ASAP thx

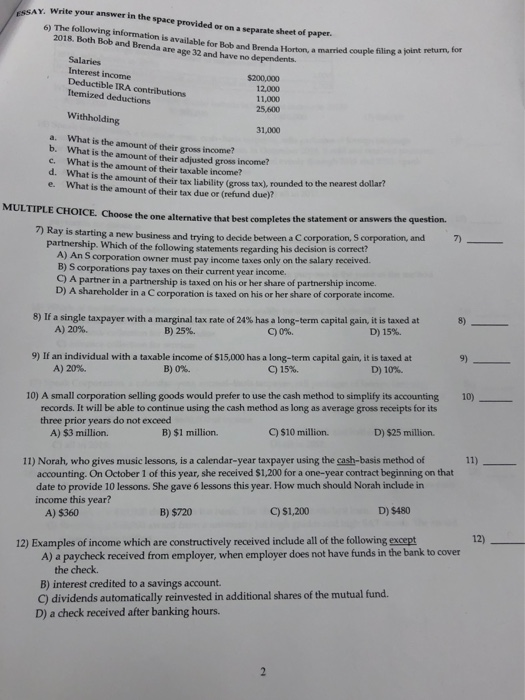

ESSAY. Write your answer in the space provided or on a separate sheet of paper. 6) The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2018. Both Bob and Brenda are age 32 and have no dependents. Salaries Interest income Deductible IRA contributions $200,000 12.000 Itemized deductions 11,000 25,600 Withholding 31,000 What is the amount of their gross income b. What is the amount of their adiusted gross income What is the amount of their taxable income? d. What is the amount of their tax liability (gross tax), rounded to the nearest dollar? What is the amount of their tax due or (refund due)? a c. e. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 7) 7) Ray is starting a new business and trving to decide between a C corporation, S corporation, and partnership. Which of the following statements regarding his decision is correct? A) An S corporation owner must pay income taxes only on the salary received. B) S corporations pay taxes on their current year income. C) A partner in a partnership is taxed on his or her share of partnership income. D) A shareholder in a C corporation is taxed on his or her share of corporate income. 8) If a single taxpayer with a marginal tax rate of 24% has a long-term capital gain, it is taxed at A) 20% 8) C)0% D) 15%. B) 25% 9) If an individual with a taxable income of $15,000 has a long-term capital gain, it is taxed at D) 10% 9) ) 15% B) 0%. A) 20% 10) A small corporation selling goods would prefer to use the cash method to simplify its accounting records. It will be able to continue using the cash method as long as average gross receipts for its three prior years do not exceed A) $3 million. 10) D) $25 million C) $10 million. B) $1 million. 11) Norah, who gives music lessons, is a calendar-year taxpayer using the cash-basis method of accounting. On October 1 of this year, she received $1,200 for a one-year contract beginning on that date to provide 10 lessons. She gave 6 lessons this year. How much should Norah include in 11) income this year? A) $360 D) $480 C) $1,200 B) $720 12) 12) Examples of income which are A) a paycheck received from employer, when employer does not have funds in the bank to cover the check. constructively received include all of the following except B) interest credited to a savings account C) dividends automatically reinvested in additional shares of the mutual fund. D) a check received after banking hours