Answered step by step

Verified Expert Solution

Question

1 Approved Answer

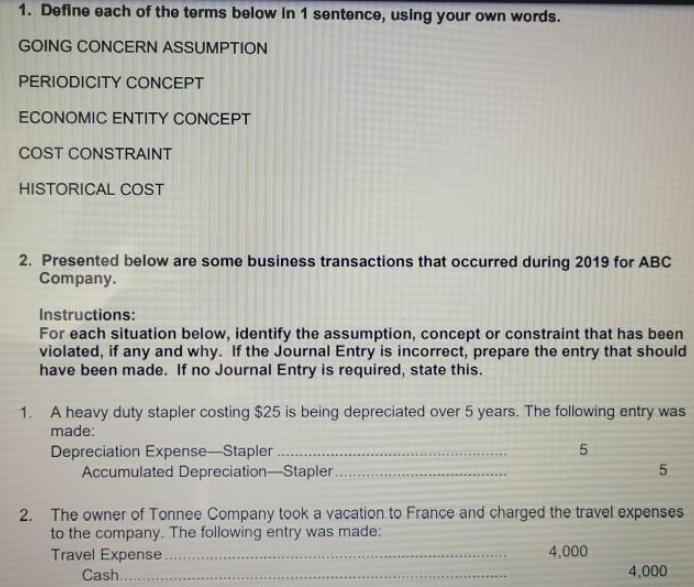

1. Define each of the terms below In 1 sentence, using your own words. GOING CONCERN ASSUMPTION PERIODICITY CONCEPT ECONOMIC ENTITY CONCEPT COST CONSTRAINT

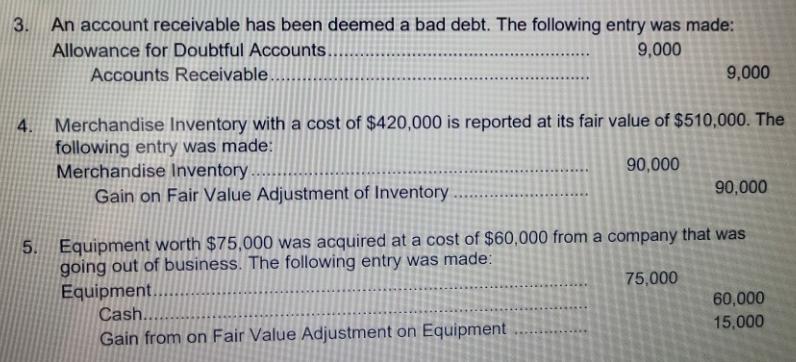

1. Define each of the terms below In 1 sentence, using your own words. GOING CONCERN ASSUMPTION PERIODICITY CONCEPT ECONOMIC ENTITY CONCEPT COST CONSTRAINT HISTORICAL COST 2. Presented below are some business transactions that occurred during 2019 for ABC Company. Instructions: For each situation below, identify the assumption, concept or constraint that has been violated, if any and why. If the Journal Entry is incorrect, prepare the entry that should have been made. If no Journal Entry is required, state this. 1. A heavy duty stapler costing $25 is being depreciated over 5 years. The following entry was made: Depreciation Expense-Stapler Accumulated Depreciation-Stapler. 2. The owner of Tonnee Company took a vacation to France and charged the travel expenses to the company. The following entry was made: Travel Expense.. 4,000 Cash. 4,000 5, An account receivable has been deemed a bad debt. The following entry was made: Allowance for Doubtful Accounts... 3. 9,000 Accounts Receivable. 9,000 Merchandise Inventory with a cost of $420,000 is reported at its fair value of $510,000. The following entry was made: Merchandise Inventory. 4. 90,000 90,000 Gain on Fair Value Adjustment of Inventory 5. Equipment worth $75,000 was acquired at a cost of $60,000 from a company that was going out of business. The following entry was made: Equipment. Cash.. Gain from on Fair Value Adjustment on Equipment 75,000 60,000 15,000

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Going concern assumption The going concern concept assumes the firm con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started