Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As per Chegg guidelines expert have to answer first four questions for case study. So please all questions given by me. Otherwise I will report

As per Chegg guidelines expert have to answer first four questions for case study. So please all questions given by me. Otherwise I will report to management.

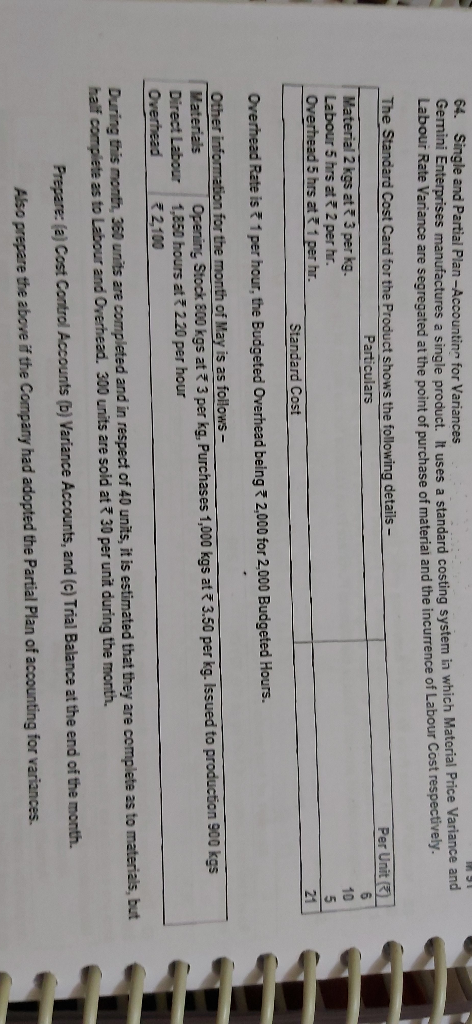

64. Single and Partial Plan-Accountin for Variances Gemini Enterprises manufactures a single product. It uses a standard costing system in which Material Price Variance and Labour Rate Variance are segregated at the point of purchase of material and the incurrence of Labour Cost respectively. The Standard Cost Card for the Product shows the following details - Per Unit 3 Particulars Material 2 kgs at 3 per kg. 10 Labour 5 hrs at 2 per hr. 5 Overhead 5 hrs at 1 per hr. 21 Standard Cost Overhead Rate is 1 per hour, the Budgeted Overhead being 2,000 for 2,000 Budgeted Hours. Other information for the month of May is as follows - Materials Opening Stock 800 kgs at 3 per kg. Purchases 1,000 kgs at 3.50 per kg. Issued to production 900 kgs Direct Labour 1,850 hours at 2.20 per hour Overhead 2.100 During this month. 360 units are completed and in respect of 40 units, it is estimated that they are complete as to materials, but half complete as to Labour and Overhead. 300 units are sold at 30 per unit during the month. Prepare: (a) Cost Control Accounts (b) Variance Accounts, and (c) Trial Balance at the end of the month. Also prepare the above if the Company has adopted the Partial Plan of accounting for variances. 64. Single and Partial Plan-Accountin for Variances Gemini Enterprises manufactures a single product. It uses a standard costing system in which Material Price Variance and Labour Rate Variance are segregated at the point of purchase of material and the incurrence of Labour Cost respectively. The Standard Cost Card for the Product shows the following details - Per Unit 3 Particulars Material 2 kgs at 3 per kg. 10 Labour 5 hrs at 2 per hr. 5 Overhead 5 hrs at 1 per hr. 21 Standard Cost Overhead Rate is 1 per hour, the Budgeted Overhead being 2,000 for 2,000 Budgeted Hours. Other information for the month of May is as follows - Materials Opening Stock 800 kgs at 3 per kg. Purchases 1,000 kgs at 3.50 per kg. Issued to production 900 kgs Direct Labour 1,850 hours at 2.20 per hour Overhead 2.100 During this month. 360 units are completed and in respect of 40 units, it is estimated that they are complete as to materials, but half complete as to Labour and Overhead. 300 units are sold at 30 per unit during the month. Prepare: (a) Cost Control Accounts (b) Variance Accounts, and (c) Trial Balance at the end of the month. Also prepare the above if the Company has adopted the Partial Plan of accounting for variancesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started