Question

As she prepared to enter Kays office, E. Hamilton pulled her summary sheets from her briefcase and quickly reviewed the details of the four projects,

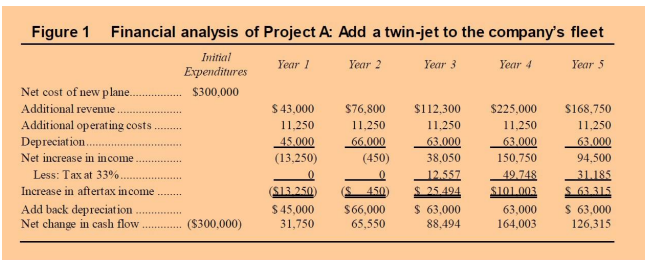

As she prepared to enter Kays office, E. Hamilton pulled her summary sheets from her briefcase and quickly reviewed the details of the four projects, all of which she considered to be equally risky. A. A proposal to add a jet to the companys fleet. The plane was only six years old and was considered a good buy at $300,000. In return, the plane would bring over $600,000 in additional revenue during the next five years with only about $56,000 in operating costs. (See Figure 1 for details.)

1. Refer to Figures 1 through 3. Add up the total increase in after-tax income for each project. Given what you know about Kay Marsh, to which project do you think she will be attracted?

2. Compute the payback period, net present value (NPV), Profitability Index based on cash flow. Use 10 % the required rate of return (discount rate) in your calculations. For the payback method, merely indicate the year in which the cash flow equals or exceeds the initial investment. You do not have to compute midyear points.

Figure 1 Financial analysis of Project A: Add a twin-jet to the company's fleet Initial Expenditures Year / Year 2 Year 3 Year 4 Year 5 Net cost of new plane.. $300,000 Additional revenue $43.000 $76,800 $112,300 $225,000 $168.750 Additional operating costs 11.250 11.250 11.250 11,250 11.250 Depreciation....... 45.000 66.000 63.000 63.000 63.000 Net increase in income (13,250) (450) 38.050 150,750 94,500 Less: Tax at 33%... 124557 49.748 311185 Increase in aftertax income ($13.250 450) $25.494 S101.003 $ 63.315 Add back depreciation $ 45,000 $ 66,000 $ 63.000 63,000 $ 63.000 Net change in cash flow . ($300,000) 31,750 65,550 88,494 164,003 126,315Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started