Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the result of a lawsuit a company was ordered to pay $20 billion in total for the damage made, through a 14-quarter payment plan.

As the result of a lawsuit a company was ordered to pay $20 billion in total for the damage made, through a 14-quarter payment plan. The company sell pay $3 billion at the end of the first quarter, and $2 billion at the end of the second quarter. For the remaining twelve quarters, the company will pay $1.25 billion each if the leterest rate is 3% per quarter, what is the present equivalent of this payment plan?

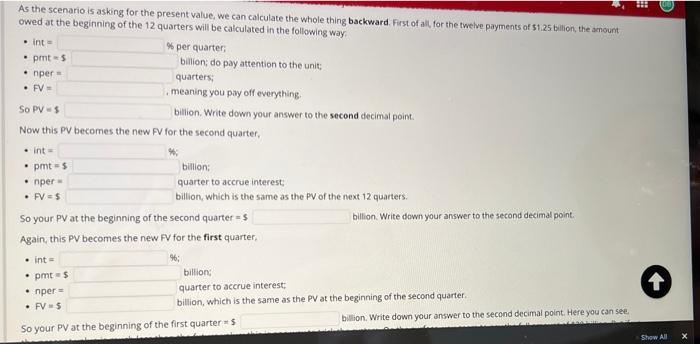

As the scenario is asking for the present value, we can calculate the whole thing backward. First of all, for the twelve payments of $1.25 billion, the amount oved at the beginning of the 12 quarters will be calculated in the following way.

So it seems that the payment plan can be changed and the payment will not be the same all the time. However, we are treating the scenario as three different periods. For the first period/quarter, you will pay $3 billion. For the second quarter, you will pay $2 billion. And for the rest of 12 quarters (eg, three years you will pay $1.25 billion each. We can still use Plan 2 of Table 4-1 for this case. We just have to find out what the PV is at different times.

Scenario 4 Example 4-18)

Solution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started