Question

Asagai (Pty) Ltd pays a maintenance contractor to maintain its premises. The maintenance contractor is paid on an annual basis. On 1 November 2022,

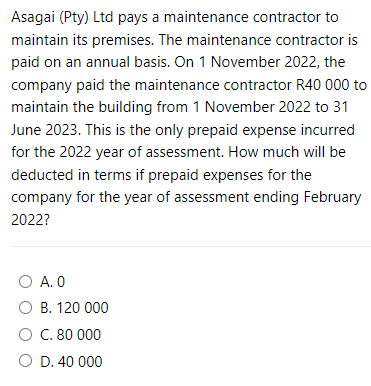

Asagai (Pty) Ltd pays a maintenance contractor to maintain its premises. The maintenance contractor is paid on an annual basis. On 1 November 2022, the company paid the maintenance contractor R40 000 to maintain the building from 1 November 2022 to 31 June 2023. This is the only prepaid expense incurred for the 2022 year of assessment. How much will be deducted in terms if prepaid expenses for the company for the year of assessment ending February 2022? O A. 0 O B. 120 000 O C. 80 000 O D. 40 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is A 0 Heres the ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting A Level And AS Level

Authors: Harold Randall

1st Edition

0521539935, 978-0521539937

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App