Answered step by step

Verified Expert Solution

Question

1 Approved Answer

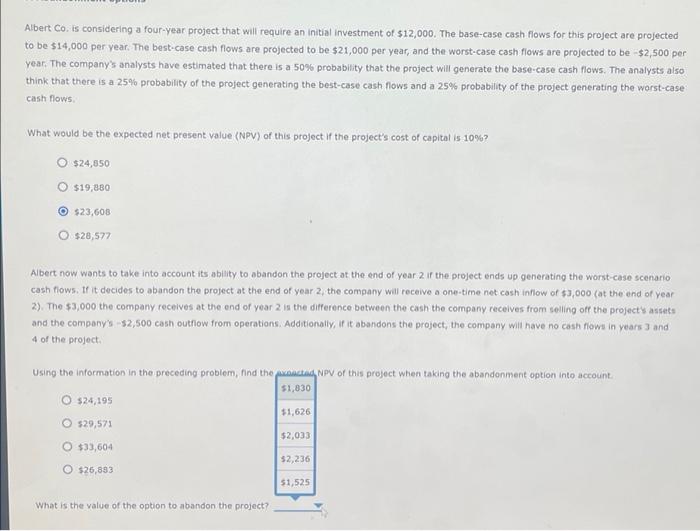

asa p pls! Albert Co. is considering a four-year project that will require an initial investment of $12,000. The base-case cash flows for this project

asa p pls!

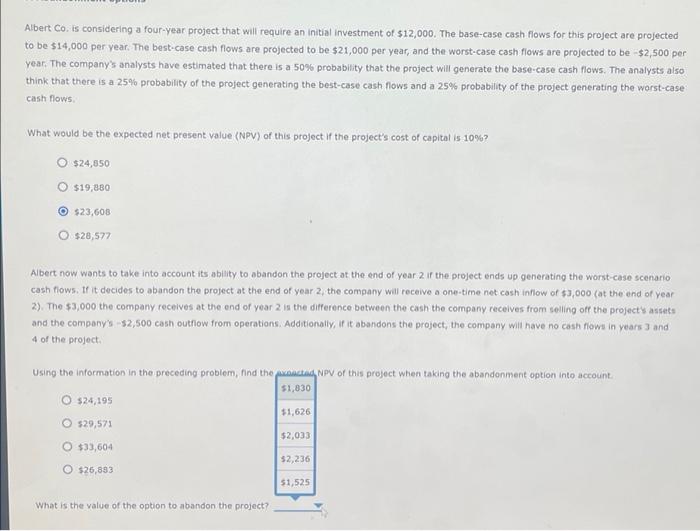

Albert Co. is considering a four-year project that will require an initial investment of $12,000. The base-case cash flows for this project are projected to be $14,000 per year. The best-case cash flows are projected to be $21,000 per year, and the worst-case cash flows are projected to be $2,500 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows What would be the expected net present value (NPV) of this project if the project's cost of capital is 10%? O $24,850 O $19,880 O $23,608 O $28,577 Albert now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst case scenario cash flows. If it decides to abandon the project at the end of year 2, the company will receive a one-time net cash inflow of $3,000 (at the end of year 2). The $3,000 the company receives at the end of year 2 in the difference between the cash the company receives from selling of the projects assets and the company's $2,500 cash outflow from operations. Additionally, if it abandons the project, the company will have no cash flow in years and 4 of the project Using the information in the preceding problem, find the pactad, NPV of this project when taking the abandonment option into account $1,830 $24,195 $1,626 $29,571 $2,033 O $33,604 32,236 O $26,833 51,525 What is the value of the option to abandon the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started