Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming that the excess earnings are expected to continue for 5 years, how much would you be willing to pay for goodwill, and for the

Assuming that the excess earnings are expected to continue for 5 years, how much would you be willing to pay for goodwill, and for the company? Estimate goodwill by the present value method. (Round factor values to 5 decimal places, e.g. 1.25124, and round answers to 0 decimal places, e.g. 5,275.)

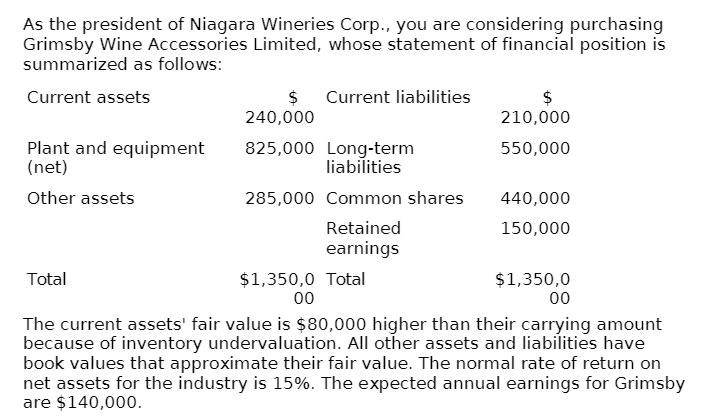

As the president of Niagara Wineries Corp., you are considering purchasing Grimsby Wine Accessories Limited, whose statement of financial position is summarized as follows: Current assets Plant and equipment (net) Other assets Total $ 240,000 Current liabilities 825,000 Long-term liabilities 285,000 Common shares Retained earnings $ 210,000 550,000 440,000 150,000 $1,350,0 Total 00 $1,350,0 00 The current assets' fair value is $80,000 higher than their carrying amount because of inventory undervaluation. All other assets and liabilities have book values that approximate their fair value. The normal rate of return on net assets for the industry is 15%. The expected annual earnings for Grimsby are $140,000.

Step by Step Solution

★★★★★

3.43 Rating (185 Votes )

There are 3 Steps involved in it

Step: 1

Assuming that the excess earnings are expected to continue for 5 years how much would you be willing to pay for goodwill and for the company The maxim...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d79982a8d2_175969.pdf

180 KBs PDF File

635d79982a8d2_175969.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started