Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Asean Mine Sdn. Bhd. (AM) is a company involved in discovering minerals and selling minerals to suppliers. It closes accounts on 30 September annually.

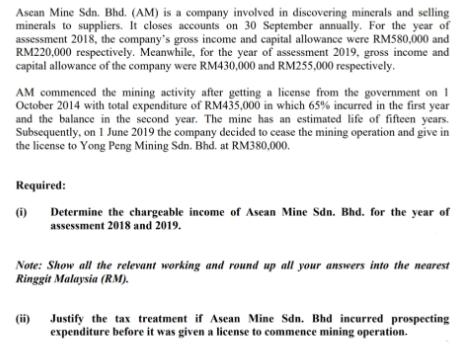

Asean Mine Sdn. Bhd. (AM) is a company involved in discovering minerals and selling minerals to suppliers. It closes accounts on 30 September annually. For the year of assessment 2018, the company's gross income and capital allowance were RM580,000 and RM220,000 respectively. Meanwhile, for the year of assessment 2019, gross income and capital allowance of the company were RM430,000 and RM255,000 respectively. AM commenced the mining activity after getting a license from the government on 1 October 2014 with total expenditure of RM435,000 in which 65% incurred in the first year and the balance in the second year. The mine has an estimated life of fifteen years. Subsequently, on 1 June 2019 the company decided to cease the mining operation and give in the license to Yong Peng Mining Sdn. Bhd. at RM380,000. Required: (i) Determine the chargeable income of Asean Mine Sdn. Bhd. for the year of assessment 2018 and 2019. Note: Show all the relevant working and round up all your answers into the nearest Ringgit Malaysia (RM). (ii) Justify the tax treatment if Asean Mine Sdn. Bhd incurred prospecting expenditure before it was given a license to commence mining operation.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To determine the chargeable income of Ascan Mine Sdn Bhd AM for the year of assessment 2018 and 2019 we need to calculate the adjusted income and dedu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started