As the Financial Director, you have been evaluating annual operating costs as you put together the budget for the next fiscal year. You've noticed

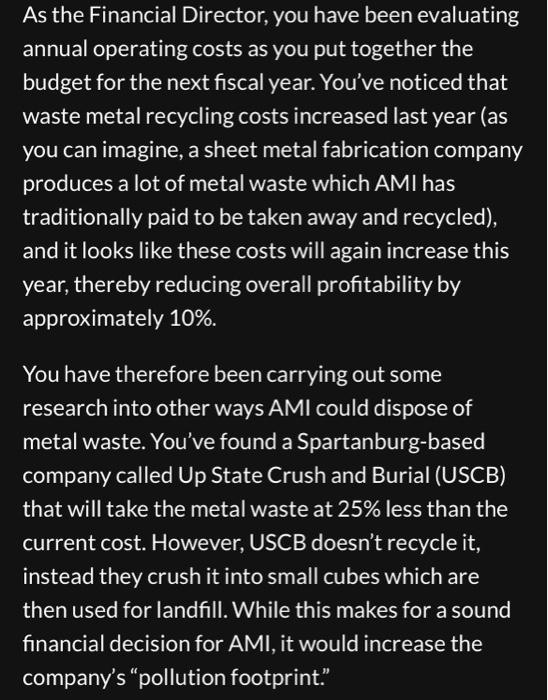

As the Financial Director, you have been evaluating annual operating costs as you put together the budget for the next fiscal year. You've noticed that waste metal recycling costs increased last year (as you can imagine, a sheet metal fabrication company produces a lot of metal waste which AMI has traditionally paid to be taken away and recycled), and it looks like these costs will again increase this year, thereby reducing overall profitability by approximately 10%. You have therefore been carrying out some research into other ways AMI could dispose of metal waste. You've found a Spartanburg-based company called Up State Crush and Burial (USCB) that will take the metal waste at 25% less than the current cost. However, USCB doesn't recycle it, instead they crush it into small cubes which are then used for landfill. While this makes for a sound financial decision for AMI, it would increase the company's "pollution footprint." 1. What are the ethical issues for AMI to consider when evaluating whether to consider USCB for metal disposal? 2. Do the CEO's comments amount to greenwashing? What is greenwashing? Are there any other alternatives?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

As the Financial Director youre facing a challenging decision that balances financial performance with environmental responsibility Heres a structured approach to evaluating the situation and making a ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started