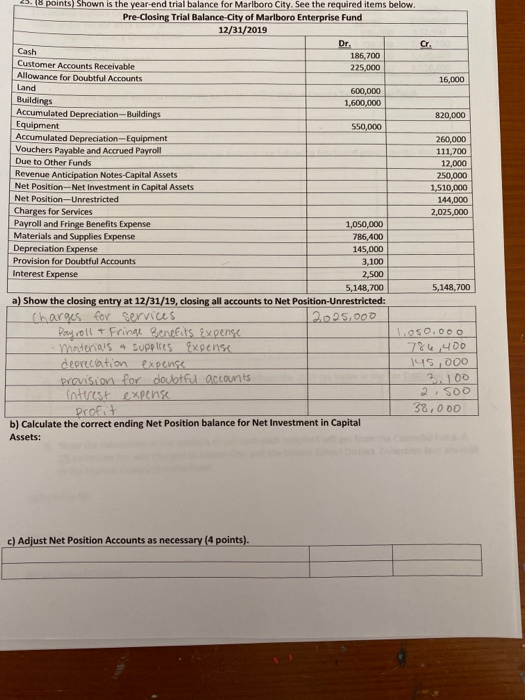

as points) Shown is the year-end trial balance for Marlboro City. See the required items below. Pre-Closing Trial Balance City of Marlboro Enterprise Fund 12/31/2019 Cash 186,700 Customer Accounts Receivable 225.000 Allowance for Doubtful Accounts 16.000 Land 600,000 Buildings 1.600.000 Accumulated Depreciation-Buildings 820.000 Equipment 550,000 Accumulated Depreciation Equipment 260,000 Vouchers Payable and Accrued Payroll 111,700 Due to Other Funds 12,000 Revenue Anticipation Notes-Capital Assets 250.000 Net Position-Net Investment in Capital Assets 1,510,000 Net Position-Unrestricted 144,000 Charges for Services 2,025,000 Payroll and Fringe Benefits Expense 1,050,000 Materials and Supplies Expense 7 86,400 Depreciation Expense 145,000 Provision for Doubtful Accounts 3,100 Interest Expense 2,500 5,148,700 5,148,700 a) Show the closing entry at 12/31/19, closing all accounts to Net Position-Unrestricted: Charges for services. 2025,000 Payroll & Fringe Benefits Expense 150.000 Materials - Supplies Expense 784,400 depreciation expenge 145,000 provision for doubtfu accounts 2 00 intures expense 2 profit 38,000 b) Calculate the correct ending Net Position balance for Net Investment in Capital Assets: c) Adjust Net Position Accounts as necessary (4 points). as points) Shown is the year-end trial balance for Marlboro City. See the required items below. Pre-Closing Trial Balance City of Marlboro Enterprise Fund 12/31/2019 Cash 186,700 Customer Accounts Receivable 225.000 Allowance for Doubtful Accounts 16.000 Land 600,000 Buildings 1.600.000 Accumulated Depreciation-Buildings 820.000 Equipment 550,000 Accumulated Depreciation Equipment 260,000 Vouchers Payable and Accrued Payroll 111,700 Due to Other Funds 12,000 Revenue Anticipation Notes-Capital Assets 250.000 Net Position-Net Investment in Capital Assets 1,510,000 Net Position-Unrestricted 144,000 Charges for Services 2,025,000 Payroll and Fringe Benefits Expense 1,050,000 Materials and Supplies Expense 7 86,400 Depreciation Expense 145,000 Provision for Doubtful Accounts 3,100 Interest Expense 2,500 5,148,700 5,148,700 a) Show the closing entry at 12/31/19, closing all accounts to Net Position-Unrestricted: Charges for services. 2025,000 Payroll & Fringe Benefits Expense 150.000 Materials - Supplies Expense 784,400 depreciation expenge 145,000 provision for doubtfu accounts 2 00 intures expense 2 profit 38,000 b) Calculate the correct ending Net Position balance for Net Investment in Capital Assets: c) Adjust Net Position Accounts as necessary (4 points)