Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken.

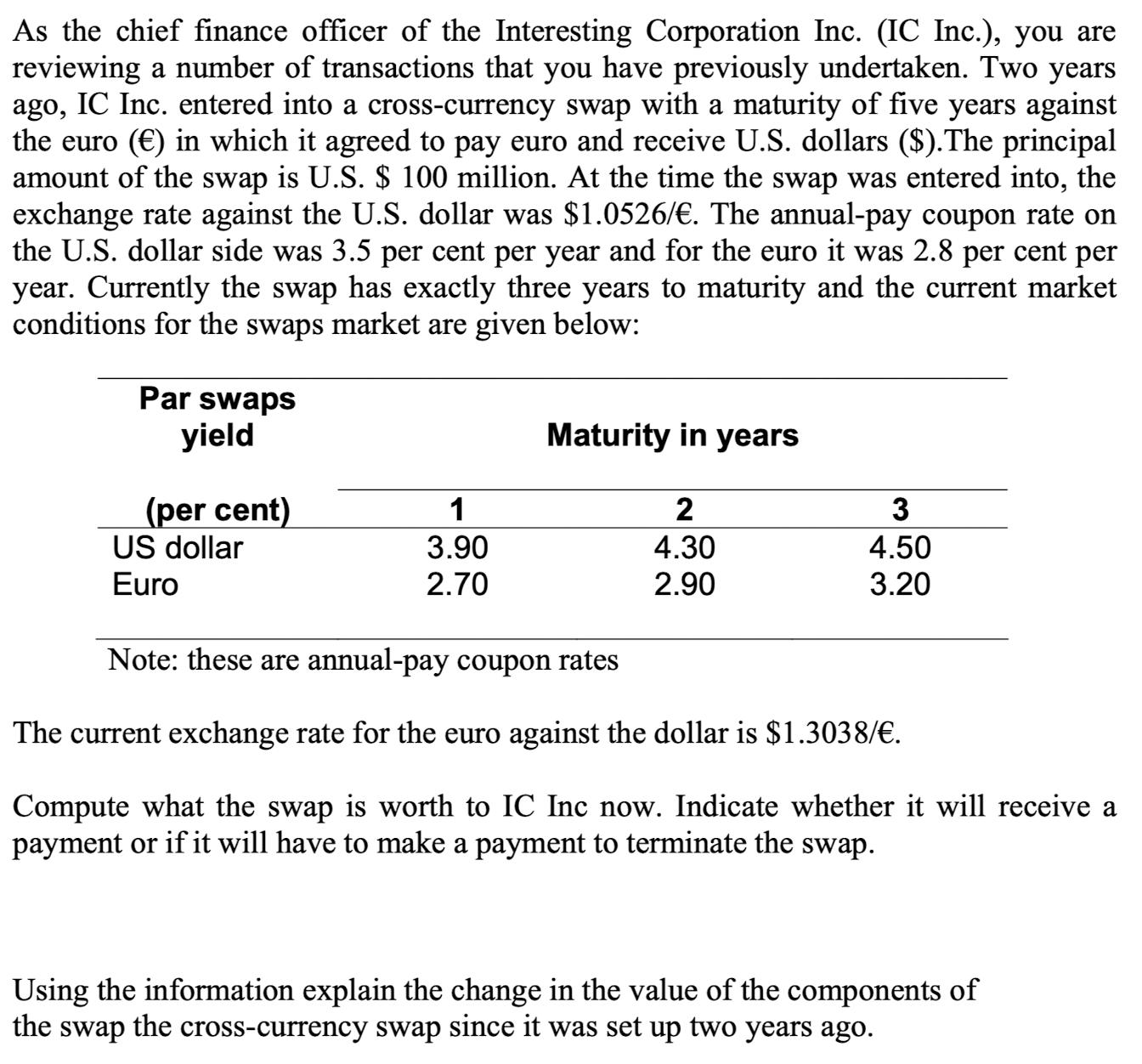

As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago. As the chief finance officer of the Interesting Corporation Inc. (IC Inc.), you are reviewing a number of transactions that you have previously undertaken. Two years ago, IC Inc. entered into a cross-currency swap with a maturity of five years against the euro () in which it agreed to pay euro and receive U.S. dollars ($).The principal amount of the swap is U.S. $ 100 million. At the time the swap was entered into, the exchange rate against the U.S. dollar was $1.0526/. The annual-pay coupon rate on the U.S. dollar side was 3.5 per cent per year and for the euro it was 2.8 per cent per year. Currently the swap has exactly three years to maturity and the current market conditions for the swaps market are given below: Par swaps yield (per cent) US dollar Euro 1 3.90 2.70 Maturity in years 2 4.30 2.90 3 4.50 3.20 Note: these are annual-pay coupon rates The current exchange rate for the euro against the dollar is $1.3038/. Compute what the swap is worth to IC Inc now. Indicate whether it will receive a payment or if it will have to make a payment to terminate the swap. Using the information explain the change in the value of the components of the swap the cross-currency swap since it was set up two years ago.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To compute the value of the crosscurrency swap to IC Inc now we need to calculate the present value of the cash flows for both sides of the swap using ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started