Answered step by step

Verified Expert Solution

Question

1 Approved Answer

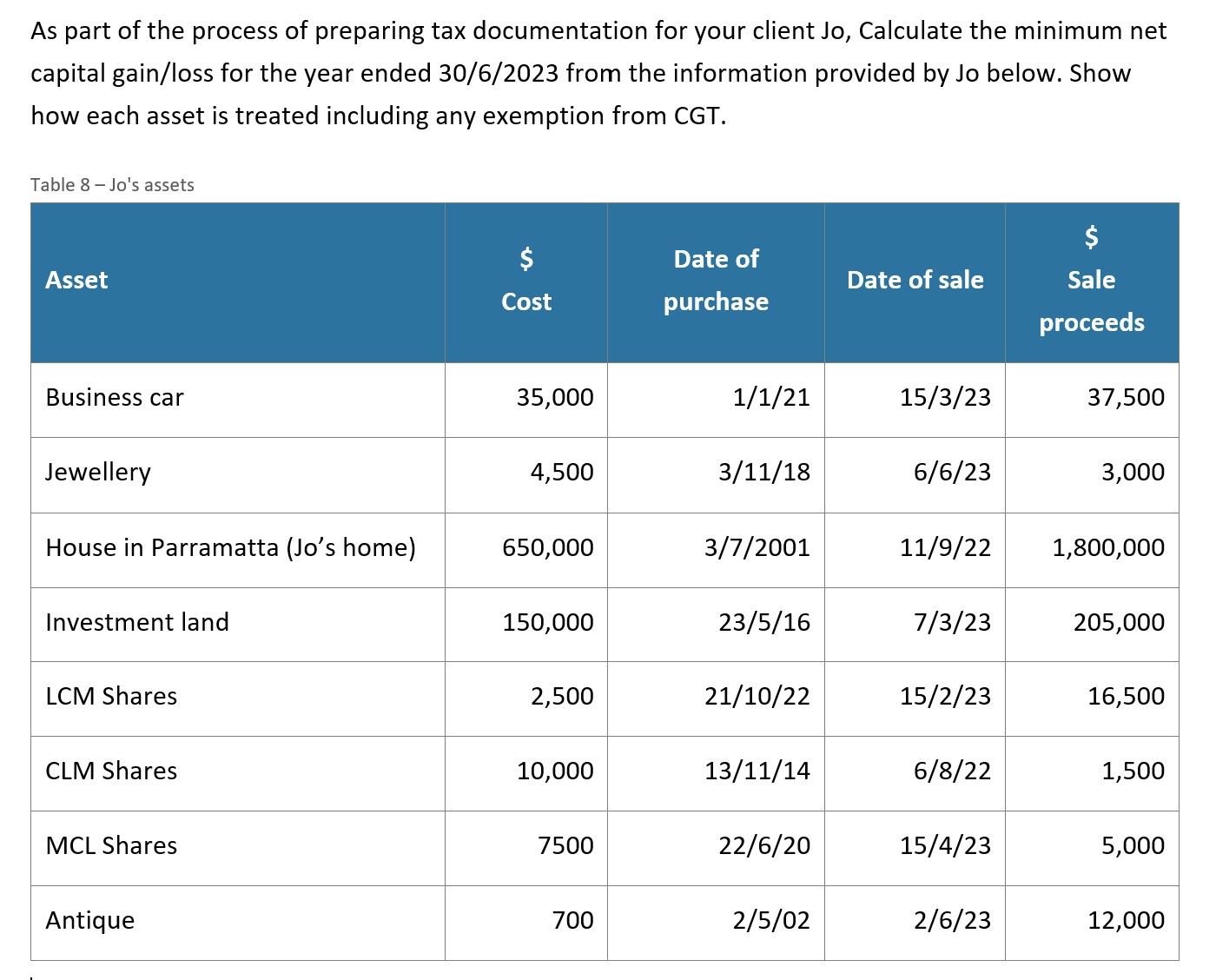

As part of the process of preparing tax documentation for your client Jo, Calculate the minimum net capital gain/loss for the year ended 30/6/2023

As part of the process of preparing tax documentation for your client Jo, Calculate the minimum net capital gain/loss for the year ended 30/6/2023 from the information provided by Jo below. Show how each asset is treated including any exemption from CGT. Table 8 Jo's assets $ Asset $ Cost Date of Date of sale Sale purchase proceeds Business car 35,000 1/1/21 15/3/23 37,500 Jewellery 4,500 3/11/18 6/6/23 3,000 House in Parramatta (Jo's home) 650,000 3/7/2001 11/9/22 1,800,000 Investment land 150,000 23/5/16 7/3/23 205,000 LCM Shares 2,500 21/10/22 15/2/23 16,500 CLM Shares 10,000 13/11/14 6/8/22 1,500 MCL Shares 7500 22/6/20 15/4/23 5,000 Antique 700 2/5/02 2/6/23 12,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Business Car Cost 35000 Sale Proceeds 37500 Calculation Capital GainLoss Sale Proceeds Cost 37500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started