ASAP

Show all working out

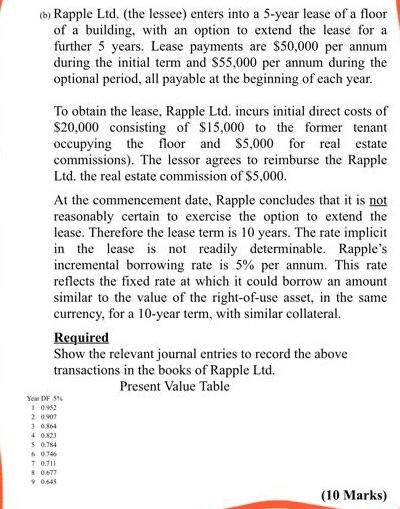

(b) Rapple Ltd. (the lessee) enters into a 5-year lease of a floor of a building, with an option to extend the lease for a further 5 years. Lease payments are $50,000 per annum during the initial term and $55,000 per annum during the optional period, all payable at the beginning of each year. To obtain the lease, Rapple Ltd. incurs initial direct costs of $20,000 consisting of $15,000 to the former tenant occupying the floor and $5,000 for real estate commissions). The lessor agrees to reimburse the Rapple Ltd. the real estate commission of $5,000. At the commencement date, Rapple concludes that it is not reasonably certain to exercise the option to extend the lease. Therefore the lease term is 10 years. The rate implicit in the lease is not readily determinable. Rapple's incremental borrowing rate is 5% per annum. This rate reflects the fixed rate at which it could borrow an amount similar to the value of the right-of-use asset, in the same currency, for a 10-year term, with similar collateral. Required Show the relevant journal entries to record the above transactions in the books of Rapple Ltd. Present Value Table (b) Rapple Ltd. (the lessee) enters into a 5-year lease of a floor of a building, with an option to extend the lease for a further 5 years. Lease payments are $50,000 per annum during the initial term and $55,000 per annum during the optional period, all payable at the beginning of each year. To obtain the lease, Rapple Ltd. incurs initial direct costs of $20,000 consisting of $15,000 to the former tenant occupying the floor and $5,000 for real estate commissions). The lessor agrees to reimburse the Rapple Ltd. the real estate commission of $5,000. At the commencement date, Rapple concludes that it is not reasonably certain to exercise the option to extend the lease. Therefore the lease term is 10 years. The rate implicit in the lease is not readily determinable. Rapple's incremental borrowing rate is 5% per annum. This rate reflects the fixed rate at which it could borrow an amount similar to the value of the right-of-use asset, in the same currency, for a 10-year term, with similar collateral. Required Show the relevant journal entries to record the above transactions in the books of Rapple Ltd. Present Value Table