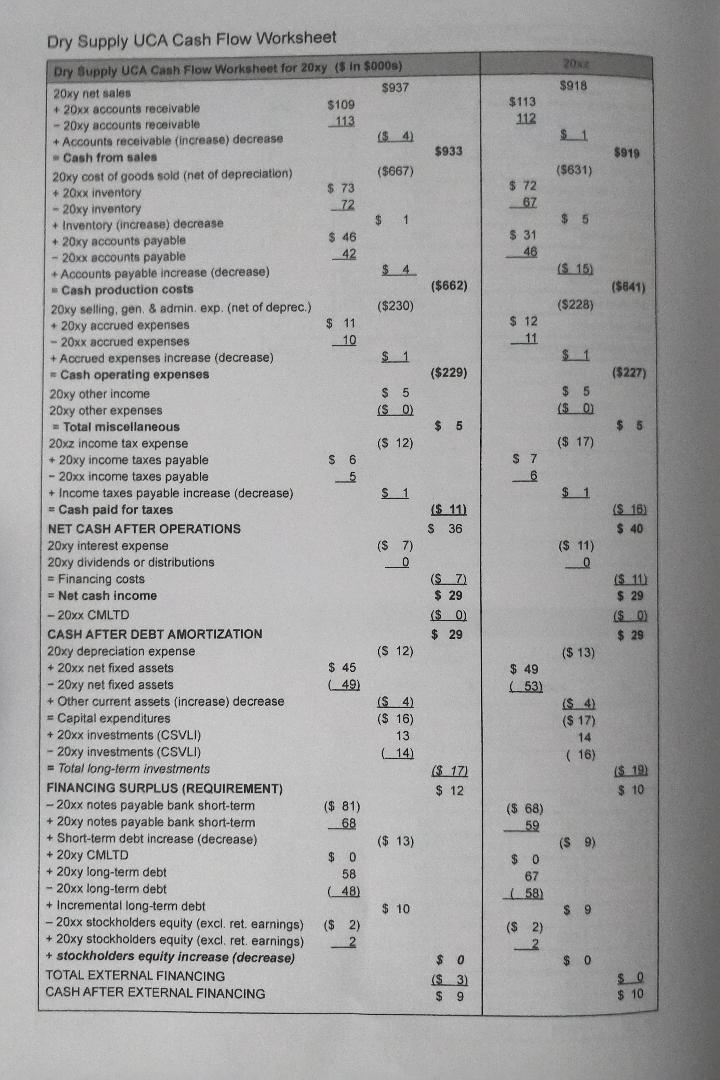

Question: As you recall, Dry Supply has requested a loan for $60,000 to purchase three new vans. On December 31, 20xz, Dry Supply had borrowed $67,000

As you recall, Dry Supply has requested a loan for $60,000 to purchase three new vans. On December 31, 20xz, Dry Supply had borrowed $67,000 from owner Kaitlyn Nielson. To provide support to the loan request, in addition to the personal guarantees of the owners, State Bank may ask Ms. Nielson to subordinate to the bank debt owed to her from Dry Supply.

Answer the following questions using Dry Supply's financial information found at the end of Chapter 5 in the textbook. Apply what you have learned about guarantees and subordination agreements.

1. What are two ways that State Bank can ask that the loan from Dry Supply be subordinated?

2. What steps can State Bank take if Ms. Nielson has secured her debt with a lien on a specific piece of equipment?

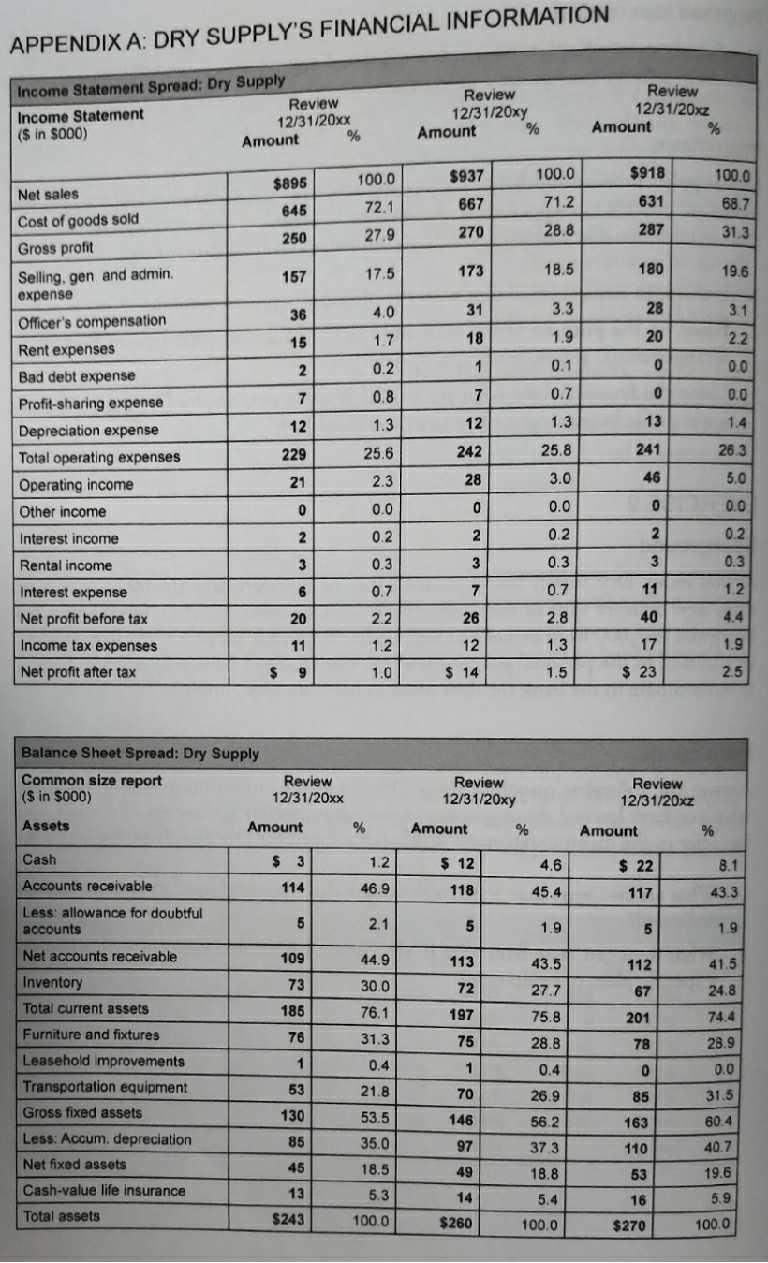

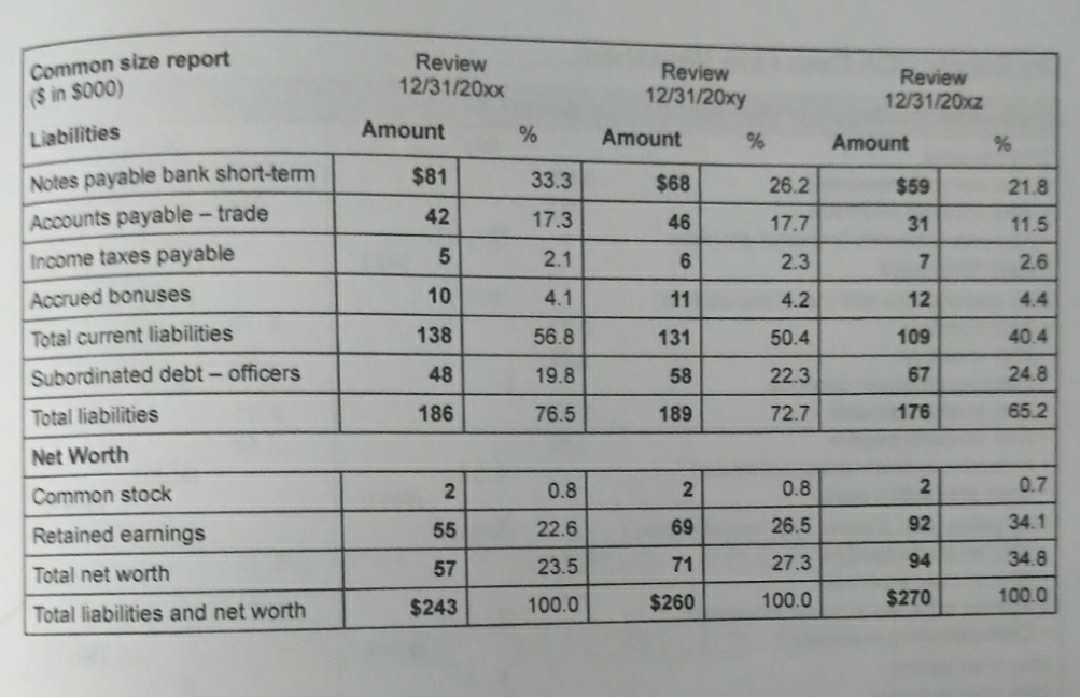

APPENDIX A: DRY SUPPLY'S FINANCIAL INFORMATION Income Statement Spread: Dry Supply Income Statement ($ in S000) Review 12/31/20xx Review 12/31/20xy Amount Review 12/31/20xz Amount Amount 100.0 $937 100.0 $918 100.0 $895 Net sales 72.1 667 71.2 631 68.7 645 Cost of goods sold 250 27.9 270 28.8 287 31.3 Gross profit 18.5 180 Selling, gen and admin. expense 157 17.5 173 19.6 36 4.0 31 3.3 28 3.1 Officer's compensation 15 17 18 1.9 20 2.2 Rent expenses 2 0.2 0.1 0.0 Bad debt expense 7 0.8 7 0.7 0.0 Profit-sharing expense 12 1.3 12 1.3 13 1.4 Depreciation expense Total operating expenses 229 25.6 242 25.8 241 26.3 Operating income 21 2.3 28 3.0 46 5.0 Other income 0.0 0.0 0.0 Interest income 0.2 2 0.2 0.2 Rental income 3 0.3 0.3 3 0.3 Interest expense 6 0.7 0.7 11 1.2 Net profit before tax 20 2.2 26 2.8 40 4.4 Income tax expenses 11 1.2 12 1.3 17 1.9 Net profit after tax $ 9 1.0 $ 14 1.5 $ 23 2.5 Balance Sheet Spread: Dry Supply Common size report (S in $000) Review 12/31/20xx Review 12/31/20xy Review 12/31/20xz Assets Amount Amount Amount Cash $ 3 1.2 $ 12 4.6 $ 22 8.1 Accounts receivable 114 46.9 118 45.4 117 43.3 Less allowance for doubtful accounts 2.1 5 1.9 5 1.9 Net accounts receivable 109 44.9 113 43.5 112 41.5 Inventory 73 30.0 72 27.7 67 24.8 Total current assets 185 76.1 197 75.8 74.4 201 Furniture and fixtures 76 31.3 75 28.8 78 28.9 Leasehold inmprovements 0.4 0.4 0.0 Transportation equipment 53 21.8 70 26.9 85 31.5 Gross fixed assets 130 53.5 146 56.2 60.4 163 Less: Accum. depreciation 85 35.0 97 40.7 37.3 110 Net fixed assets 45 18.5 49 18.8 19.6 53 Cash-value life insurance 13 5.3 14 5.4 16 5.9 Total assets $243 100.0 $260 100.0 100.0 $270 3.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

ANSWER 1 The following two ways by eich State Bank can ask the loan of Dry Supply be subordinated a ... View full answer

Get step-by-step solutions from verified subject matter experts