Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As with all accounts some of the line items have been aggregated and it is necessary to look in the notes to the financial accounts

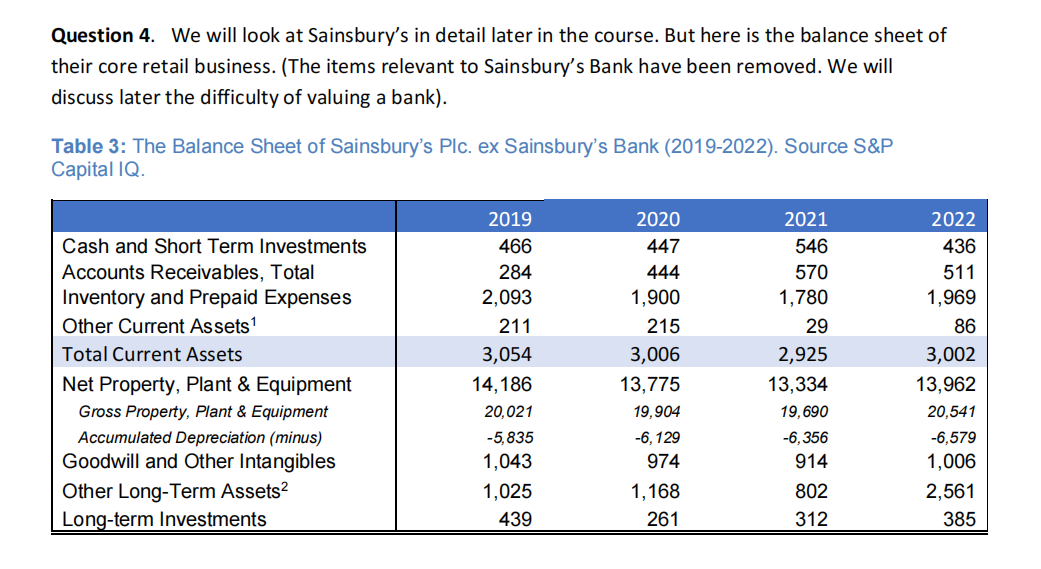

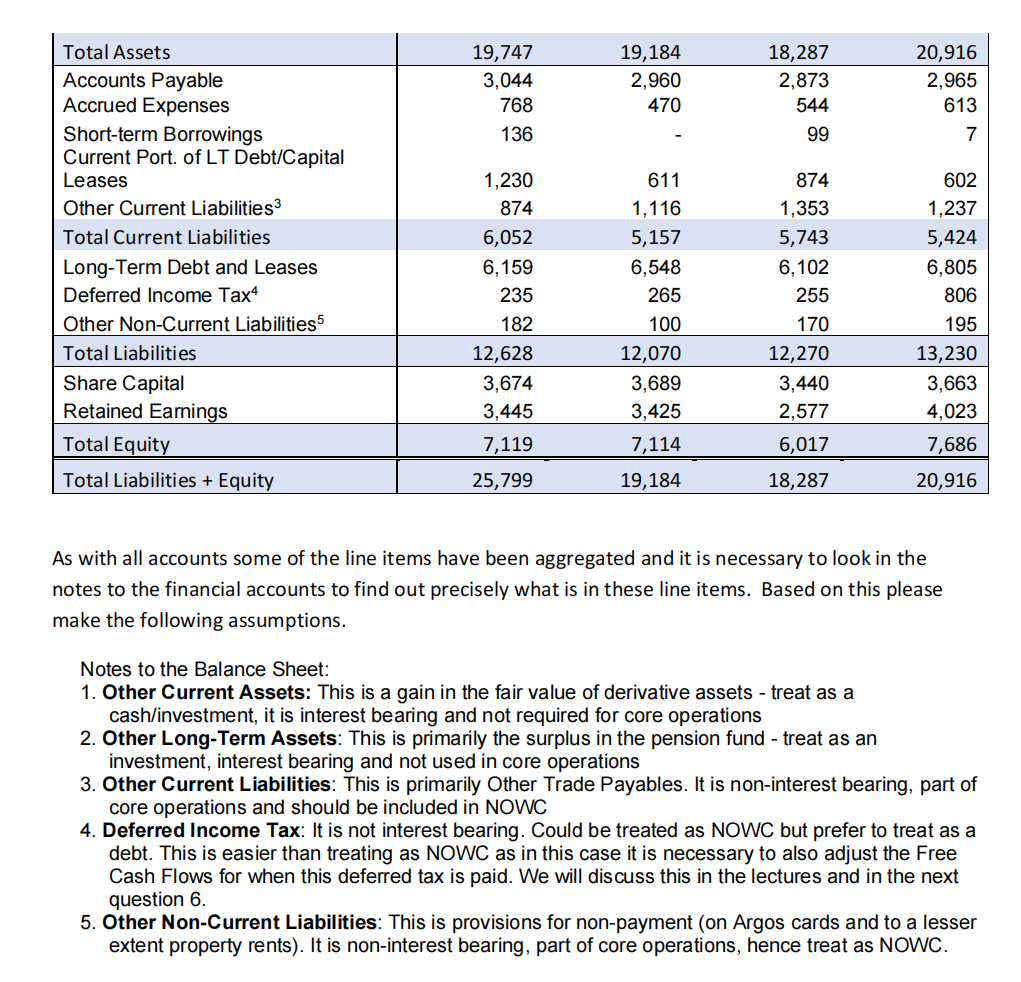

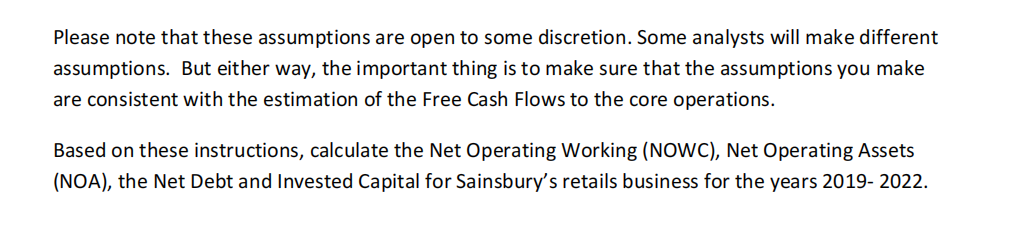

As with all accounts some of the line items have been aggregated and it is necessary to look in the notes to the financial accounts to find out precisely what is in these line items. Based on this please make the following assumptions. Notes to the Balance Sheet: 1. Other Current Assets: This is a gain in the fair value of derivative assets - treat as a cash/investment, it is interest bearing and not required for core operations 2. Other Long-Term Assets: This is primarily the surplus in the pension fund - treat as an investment, interest bearing and not used in core operations 3. Other Current Liabilities: This is primarily Other Trade Payables. It is non-interest bearing, part of core operations and should be included in NOWC 4. Deferred Income Tax: It is not interest bearing. Could be treated as NOWC but prefer to treat as a debt. This is easier than treating as NOWC as in this case it is necessary to also adjust the Free Cash Flows for when this deferred tax is paid. We will discuss this in the lectures and in the next question 6. 5. Other Non-Current Liabilities: This is provisions for non-payment (on Argos cards and to a lesser extent property rents). It is non-interest bearing, part of core operations, hence treat as NOWC. Question 4. We will look at Sainsbury's in detail later in the course. But here is the balance sheet of their core retail business. (The items relevant to Sainsbury's Bank have been removed. We will discuss later the difficulty of valuing a bank). Table 3: The Balance Sheet of Sainsbury's Plc. ex Sainsbury's Bank (2019-2022). Source S\&P Capital IQ. Please note that these assumptions are open to some discretion. Some analysts will make different assumptions. But either way, the important thing is to make sure that the assumptions you make are consistent with the estimation of the Free Cash Flows to the core operations. Based on these instructions, calculate the Net Operating Working (NOWC), Net Operating Assets (NOA), the Net Debt and Invested Capital for Sainsbury's retails business for the years 2019- 2022. As with all accounts some of the line items have been aggregated and it is necessary to look in the notes to the financial accounts to find out precisely what is in these line items. Based on this please make the following assumptions. Notes to the Balance Sheet: 1. Other Current Assets: This is a gain in the fair value of derivative assets - treat as a cash/investment, it is interest bearing and not required for core operations 2. Other Long-Term Assets: This is primarily the surplus in the pension fund - treat as an investment, interest bearing and not used in core operations 3. Other Current Liabilities: This is primarily Other Trade Payables. It is non-interest bearing, part of core operations and should be included in NOWC 4. Deferred Income Tax: It is not interest bearing. Could be treated as NOWC but prefer to treat as a debt. This is easier than treating as NOWC as in this case it is necessary to also adjust the Free Cash Flows for when this deferred tax is paid. We will discuss this in the lectures and in the next question 6. 5. Other Non-Current Liabilities: This is provisions for non-payment (on Argos cards and to a lesser extent property rents). It is non-interest bearing, part of core operations, hence treat as NOWC. Question 4. We will look at Sainsbury's in detail later in the course. But here is the balance sheet of their core retail business. (The items relevant to Sainsbury's Bank have been removed. We will discuss later the difficulty of valuing a bank). Table 3: The Balance Sheet of Sainsbury's Plc. ex Sainsbury's Bank (2019-2022). Source S\&P Capital IQ. Please note that these assumptions are open to some discretion. Some analysts will make different assumptions. But either way, the important thing is to make sure that the assumptions you make are consistent with the estimation of the Free Cash Flows to the core operations. Based on these instructions, calculate the Net Operating Working (NOWC), Net Operating Assets (NOA), the Net Debt and Invested Capital for Sainsbury's retails business for the years 2019- 2022

As with all accounts some of the line items have been aggregated and it is necessary to look in the notes to the financial accounts to find out precisely what is in these line items. Based on this please make the following assumptions. Notes to the Balance Sheet: 1. Other Current Assets: This is a gain in the fair value of derivative assets - treat as a cash/investment, it is interest bearing and not required for core operations 2. Other Long-Term Assets: This is primarily the surplus in the pension fund - treat as an investment, interest bearing and not used in core operations 3. Other Current Liabilities: This is primarily Other Trade Payables. It is non-interest bearing, part of core operations and should be included in NOWC 4. Deferred Income Tax: It is not interest bearing. Could be treated as NOWC but prefer to treat as a debt. This is easier than treating as NOWC as in this case it is necessary to also adjust the Free Cash Flows for when this deferred tax is paid. We will discuss this in the lectures and in the next question 6. 5. Other Non-Current Liabilities: This is provisions for non-payment (on Argos cards and to a lesser extent property rents). It is non-interest bearing, part of core operations, hence treat as NOWC. Question 4. We will look at Sainsbury's in detail later in the course. But here is the balance sheet of their core retail business. (The items relevant to Sainsbury's Bank have been removed. We will discuss later the difficulty of valuing a bank). Table 3: The Balance Sheet of Sainsbury's Plc. ex Sainsbury's Bank (2019-2022). Source S\&P Capital IQ. Please note that these assumptions are open to some discretion. Some analysts will make different assumptions. But either way, the important thing is to make sure that the assumptions you make are consistent with the estimation of the Free Cash Flows to the core operations. Based on these instructions, calculate the Net Operating Working (NOWC), Net Operating Assets (NOA), the Net Debt and Invested Capital for Sainsbury's retails business for the years 2019- 2022. As with all accounts some of the line items have been aggregated and it is necessary to look in the notes to the financial accounts to find out precisely what is in these line items. Based on this please make the following assumptions. Notes to the Balance Sheet: 1. Other Current Assets: This is a gain in the fair value of derivative assets - treat as a cash/investment, it is interest bearing and not required for core operations 2. Other Long-Term Assets: This is primarily the surplus in the pension fund - treat as an investment, interest bearing and not used in core operations 3. Other Current Liabilities: This is primarily Other Trade Payables. It is non-interest bearing, part of core operations and should be included in NOWC 4. Deferred Income Tax: It is not interest bearing. Could be treated as NOWC but prefer to treat as a debt. This is easier than treating as NOWC as in this case it is necessary to also adjust the Free Cash Flows for when this deferred tax is paid. We will discuss this in the lectures and in the next question 6. 5. Other Non-Current Liabilities: This is provisions for non-payment (on Argos cards and to a lesser extent property rents). It is non-interest bearing, part of core operations, hence treat as NOWC. Question 4. We will look at Sainsbury's in detail later in the course. But here is the balance sheet of their core retail business. (The items relevant to Sainsbury's Bank have been removed. We will discuss later the difficulty of valuing a bank). Table 3: The Balance Sheet of Sainsbury's Plc. ex Sainsbury's Bank (2019-2022). Source S\&P Capital IQ. Please note that these assumptions are open to some discretion. Some analysts will make different assumptions. But either way, the important thing is to make sure that the assumptions you make are consistent with the estimation of the Free Cash Flows to the core operations. Based on these instructions, calculate the Net Operating Working (NOWC), Net Operating Assets (NOA), the Net Debt and Invested Capital for Sainsbury's retails business for the years 2019- 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started