Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? Note: For the exercises and problems in this chapter, use the following tax rates: FICA-Employer and employee, 8% of the first $100,000 of earnings

?

?

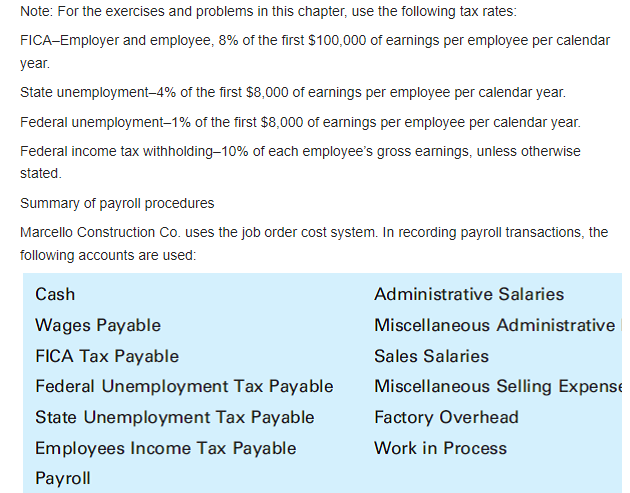

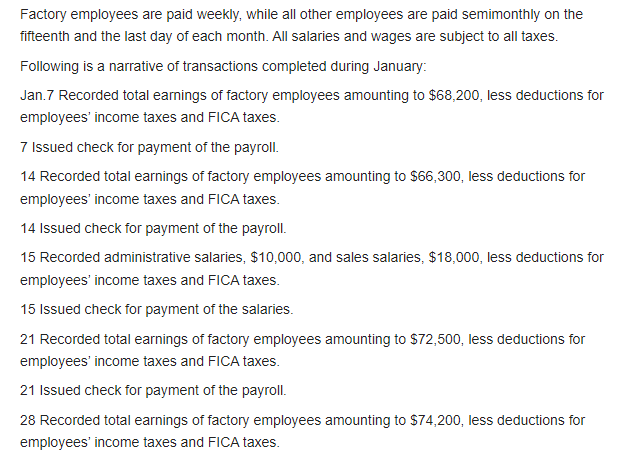

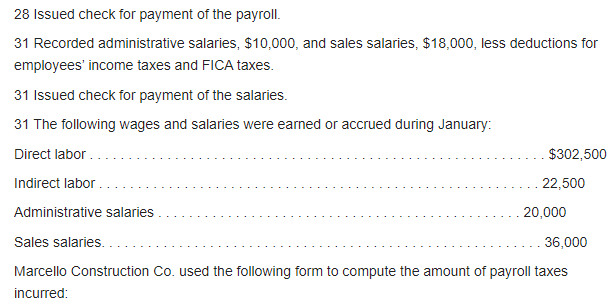

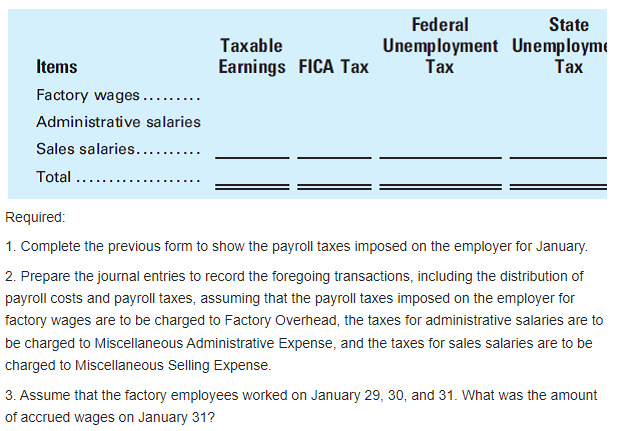

Note: For the exercises and problems in this chapter, use the following tax rates: FICA-Employer and employee, 8% of the first $100,000 of earnings per employee per calendar year. State unemployment-4% of the first $8,000 of earnings per employee per calendar year. Federal unemployment-1% of the first $8,000 of earnings per employee per calendar year. Federal income tax withholding-10% of each employee's gross earnings, unless otherwise stated. Summary of payroll procedures Marcello Construction Co. uses the job order cost system. In recording payroll transactions, the following accounts are used: Cash Administrative Salaries Wages Payable Miscellaneous Administrative FICA Tax Payable Sales Salaries Federal Unemployment Tax Payable Miscellaneous Selling Expense State Unemployment Tax Payable Factory Overhead Employees Income Tax Payable Work in Process Payroll

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

step 1 Step 2 Ste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started