Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the financial planner for Bob and Jill, you are consulting on their property decisions. They wish to sell their current house that has

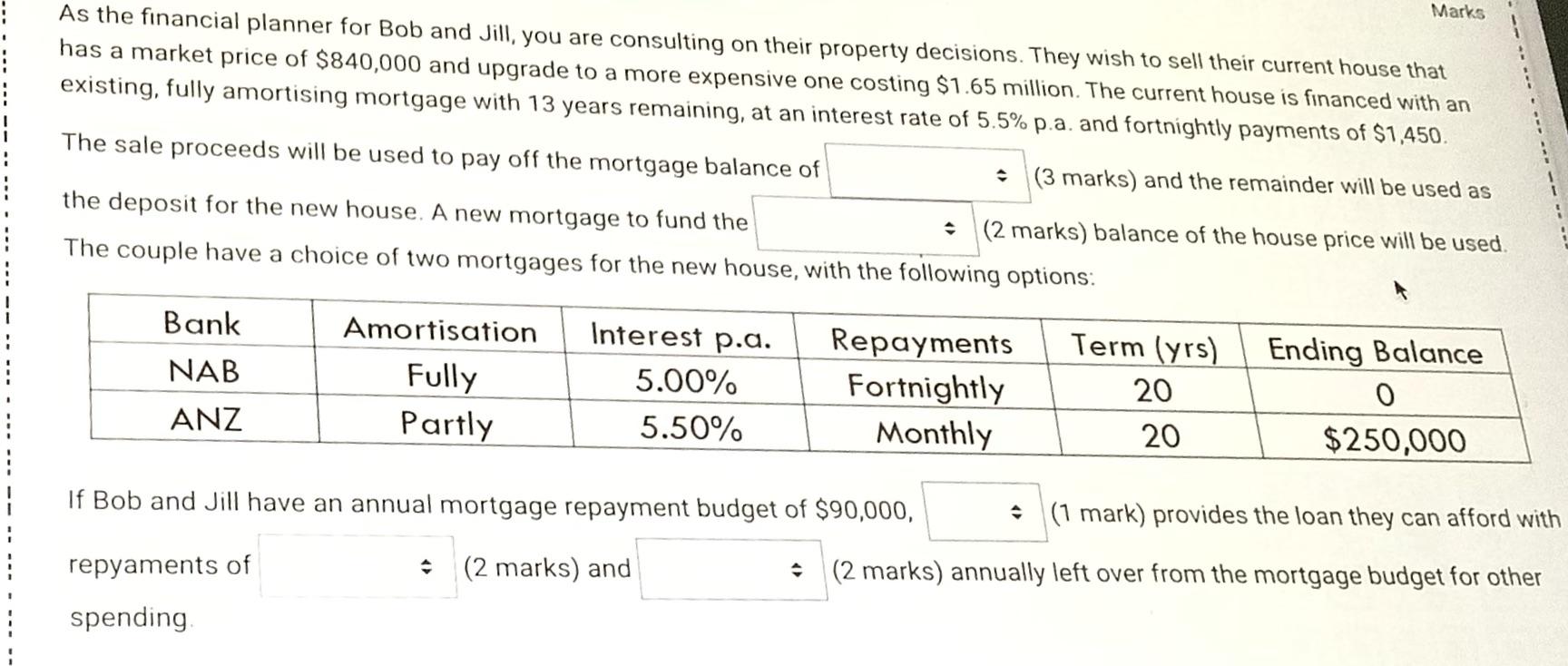

As the financial planner for Bob and Jill, you are consulting on their property decisions. They wish to sell their current house that has a market price of $840,000 and upgrade to a more expensive one costing $1.65 million. The current house is financed with an existing, fully amortising mortgage with 13 years remaining, at an interest rate of 5.5% p.a. and fortnightly payments of $1,450. The sale proceeds will be used to pay off the mortgage balance of (3 marks) and the remainder will be used as the deposit for the new house. A new mortgage to fund the The couple have a choice of two mortgages for the new house, with the following options: Bank NAB ANZ Amortisation Fully Partly Interest p.a. 5.00% 5.50% Repayments Fortnightly Monthly If Bob and Jill have an annual mortgage repayment budget of $90,000, repyaments of (2 marks) and spending. (2 marks) balance of the house price will be used. Marks Term (yrs) 20 20 Ending Balance 0 $250,000 (1 mark) provides the loan they can afford with (2 marks) annually left over from the mortgage budget for other

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine the mortgage options for Bob and Jill we need to consider the details of their current house the new house and their mortgage repayment b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started