Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the CFO of XYZ Corporation, you are responsible for maximizing revenue by making medium to long term investments of excess capital. You are reviewing

As the CFO of XYZ Corporation, you are responsible for maximizing revenue by making medium to long term investments of excess capital. You are reviewing the General Mills annual report as a possible investment. What is your decision? Would you invest in GM Inc. or not? What type of investment would it be - long or short term? Why?

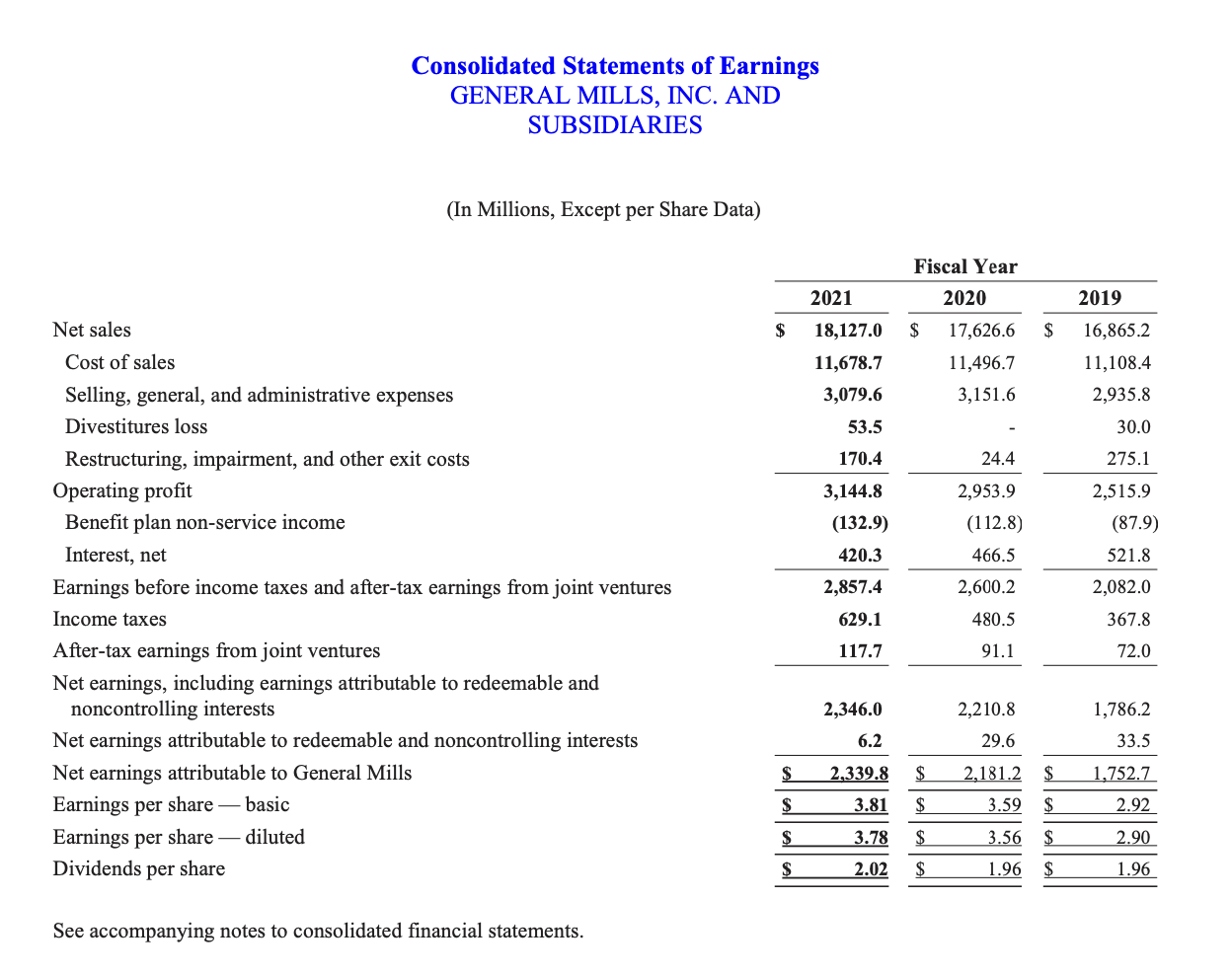

Net sales Operating profit Benefit plan non-service income Interest, net Consolidated Statements of Earnings GENERAL MILLS, INC. AND SUBSIDIARIES Cost of sales Selling, general, and administrative expenses Divestitures loss Restructuring, impairment, and other exit costs (In Millions, Except per Share Data) Earnings before income taxes and after-tax earnings from joint ventures Income taxes After-tax earnings from joint ventures Net earnings, including earnings attributable to redeemable and noncontrolling interests Earnings per share - basic Earnings per share - diluted Dividends per share Net earnings attributable to redeemable and noncontrolling interests Net earnings attributable to General Mills See accompanying notes to consolidated financial statements. 2021 $ 18,127.0 11,678.7 3,079.6 $ $ $ $ 53.5 170.4 3,144.8 (132.9) 420.3 2,857.4 629.1 117.7 2,346.0 6.2 2,339.8 3.81 3.78 2.02 Fiscal Year 2020 $ 17,626.6 11,496.7 3,151.6 24.4 2,953.9 (112.8) 466.5 2,600.2 480.5 91.1 2,210.8 29.6 2,181.2 $ $ 3.59 $ 3.56 $ 1.96 $ 2019 16,865.2 11,108.4 2,935.8 30.0 275.1 2,515.9 (87.9) 521.8 2,082.0 367.8 72.0 1,786.2 33.5 1,752.7 2.92 2.90 1.96

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

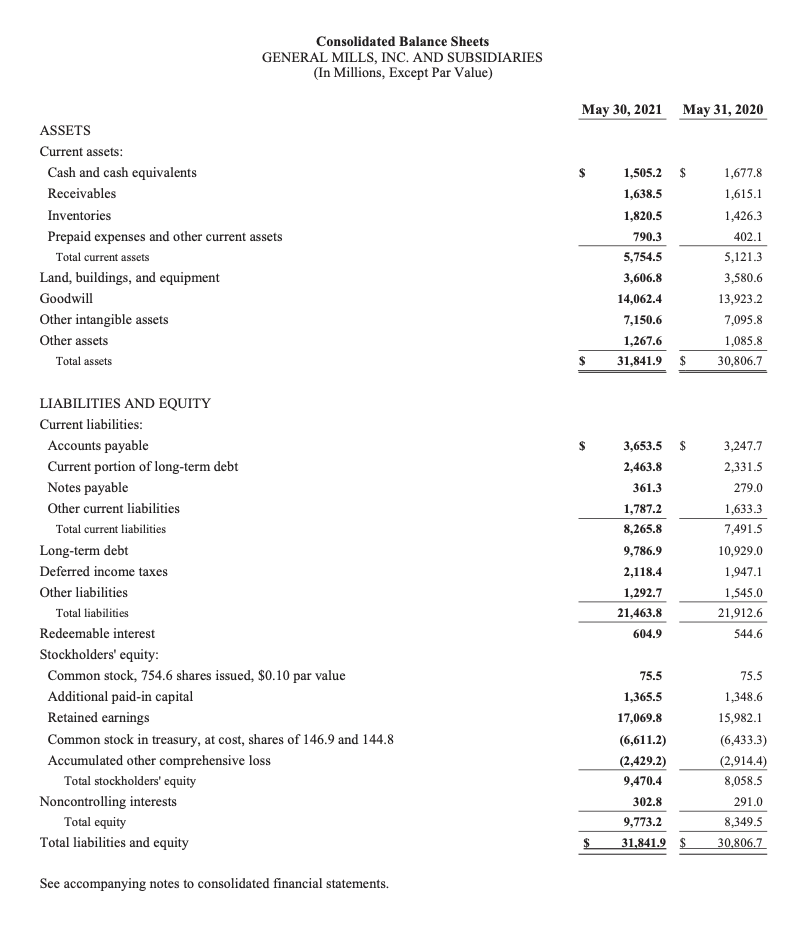

The information you provided is a portion of the Consolidated Balance Sheets of General Mills Inc and its subsidiaries The amounts are in millions of dollars Here is a breakdown of the information ASS...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started