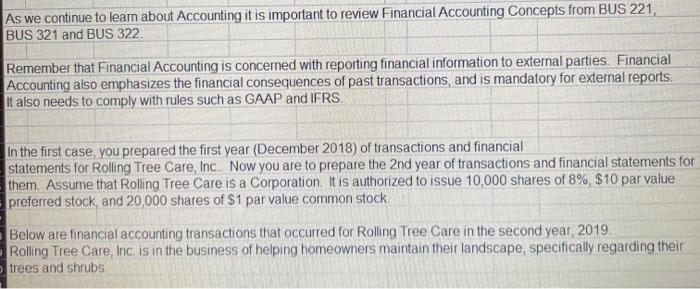

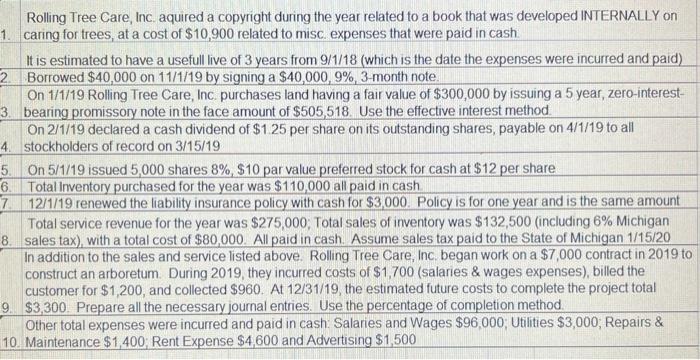

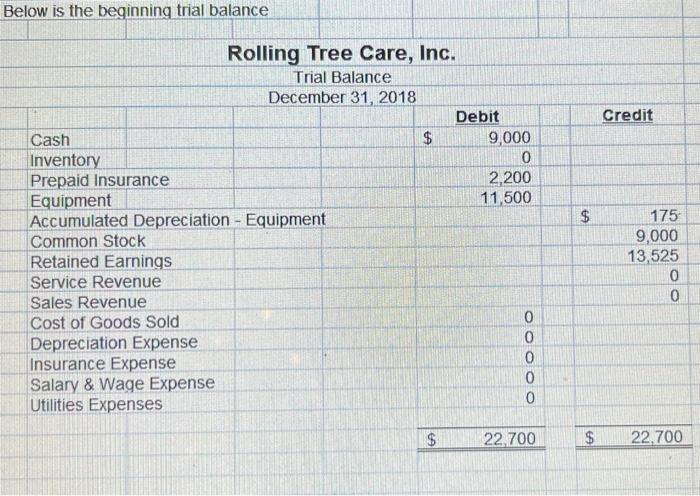

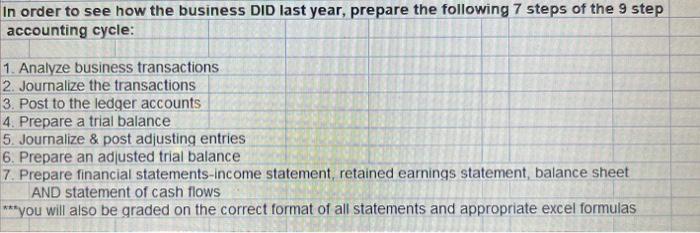

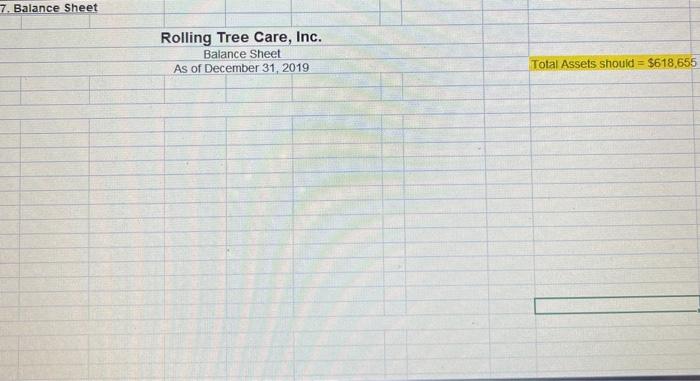

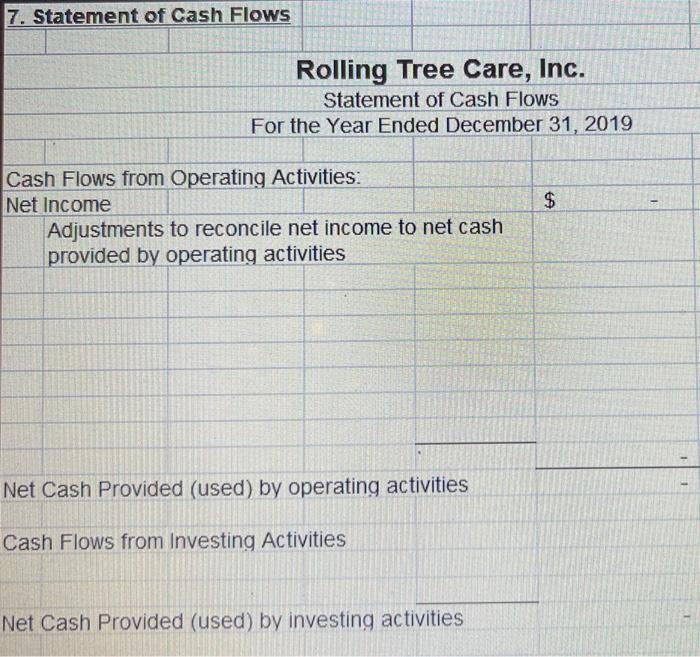

As we continue to learn about Accounting it is important to review Financial Accounting Concepts from BUS 221, BUS 321 and BUS 322 Remember that Financial Accounting is concerned with reporting financial information to external parties. Financial Accounting also emphasizes the financial consequences of past transactions, and is mandatory for external reports It also needs to comply with rules such as GAAP and IFRS. In the first case you prepared the first year (December 2018) of transactions and financial statements for Rolling Tree Care, Inc. Now you are to prepare the 2nd year of transactions and financial statements for them. Assume that Rolling Tree Care is a Corporation it is authorized to issue 10,000 shares of 8%, $10 par value preferred stock, and 20,000 shares of $1 par value common stock Below are financial accounting transactions that occurred for Rolling Tree Care in the second year, 2019 Rolling Tree Care, Inc. is in the business of helping homeowners maintain their landscape, specifically regarding their trees and shrubs Rolling Tree Care, Inc. aquired a copyright during the year related to a book that was developed INTERNALLY on 1. caring for trees, at a cost of $10,900 related to misc. expenses that were paid in cash It is estimated to have a usefull live of 3 years from 9/1/18 (which is the date the expenses were incurred and paid) 2. Borrowed $40,000 on 11/1/19 by signing a $40,000, 9%, 3-month note. On 1/1/19 Rolling Tree Care, Inc. purchases land having a fair value of $300,000 by issuing a 5 year, zero-interest- 3. bearing promissory note in the face amount of $505,518. Use the effective interest method. On 2/1/19 declared a cash dividend of $1 25 per share on its outstanding shares, payable on 4/1/19 to all 4 stockholders of record on 3/15/19 5. On 5/1/19 issued 5,000 shares 8% $10 par value preferred stock for cash at $12 per share 6 Total Inventory purchased for the year was $110,000 all paid in cash 7 12/1/19 renewed the liability insurance policy with cash for $3,000. Policy is for one year and is the same amount Total service revenue for the year was $275,000, Total sales of inventory was $132,500 (including 6% Michigan 8. sales tax), with a total cost of $80,000. All paid in cash. Assume sales tax paid to the State of Michigan 1/15/20 In addition to the sales and service listed above. Rolling Tree Care, Inc began work on a $7,000 contract in 2019 to construct an arboretum. During 2019, they incurred costs of $1,700 (salaries & wages expenses), billed the customer for $1,200, and collected $960. At 12/31/19, the estimated future costs to complete the project total 9. $3,300. Prepare all the necessary journal entries. Use the percentage of completion method. Other total expenses were incurred and paid in cash Salaries and Wages $96.000; Utilities $3,000, Repairs & 10. Maintenance $1,400, Rent Expense $4,600 and Advertising $1,500 Below is the beginning trial balance Credit $ Rolling Tree Care, Inc. Trial Balance December 31, 2018 Debit Cash $ 9,000 Inventory 0 Prepaid Insurance 2,200 Equipment 11.500 Accumulated Depreciation - Equipment Common Stock Retained Earnings Service Revenue Sales Revenue Cost of Goods Sold 0 Depreciation Expense 0 Insurance Expense 0 Salary & Wage Expense 0 Utilities Expenses 0 175 9,000 13,525 0 0 $ 22.700 $ 22.700 In order to see how the business DID last year, prepare the following 7 steps of the 9 step accounting cycle: 1. Analyze business transactions 2. Journalize the transactions 3. Post to the ledger accounts 4. Prepare a trial balance 5. Journalize & post adjusting entries 6. Prepare an adjusted trial balance 7. Prepare financial statements-income statement, retained earnings statement, balance sheet AND statement of cash flows *** you will also be graded on the correct format of all statements and appropriate excel formulas 2. Journal Entries: Date Debit Credit 1 2 3 4 5 6 7 8 9 10 3. Post to the Ledger Accounts: (use Taccounts) b 5. Journalize and Post Adjusting Journal Entries: Date Debit Credit 6. Adjusted Trial Balance: Rolling Tree Care, Inc. Trial Balance December 31, 2019 Debit Credit 7. Income Statement Rolling Tree Care, Inc. Income Statement For the Year Ended December 2019 Net Income 7. Statement of Retained Earnings Rolling Tree Care, Inc. Statement of Retained Earnings For the Year Ended December 31, 2019 7. Balance Sheet Rolling Tree Care, Inc. Balance Sheet As of December 31, 2019 Total Assets should = $618,655 7. Statement of Cash Flows Rolling Tree Care, Inc. Statement of Cash Flows For the Year Ended December 31, 2019 Cash Flows from Operating Activities: Net Income Adjustments to reconcile net income to net cash provided by operating activities Net Cash Provided (used) by operating activities Cash Flows from Investing Activities Net Cash Provided (used) by investing activities Cash Flows from Financing Activities Net Cash Provided (used) by financing activities Net increase (decrease) in cash - Cash, January 1, 2019 - Cash, December 31, 2019 $ 0 Supplemental Schedule of Noncash Investing & Financing Activities