Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASAP please Thank you :) % (SML) The following table shows the beta of each stock. If the expected market return is 10% and the

ASAP please Thank you :)

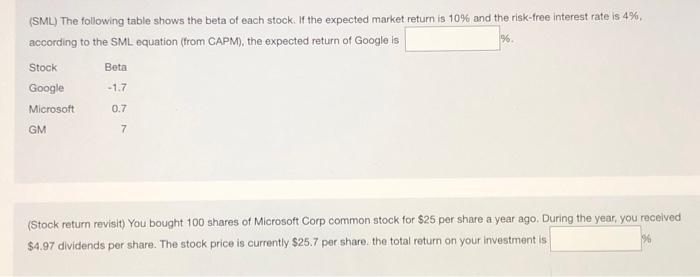

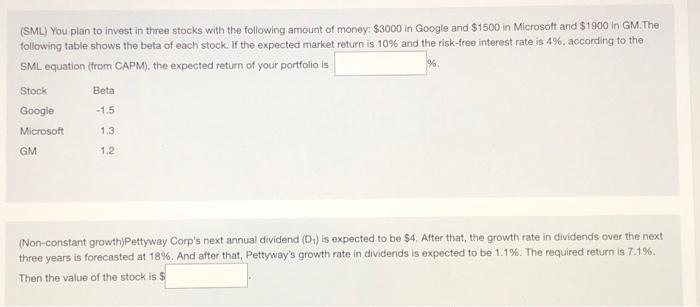

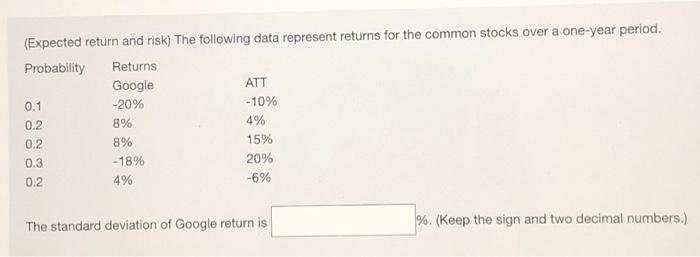

% (SML) The following table shows the beta of each stock. If the expected market return is 10% and the risk-free interest rate is 4%, according to the SML equation (from CAPM), the expected return of Google is Beta Google Microsoft 7 Stock -1.7 0.7 GM (Stock return revisit) You bought 100 shares of Microsoft Corp common stock for $25 per share a year ago. During the year, you received $4.97 dividends per share. The stock price is currently $25.7 per share the total return on your investment is (SML) You plan to invest in three stocks with the following amount of money: $3000 in Google and $1500 in Microsoft and $1900 in GM. The following table shows the beta of each stock. If the expected market return is 10% and the risk-free interest rate is 4%, according to the SML equation (from CAPM), the expected return of your portfolio is Stock Google -1.5 Microsoft Beta 1.3 GM 1.2 (Non-constant growth Pettyway Corp's next annual dividend (D) is expected to be $4. After that, the growth rate in dividends over the next three years is forecasted at 18%. And after that, Pettyway's growth rate in dividends is expected to be 1.1%. The required return is 7.1%. Then the value of the stock is $ (Expected return and risk) The following data represent returns for the common stocks over a one-year period. Probability Returns Google ATT 0.1 -20% - 10% 0.2 8% 0.2 8% 15% 0.3 -18% 20% 0.2 4% -6% 4% The standard deviation of Google return is %. (Keep the sign and two decimal numbers.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started