Question

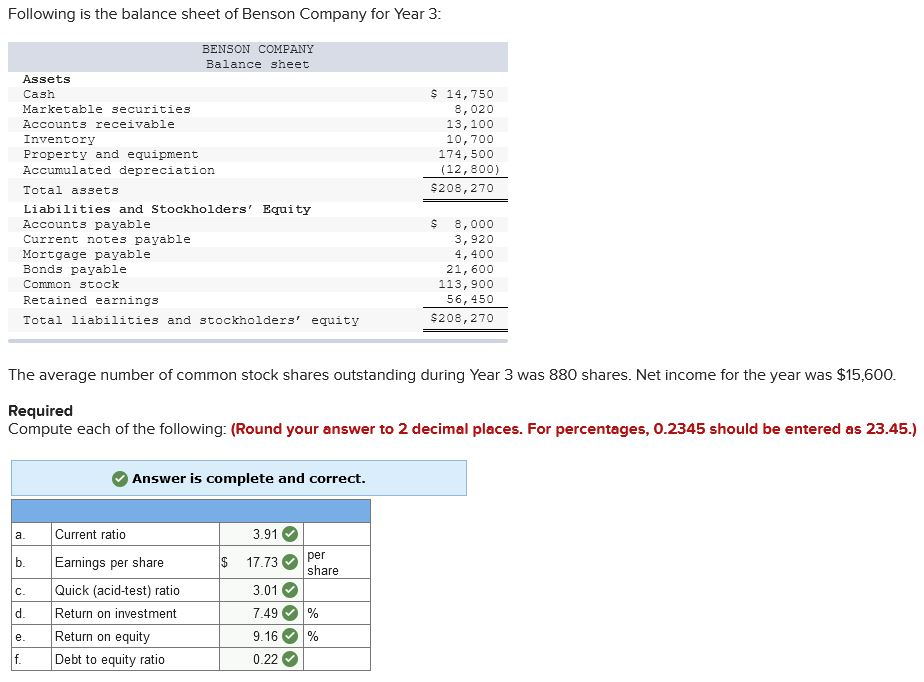

As you learned in this modules practice assignment (Practice: Ratio Analysis), many different calculations need to be completed to assist an organization with its financial

As you learned in this modules practice assignment (Practice: Ratio Analysis), many different calculations need to be completed to assist an organization with its financial statements.

Write a 250-word response reflecting on your experience making the calculations from the practice assignment. In your reflection, share your thoughts on the activities within this modules readings. Consider how calculating financial statements will help drive effective business decisions.

Answer the following questions within your response:

- Which calculations were challenging for you? Why?

- Which ratios were difficult to understand?

- What will you do differently in the following modules?

If you did not have any challenges, respond to the following questions:

- What prepared you for these calculations?

- What advice would you give a classmate who needs assistance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started