) What is the capital gains yield an investor can expect to earn from holding LSSX over the two-year period? State the total and annualized yields.

(e) How would your conclusions change if both the permanent growth rate and the required return on equity (ROE) were to fall by 50 basis points, i.e., to 3.50% and 10.50%, respectively?

1 2 3 4 Year Growth Dividend 0% 0% 2% 2% 2% 0.80 0.80 Year 6 - t Growth 4% 4% 4% 4% Dividend 1 2 3 4 Year Growth Dividend 0% 0% 2% 2% 2% 0.80 0.80 Year 6 - t Growth 4% 4% 4% 4% DividendStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started