asap plz no expalantion needed just give me the answers

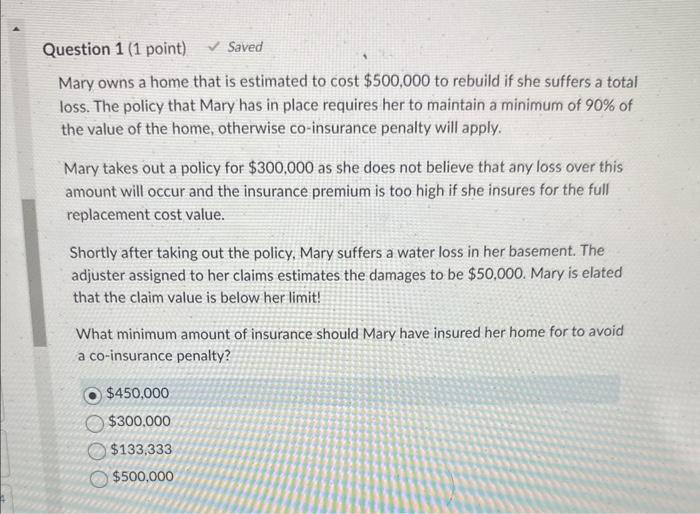

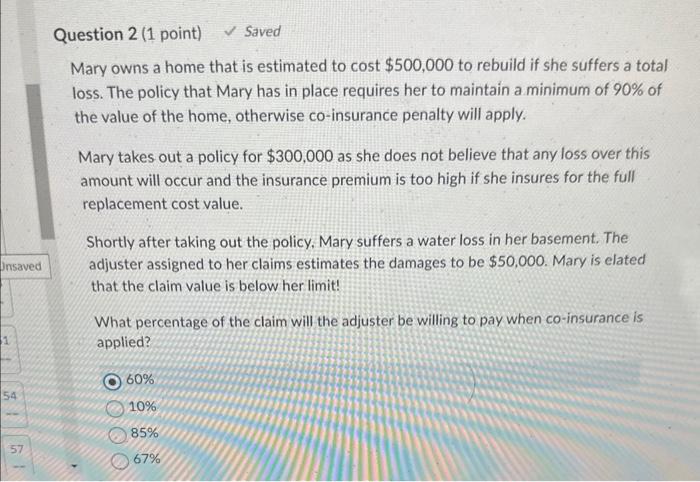

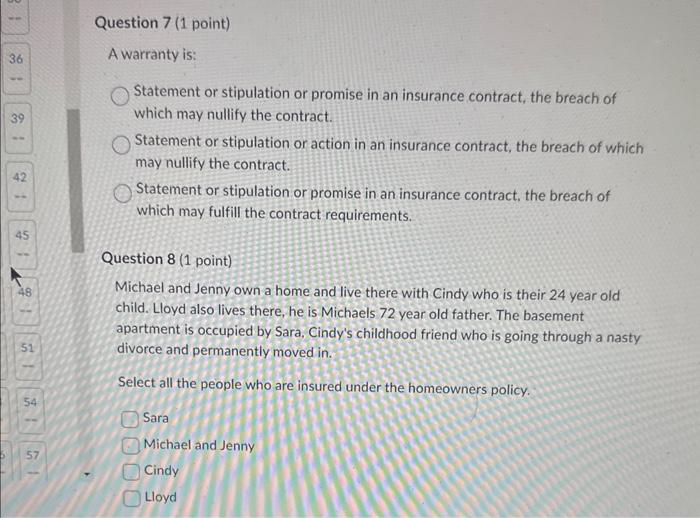

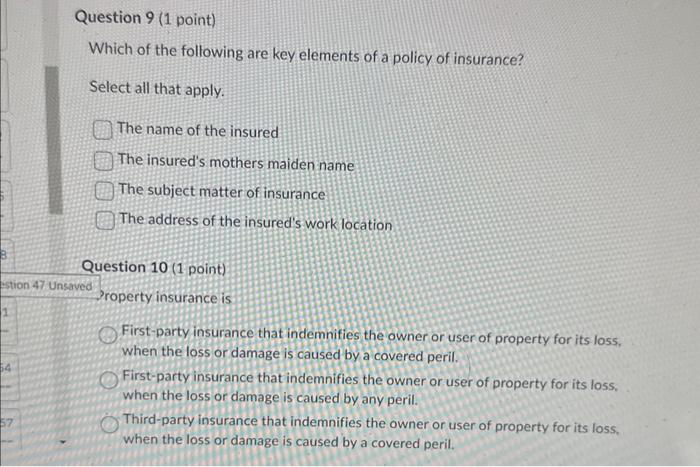

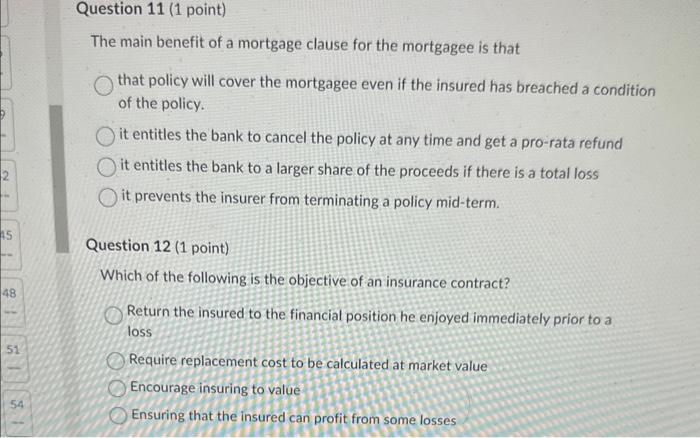

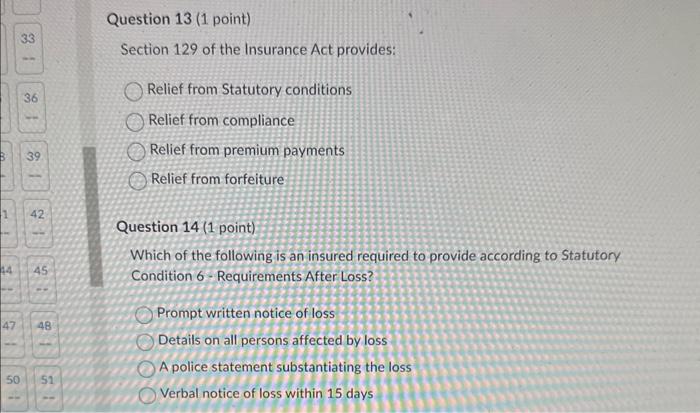

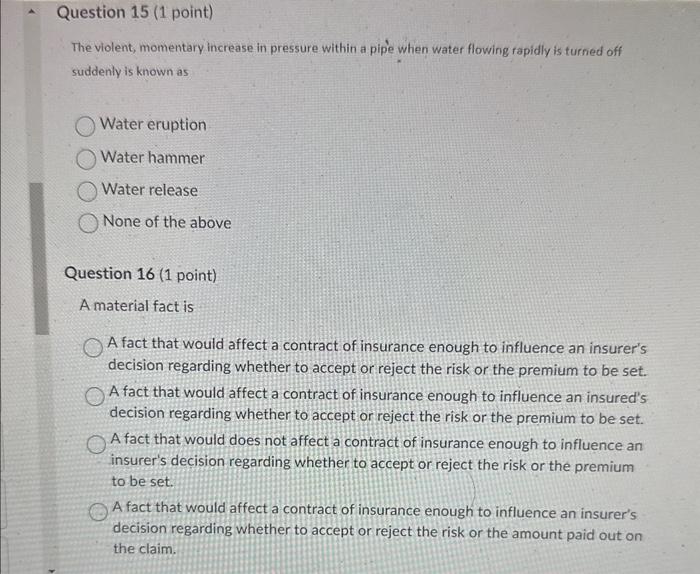

Mary owns a home that is estimated to cost $500,000 to rebuild if she suffers a total loss. The policy that Mary has in place requires her to maintain a minimum of 90% of the value of the home, otherwise co-insurance penalty will apply. Mary takes out a policy for $300,000 as she does not believe that any loss over this amount will occur and the insurance premium is too high if she insures for the full replacement cost value. Shortly after taking out the policy. Mary suffers a water loss in her basement. The adjuster assigned to her claims estimates the damages to be $50,000. Mary is elated that the claim value is below her limit! What minimum amount of insurance should Mary have insured her home for to avoid a co-insurance penalty? $450,000$300,000$133,333$500,000 Mary owns a home that is estimated to cost $500,000 to rebuild if she suffers a total loss. The policy that Mary has in place requires her to maintain a minimum of 90% of the value of the home, otherwise co-insurance penalty will apply. Mary takes out a policy for $300,000 as she does not believe that any loss over this amount will occur and the insurance premium is too high if she insures for the full replacement cost value. Shortly after taking out the policy. Mary suffers a water loss in her basement. The adjuster assigned to her claims estimates the damages to be $50,000. Mary is elated that the claim value is below her limit! What percentage of the claim will the adjuster be willing to pay when co-insurance is applied? 60% 10% 85% 67% Question 7 ( 1 point) A warranty is: Statement or stipulation or promise in an insurance contract, the breach of which may nullify the contract. Statement or stipulation or action in an insurance contract, the breach of which may nullify the contract. Statement or stipulation or promise in an insurance contract, the breach of which may fulfill the contract requirements. Question 8 (1 point) Michael and Jenny own a home and live there with Cindy who is their 24 year old child. Lloyd also lives there, he is Michaels 72 year old father. The basement apartment is occupied by Sara, Cindy's childhood friend who is going through a nasty divorce and permanently moved in. Select all the people who are insured under the homeowners policy. Sara Michael and Jenny Cindy Lloyd Which of the following are key elements of a policy of insurance? Select all that apply. The name of the insured The insured's mothers maiden name The subject matter of insurance The address of the insured's work location Question 10 (1 point) roperty insurance is First-party insurance that indemnifies the owner or user of property for its loss, when the loss or damage is caused by a covered peril. First-party insurance that indemnifies the owner or user of property for its loss, when the loss or damage is caused by any peril. Third-party insurance that indemnifies the owner or user of property for its loss, when the loss or damage is caused by a covered peril. The main benefit of a mortgage clause for the mortgagee is that that policy will cover the mortgagee even if the insured has breached a condition of the policy. it entitles the bank to cancel the policy at any time and get a pro-rata refund it entitles the bank to a larger share of the proceeds if there is a total loss it prevents the insurer from terminating a policy mid-term. Question 12 (1 point) Which of the following is the objective of an insurance contract? Return the insured to the financial position he enjoyed immediately prior to a loss Require replacement cost to be calculated at market value Encourage insuring to value Ensuring that the insured can profit from some losses Section 129 of the Insurance Act provides: Relief from Statutory conditions Relief from compliance Relief from premium payments Relief from forfeiture Question 14 (1 point) Which of the following is an insured required to provide according to Statutory Condition 6-Requirements After Loss? Prompt written notice of loss Details on all persons affected by loss A police statement substantiating the loss Verbal notice of loss within 15 days The violent, momentary increase in pressure within a pipe when water flowing rapidly is turned off suddenly is known as Water eruption Water hammer Water release None of the above Question 16 (1 point) A material fact is A fact that would affect a contract of insurance enough to influence an insurer's decision regarding whether to accept or reject the risk or the premium to be set. A fact that would affect a contract of insurance enough to influence an insured's decision regarding whether to accept or reject the risk or the premium to be set. A fact that would does not affect a contract of insurance enough to influence an insurer's decision regarding whether to accept or reject the risk or the premium to be set. A fact that would affect a contract of insurance enough to influence an insurer's decision regarding whether to accept or reject the risk or the amount paid out on the claim