Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rick is considering expanding his pizza empire and opening up a new upscale pizza shop. The life of the pizza shop is expected to

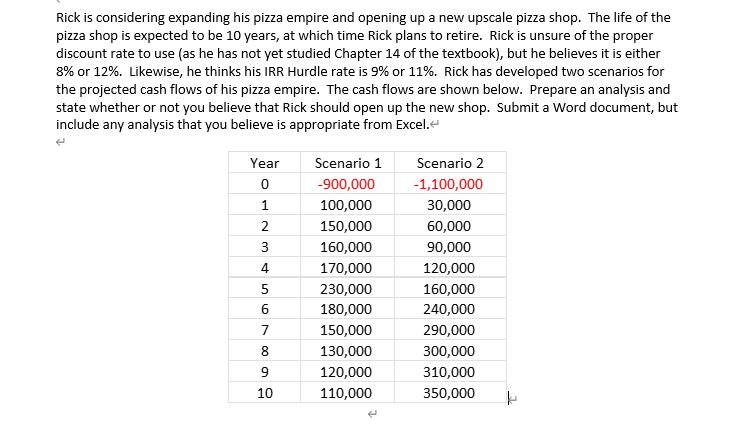

Rick is considering expanding his pizza empire and opening up a new upscale pizza shop. The life of the pizza shop is expected to be 10 years, at which time Rick plans to retire. Rick is unsure of the proper discount rate to use (as he has not yet studied Chapter 14 of the textbook), but he believes it is either 8% or 12%. Likewise, he thinks his IRR Hurdle rate is 9% or 11%. Rick has developed two scenarios for the projected cash flows of his pizza empire. The cash flows are shown below. Prepare an analysis and state whether or not you believe that Rick should open up the new shop. Submit a Word document, but include any analysis that you believe is appropriate from Excel. < E Year 0 1 2 3 4 5 6 LO 7 8 9 10 Scenario 1 -900,000 100,000 150,000 160,000 170,000 230,000 180,000 150,000 130,000 120,000 110,000 Scenario 2 -1,100,000 30,000 60,000 90,000 120,000 160,000 240,000 290,000 300,000 310,000 350,000

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The first step is to determine the NPV of the two scenarios using the discount rates of 8 and 12 In ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started