Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the manager of the WE-CONSULT Consulting Firm, you have been tasked with assisting the Mike-Milk Company with the following items: Item #1a. Scheduling

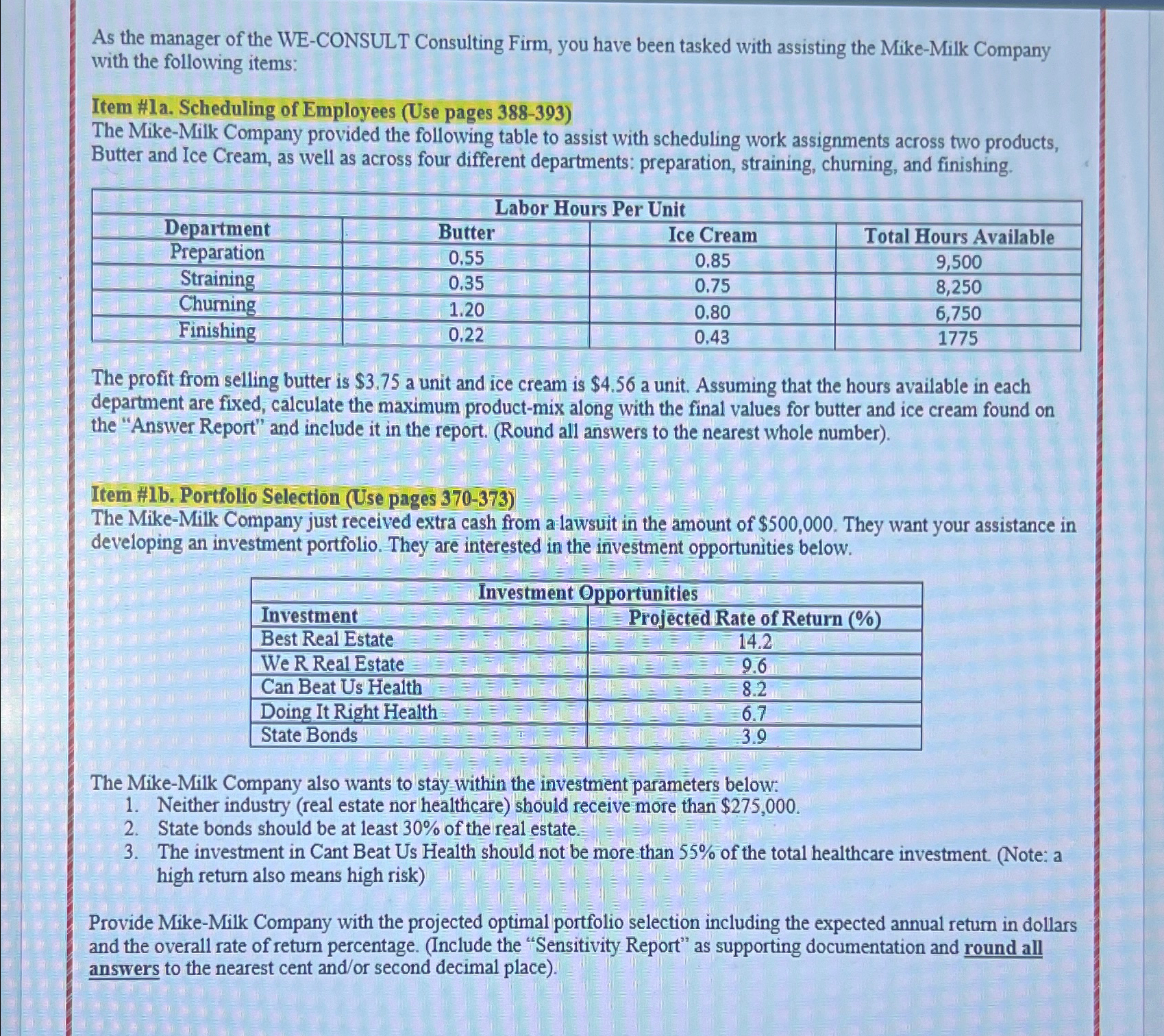

As the manager of the WE-CONSULT Consulting Firm, you have been tasked with assisting the Mike-Milk Company with the following items: Item #1a. Scheduling of Employees (Use pages 388-393) The Mike-Milk Company provided the following table to assist with scheduling work assignments across two products, Butter and Ice Cream, as well as across four different departments: preparation, straining, churning, and finishing. Department Preparation Straining Churning Finishing Labor Hours Per Unit Butter Ice Cream 0.55 0.85 0.35 0.75 1.20 0.80 0.22 0.43 Total Hours Available 9,500 8,250 6,750 1775 The profit from selling butter is $3.75 a unit and ice cream is $4.56 a unit. Assuming that the hours available in each department are fixed, calculate the maximum product-mix along with the final values for butter and ice cream found on the "Answer Report" and include it in the report. (Round all answers to the nearest whole number). Item #1b. Portfolio Selection (Use pages 370-373) The Mike-Milk Company just received extra cash from a lawsuit in the amount of $500,000. They want your assistance in developing an investment portfolio. They are interested in the investment opportunities below. Investment Best Real Estate We R Real Estate Can Beat Us Health Doing It Right Health Investment Opportunities Projected Rate of Return (%) 14.2 9.6 8.2 6.7 3.9 State Bonds The Mike-Milk Company also wants to stay within the investment parameters below: 1. Neither industry (real estate nor healthcare) should receive more than $275,000. 2. State bonds should be at least 30% of the real estate. 3. The investment in Cant Beat Us Health should not be more than 55% of the total healthcare investment. (Note: a high return also means high risk) Provide Mike-Milk Company with the projected optimal portfolio selection including the expected annual return in dollars and the overall rate of return percentage. (Include the "Sensitivity Report" as supporting documentation and round all answers to the nearest cent and/or second decimal place).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started