Answered step by step

Verified Expert Solution

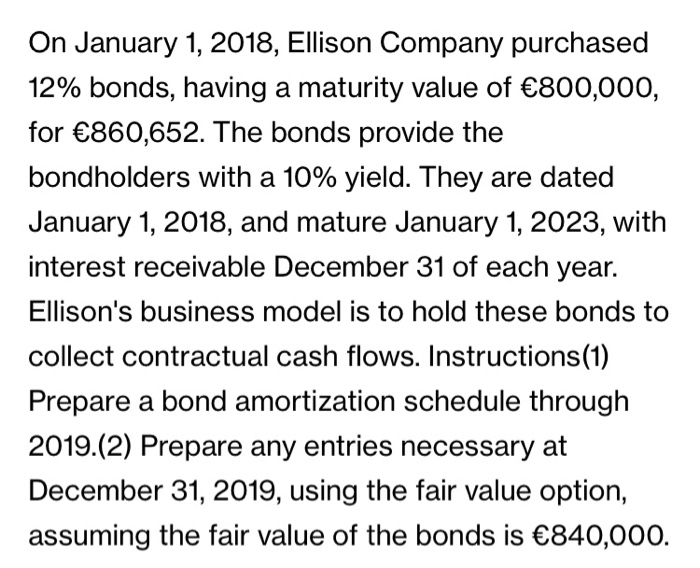

Question

1 Approved Answer

As per IFRS 9 Financial Instruments, it states that debt investment should be recorded at fair value when a companys business model is fulfilling three

As per IFRS 9 Financial Instruments, it states that debt investment should be recorded at fair value when a companys business model is fulfilling three conditions:

I. Holding-of-financial asset.

II. Collection of contractual cash flows.

III. Selling of financial assets.

It also states that debt investment should be recorded on Amortized cost when a companys business model is fulfilling two conditions only:

I. Holding-of-financial asset.

II. Collection-of-contractual cash flows.

In the question, it was clearly mentioned the business model is (holding the bonds for collection of contractual cash flow), which matches the 2nd statement of IFRS 9; therefore, I ignored the fair value assumption. If the business model in the question was (holding the bonds for collection of contractual cash flow and selling), then yes we should take the fair value assumption into consideration.

so based on above explanation, the etries on Dec 31, 2019 as mentioned below?

Dr. Cash 96,000

Cr. Debt investment 10,928

Interest Revenue 85,072

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started