Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the head accountant for E-Lan Electronics, you are responsible to prepare the company's master budget for the next fiscal period. The administrative and

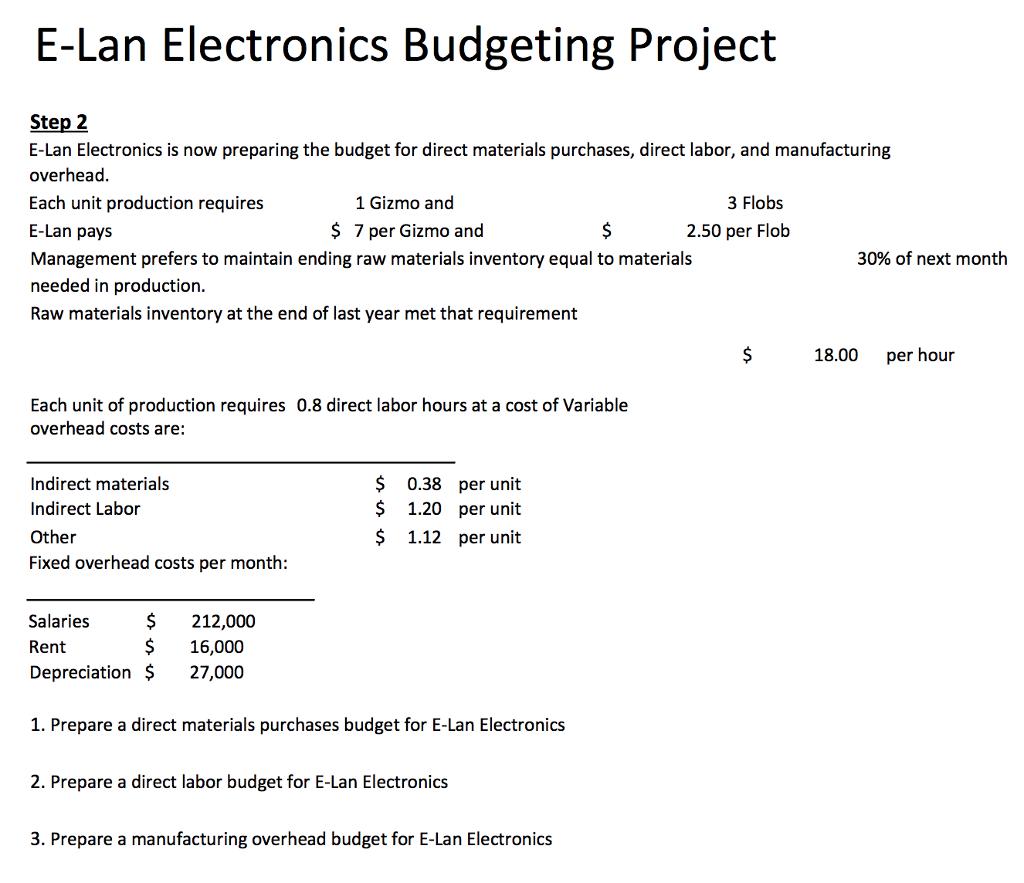

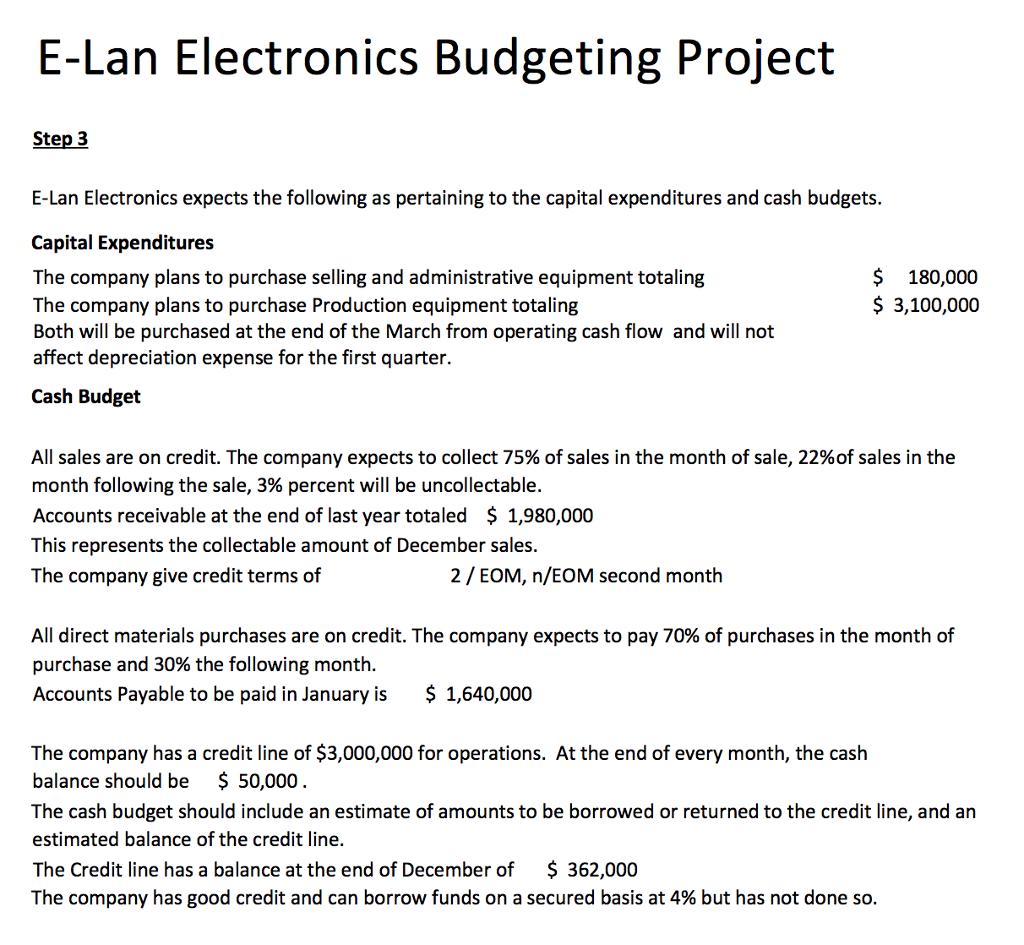

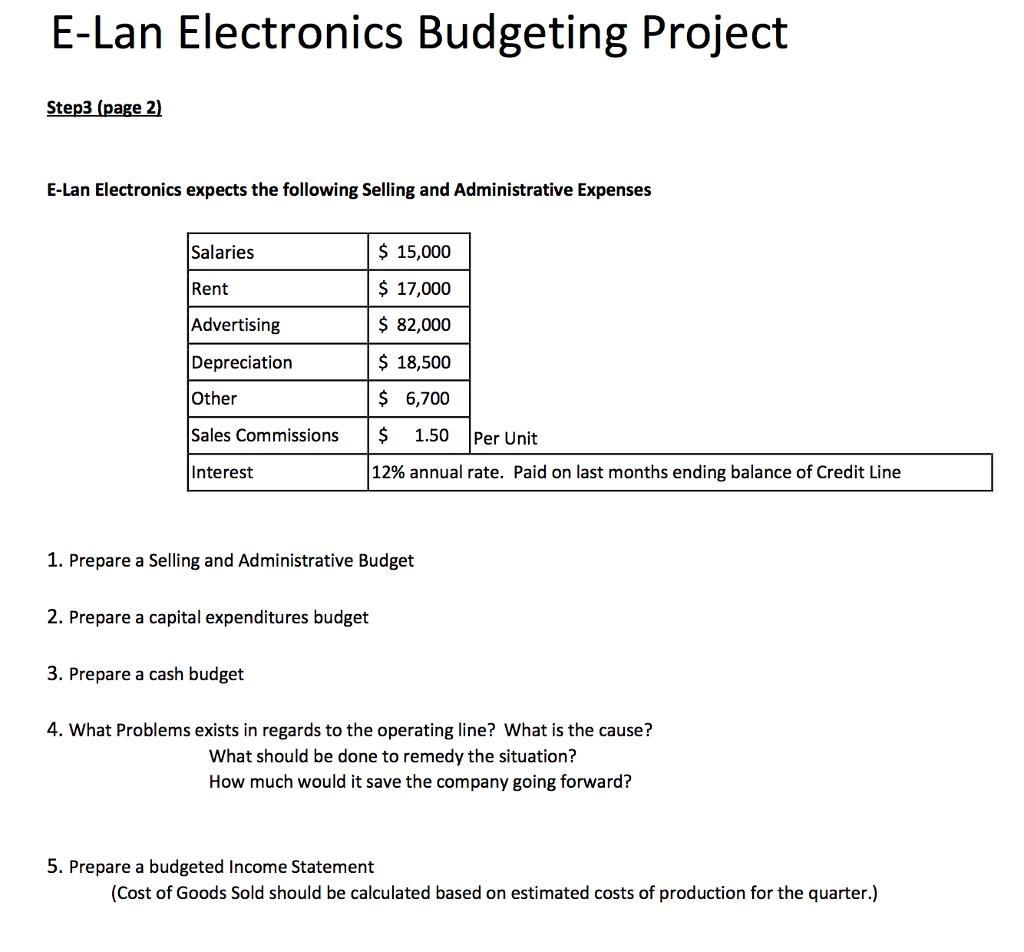

As the head accountant for E-Lan Electronics, you are responsible to prepare the company's master budget for the next fiscal period. The administrative and divisional managers have prepared the appropriate information (found below) for you to prepare the budget. In addition to the compiled information, you will also find the budgets, reports, questions, and statements required by the CFO. Step 1 E-Lan Electronics produces Widgets for sale at local Electronic stores. The company is in the process of creating a master budget for the first quarter of the coming year. Results from the prior year are: Last Year Units January 200,000 February 268,000 March 240,000 April 210,000 May 230,000 Unit Sales are to expected increase 15% and each unit is expected to sell for $38 The management prefers to maintain ending finished goods inventory equal to 10% of next month's sales. 1. Prepare a sales budget for E-Lan Electronics 2. Prepare a production budget for E-Lan Electronics E-Lan Electronics Budgeting Project Step 2 E-Lan Electronics is now preparing the budget for direct materials purchases, direct labor, and manufacturing overhead. Each unit production requires 1 Gizmo and 3 Flobs E-Lan pays $ 7 per Gizmo and $ 2.50 per Flob Management prefers to maintain ending raw materials inventory equal to materials 30% of next month needed in production. Raw materials inventory at the end of last year met that requirement $ 18.00 per hour Each unit of production requires 0.8 direct labor hours at a cost of Variable overhead costs are: Indirect materials $ 0.38 per unit Indirect Labor $ 1.20 per unit Other $ 1.12 per unit Fixed overhead costs per month: Salaries 212,000 Rent 2$ 16,000 Depreciation $ 27,000 1. Prepare a direct materials purchases budget for E-Lan Electronics 2. Prepare a direct labor budget for E-Lan Electronics 3. Prepare a manufacturing overhead budget for E-Lan Electronics E-Lan Electronics Budgeting Project Step 3 E-Lan Electronics expects the following as pertaining to the capital expenditures and cash budgets. Capital Expenditures The company plans to purchase selling and administrative equipment totaling The company plans to purchase Production equipment totaling Both will be purchased at the end of the March from operating cash flow and will not affect depreciation expense for the first quarter. $ 180,000 $ 3,100,000 Cash Budget All sales are on credit. The company expects to collect 75% of sales in the month of sale, 22%of sales in the month following the sale, 3% percent will be uncollectable. Accounts receivable at the end of last year totaled $ 1,980,000 This represents the collectable amount of December sales. The company give credit terms of 2/ EOM, n/EOM second month All direct materials purchases are on credit. The company expects to pay 70% of purchases in the month of purchase and 30% the following month. Accounts Payable to be paid in January is $ 1,640,000 The company has a credit line of $3,000,000 for operations. At the end of every month, the cash balance should be $ 50,000. The cash budget should include an estimate of amounts to be borrowed or returned to the credit line, and an estimated balance of the credit line. The Credit line has a balance at the end of December of $ 362,000 The company has good credit and can borrow funds on a secured basis at 4% but has not done so. E-Lan Electronics Budgeting Project Step3 (page 2) E-Lan Electronics expects the following Selling and Administrative Expenses Salaries $ 15,000 Rent $ 17,000 Advertising $ 82,000 Depreciation $ 18,500 Other $ 6,700 Sales Commissions $ 1.50 Per Unit Interest 12% annual rate. Paid on last months ending balance of Credit Line 1. Prepare a Selling and Administrative Budget 2. Prepare a capital expenditures budget 3. Prepare a cash budget 4. What Problems exists in regards to the operating line? What is the cause? What should be done to remedy the situation? How much would it save the company going forward? 5. Prepare a budgeted Income Statement (Cost of Goods Sold should be calculated based on estimated costs of production for the quarter.) Budgeting Project Check Figures Total Sales 30,939,600 Total Raw Materials Purchased 11,848,588 Total Direct Labor Cost (March) 3,924,720 Budgeted Production Cost per Unit 3.64 Ending Finished Goods Inventory 785,799 (Quarter) 1,534,179 (With December) Total S&A Expenses 2,567,088 Total Financing 2,629,913 Net Income 1,396,306 Assets 15,147,189

Step by Step Solution

★★★★★

3.35 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started