Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the firm has grown, Clark Communications decided to broaden its operations by acquiring new machinery. Now presented with a choice between two probable

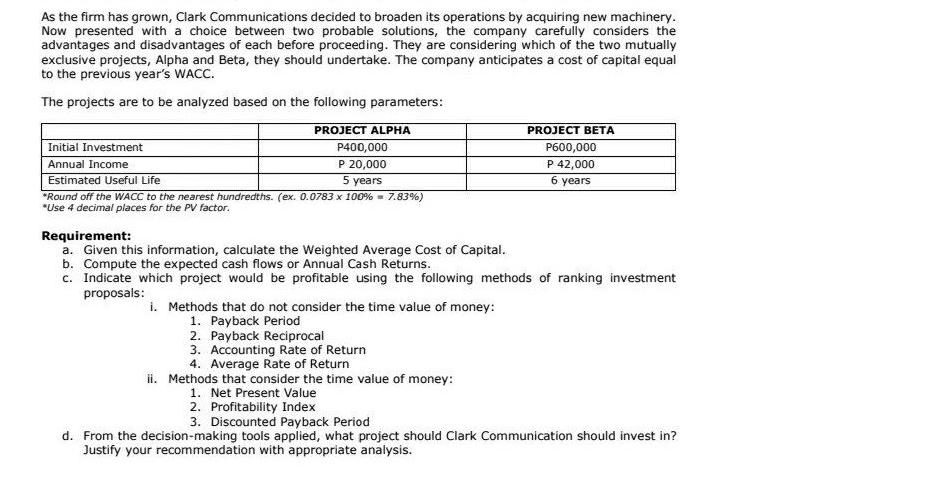

As the firm has grown, Clark Communications decided to broaden its operations by acquiring new machinery. Now presented with a choice between two probable solutions, the company carefully considers the advantages and disadvantages of each before proceeding. They are considering which of the two mutually exclusive projects, Alpha and Beta, they should undertake. The company anticipates a cost of capital equal to the previous year's WACC. The projects are to be analyzed based on the following parameters: Initial Investment Annual Income PROJECT ALPHA P400,000 P 20,000 PROJECT BETA P600,000 P 42,000 Estimated Useful Life 5 years 6 years *Round off the WACC to the nearest hundredths. (ex. 0.0783 x 100% = 7.83%) *Use 4 decimal places for the PV factor. Requirement: a. Given this information, calculate the Weighted Average Cost of Capital. b. Compute the expected cash flows or Annual Cash Returns. c. Indicate which project would be profitable using the following methods of ranking investment proposals: i. Methods that do not consider the time value of money: 1. Payback Period 2. Payback Reciprocal 3. Accounting Rate of Return 4. Average Rate of Return ii. Methods that consider the time value of money: 1. Net Present Value 2. Profitability Index 3. Discounted Payback Period d. From the decision-making tools applied, what project should Clark Communication should invest in? Justify your recommendation with appropriate analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started