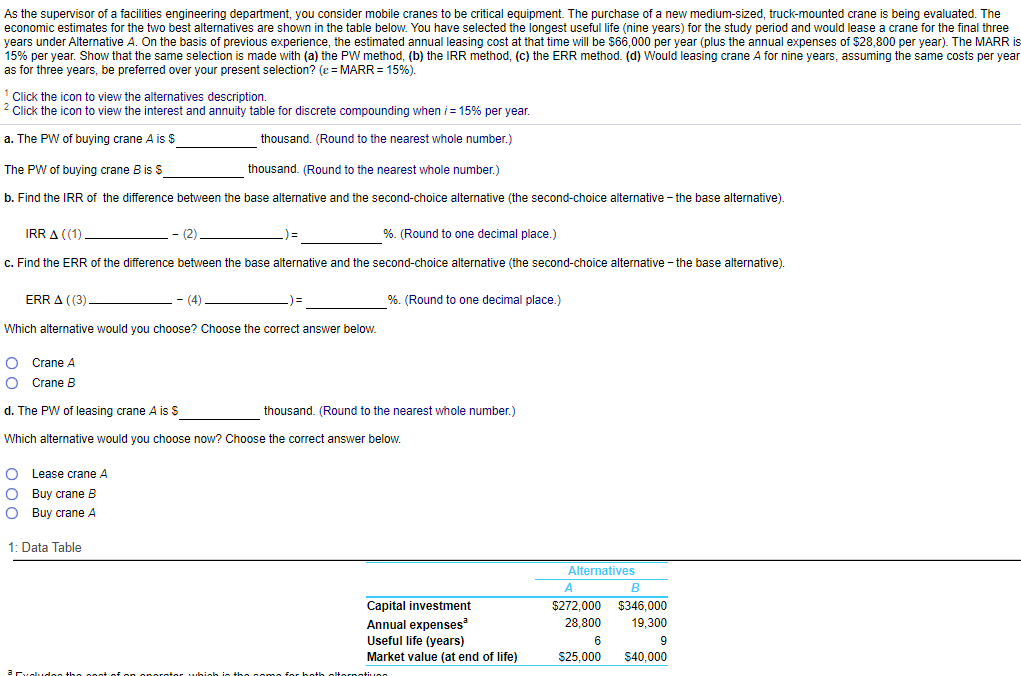

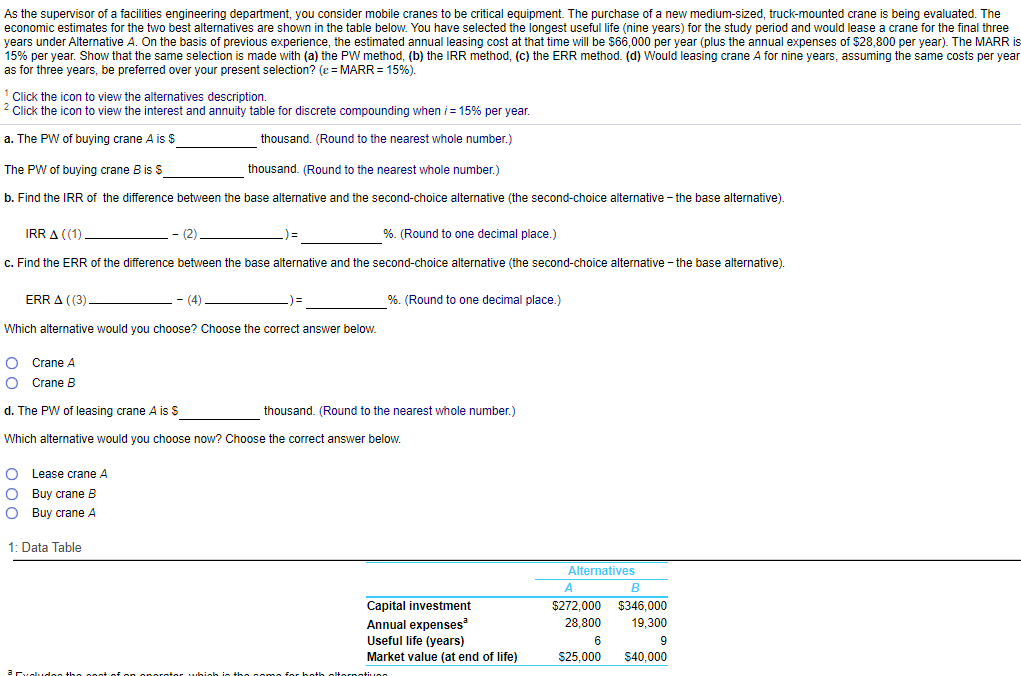

As the supervisor of a facilities engineering department, you consider mobile cranes to be critical equipment. The purchase of a new medium-sized, truck-mounted crane is being evaluated. The economic estimates for the two best alternatives are shown in the table below. You have selected the longest useful life nine years) for the study period and would lease a crane for the final three years under Alternative A. On the basis of previous experience, the estimated annual leasing cost at that time will be $66,000 per year (plus the annual expenses of $28,800 per year). The MARR is 15% per year. Show that the same selection is made with (a) the PW method, (b) the IRR method, (c) the ERR method. (d) Would leasing crane A for nine years, assuming the same costs per year as for three years, be preferred over your present selection? (e = MARR = 15%). Click the icon to view the alternatives description. 2 Click the icon to view the interest and annuity table for discrete compounding when i = 15% per year. a. The PW of buying crane A is $ thousand. (Round to the nearest whole number.) The PW of buying crane B is thousand. (Round to the nearest whole number.) b. Find the IRR of the difference between the base alternative and the second-choice alternative (the second-choice alternative - the base alternative). IRRA (1) -- (2) %. (Round to one decimal place.) c. Find the ERR of the difference between the base alternative and the second-choice alternative (the second-choice alternative - the base alternative). %. (Round to one decimal place.) ERRA ((3) -(4) Which alternative would you choose? Choose the correct answer below. O Crane A O Crane B d. The PW of leasing crane Ais 5 thousand. (Round to the nearest whole number.) Which alternative would you choose now? Choose the correct answer below. O O O Lease crane a Buy crane B Buy crane A 1: Data Table Alternatives $272,000 28,800 $346,000 19,300 Capital investment Annual expenses Useful life (years) Market value (at end of life) $25,000 $40,000 radott orator As the supervisor of a facilities engineering department, you consider mobile cranes to be critical equipment. The purchase of a new medium-sized, truck-mounted crane is being evaluated. The economic estimates for the two best alternatives are shown in the table below. You have selected the longest useful life nine years) for the study period and would lease a crane for the final three years under Alternative A. On the basis of previous experience, the estimated annual leasing cost at that time will be $66,000 per year (plus the annual expenses of $28,800 per year). The MARR is 15% per year. Show that the same selection is made with (a) the PW method, (b) the IRR method, (c) the ERR method. (d) Would leasing crane A for nine years, assuming the same costs per year as for three years, be preferred over your present selection? (e = MARR = 15%). Click the icon to view the alternatives description. 2 Click the icon to view the interest and annuity table for discrete compounding when i = 15% per year. a. The PW of buying crane A is $ thousand. (Round to the nearest whole number.) The PW of buying crane B is thousand. (Round to the nearest whole number.) b. Find the IRR of the difference between the base alternative and the second-choice alternative (the second-choice alternative - the base alternative). IRRA (1) -- (2) %. (Round to one decimal place.) c. Find the ERR of the difference between the base alternative and the second-choice alternative (the second-choice alternative - the base alternative). %. (Round to one decimal place.) ERRA ((3) -(4) Which alternative would you choose? Choose the correct answer below. O Crane A O Crane B d. The PW of leasing crane Ais 5 thousand. (Round to the nearest whole number.) Which alternative would you choose now? Choose the correct answer below. O O O Lease crane a Buy crane B Buy crane A 1: Data Table Alternatives $272,000 28,800 $346,000 19,300 Capital investment Annual expenses Useful life (years) Market value (at end of life) $25,000 $40,000 radott orator