Answered step by step

Verified Expert Solution

Question

1 Approved Answer

asap please Darby Products uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Darby

asap please

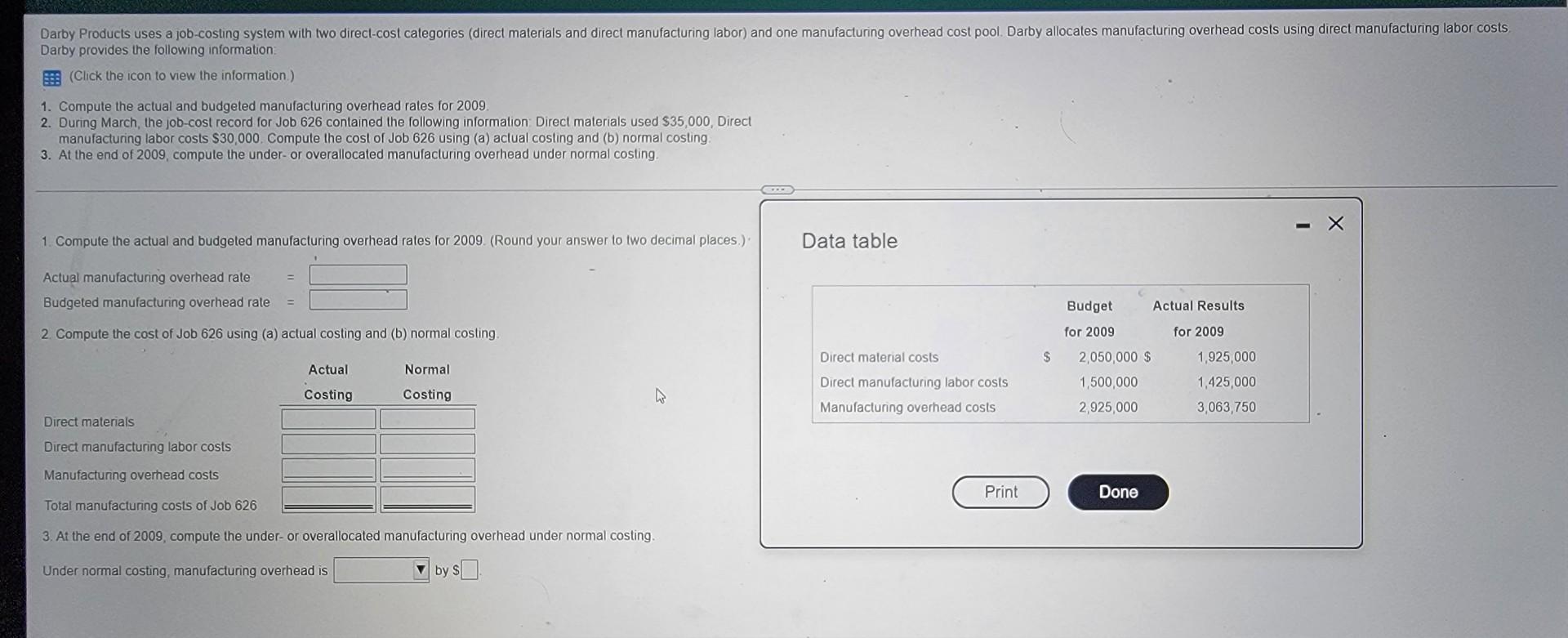

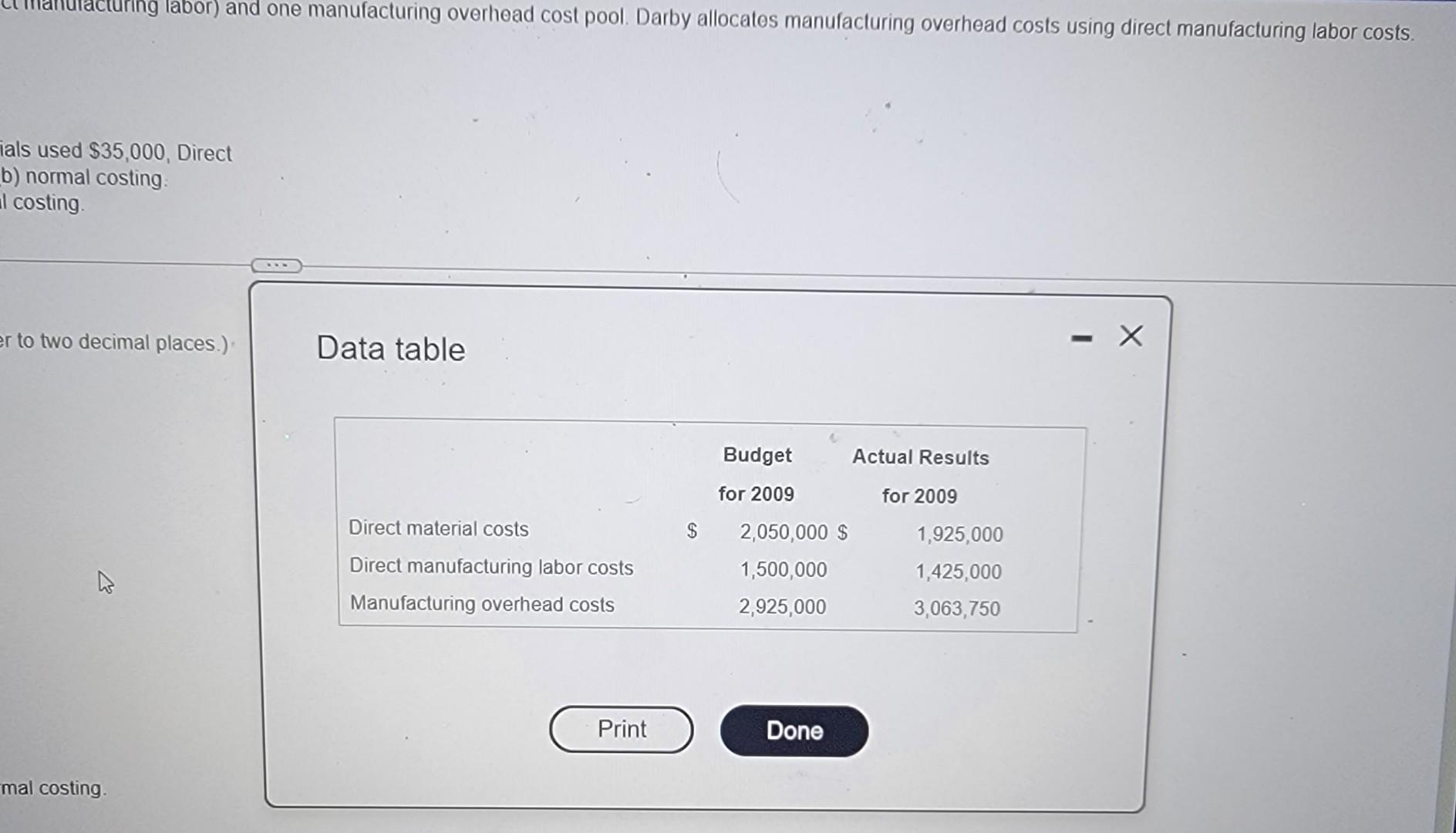

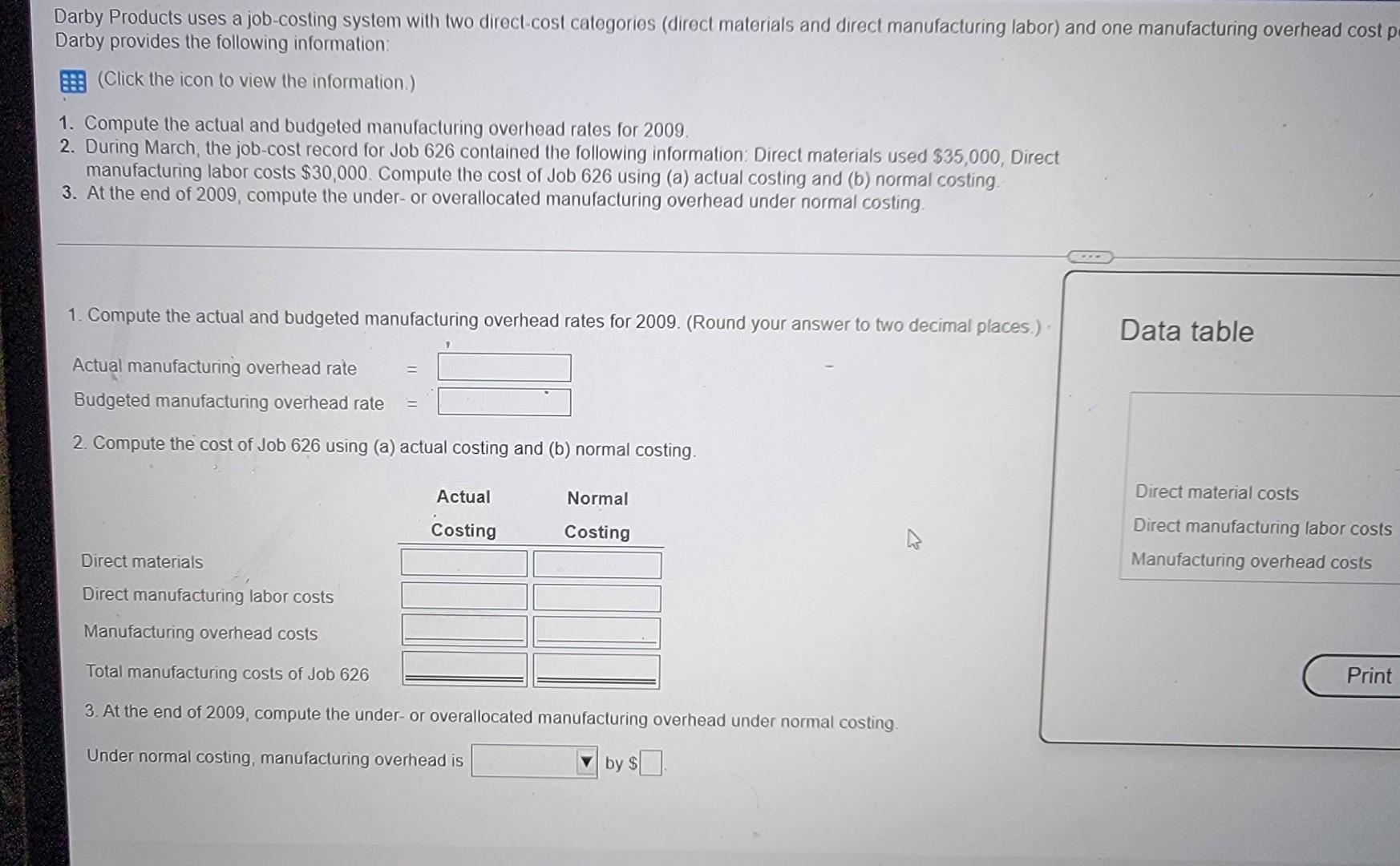

Darby Products uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Darby allocales manufacturing overhead costs using direct manufacturing labor costs Darby provides the following information BE (Click the icon to view the information) 1. Compute the actual and budgeted manufacturing overhead rates for 2009 2. During March, the job-cost record for Job 626 contained the following information Direct materials used $35,000, Direct manufacturing labor costs $30,000. Compute the cost of Job 626 using (a) actual cosling and (b) normal cosling 3. At the end of 2009, compute the under-or overallocated manufacturing overhead under normal costing 1. Compute the actual and budgeted manufacturing overhead rales for 2009. (Round your answer to two decimal places) Data table Actual manufacturing overhead rale Budgeted manufacturing overhead rale Budget Actual Results 2. Compute the cost of Job 626 using (a) actual costing and (b) normal costing for 2009 for 2009 Direct material costs $ Actual Normal 2,050,000 $ 1,500,000 2,925,000 1.925,000 1,425,000 3,063,750 Direct manufacturing labor costs Manufacturing overhead costs Costing Costing Direct materials Direct manufacturing labor costs Manufacturing overhead costs Print Done Total manufacturing costs of Job 626 3. At the end of 2009, compute the under-or overallocated manufacturing overhead under normal costing. Under normal costing, manufacturing overhead is by $ Ang labor) and one manufacturing overhead cost pool. Darby allocates manufacturing overhead costs using direct manufacturing labor costs. ials used $35,000, Direct b) normal costing I costing er to two decimal places.) Data table - X Budget Actual Results for 2009 for 2009 Direct material costs $ Direct manufacturing labor costs Manufacturing overhead costs 2,050,000 $ 1,500,000 2,925,000 1,925,000 1,425,000 3,063,750 Print Done mal costing Darby Products uses a job-costing system with two direct cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost p Darby provides the following information (Click the icon to view the information.) 1. Compute the actual and budgeted manufacturing overhead rates for 2009 2. During March, the job-cost record for Job 626 contained the following information: Direct materials used $35,000, Direct manufacturing labor costs $30,000. Compute the cost of Job 626 using (a) actual costing and (b) normal costing. 3. At the end of 2009, compute the under-or overallocated manufacturing overhead under normal costing. 1. Compute the actual and budgeted manufacturing overhead rates for 2009. (Round your answer to two decimal places.) Data table Actual manufacturing overhead rate Budgeted manufacturing overhead rate 2. Compute the cost of Job 626 using (a) actual costing and (b) normal costing Actual Normal Direct material costs Costing Costing Direct manufacturing labor costs Manufacturing overhead costs Direct materials Direct manufacturing labor costs Manufacturing overhead costs Total manufacturing costs of Job 626 Print 3. At the end of 2009, compute the under- or overallocated manufacturing overhead under normal costing. Under normal costing, manufacturing overhead is by $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started