Answered step by step

Verified Expert Solution

Question

1 Approved Answer

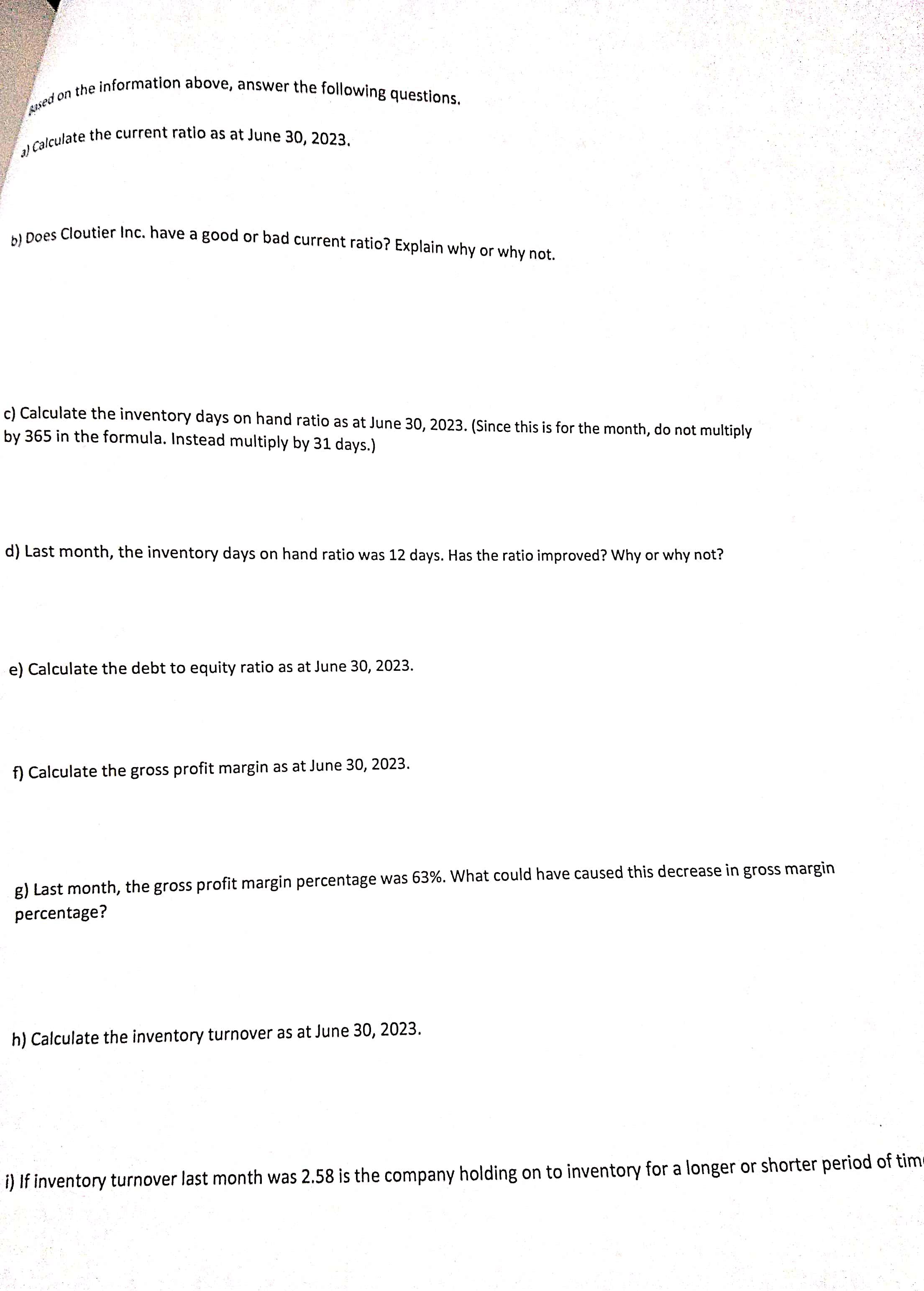

Ased on the information above, answer the following questions. a) Calculate the current ratio as at June 30, 2023. b) Does Cloutier Inc. have

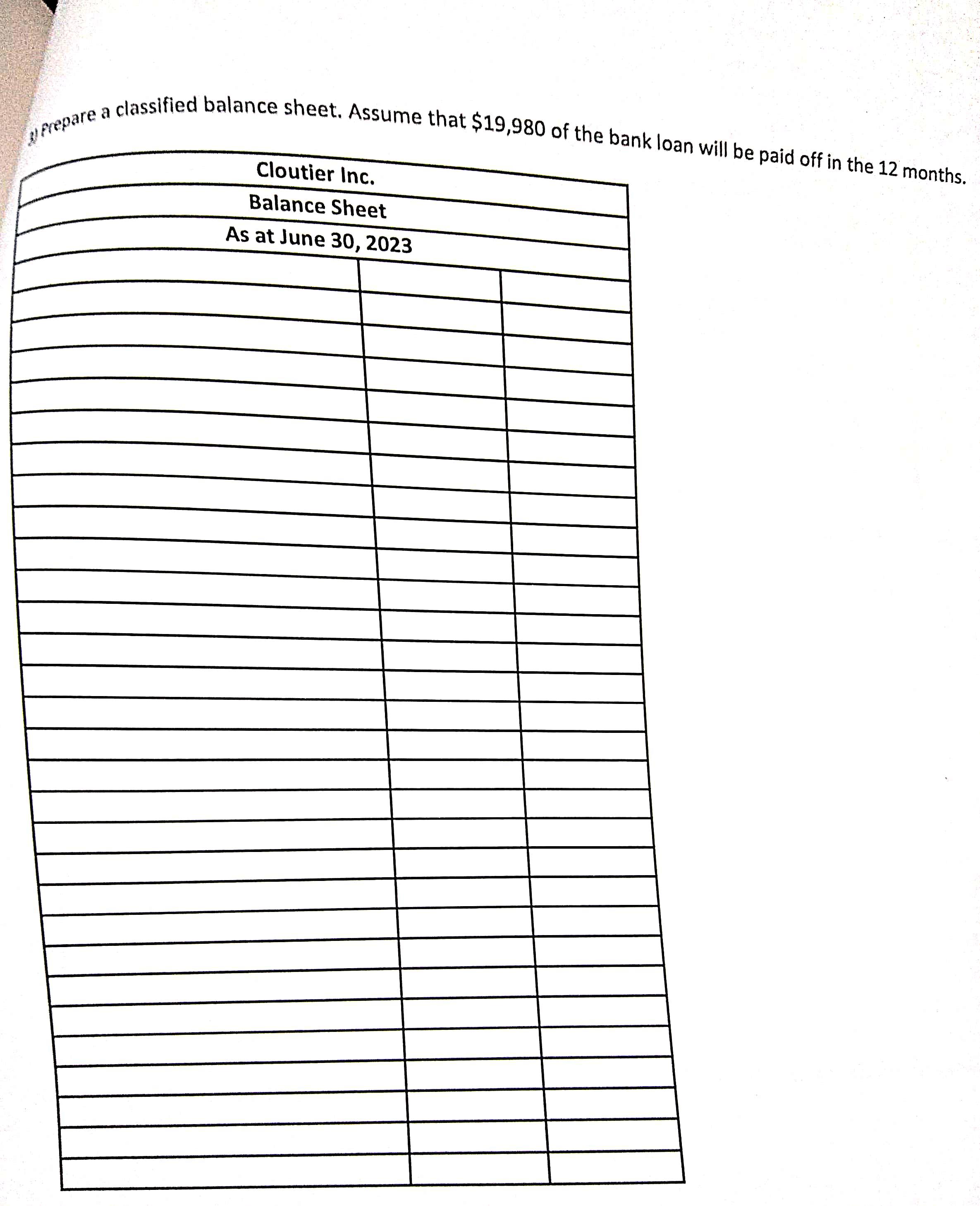

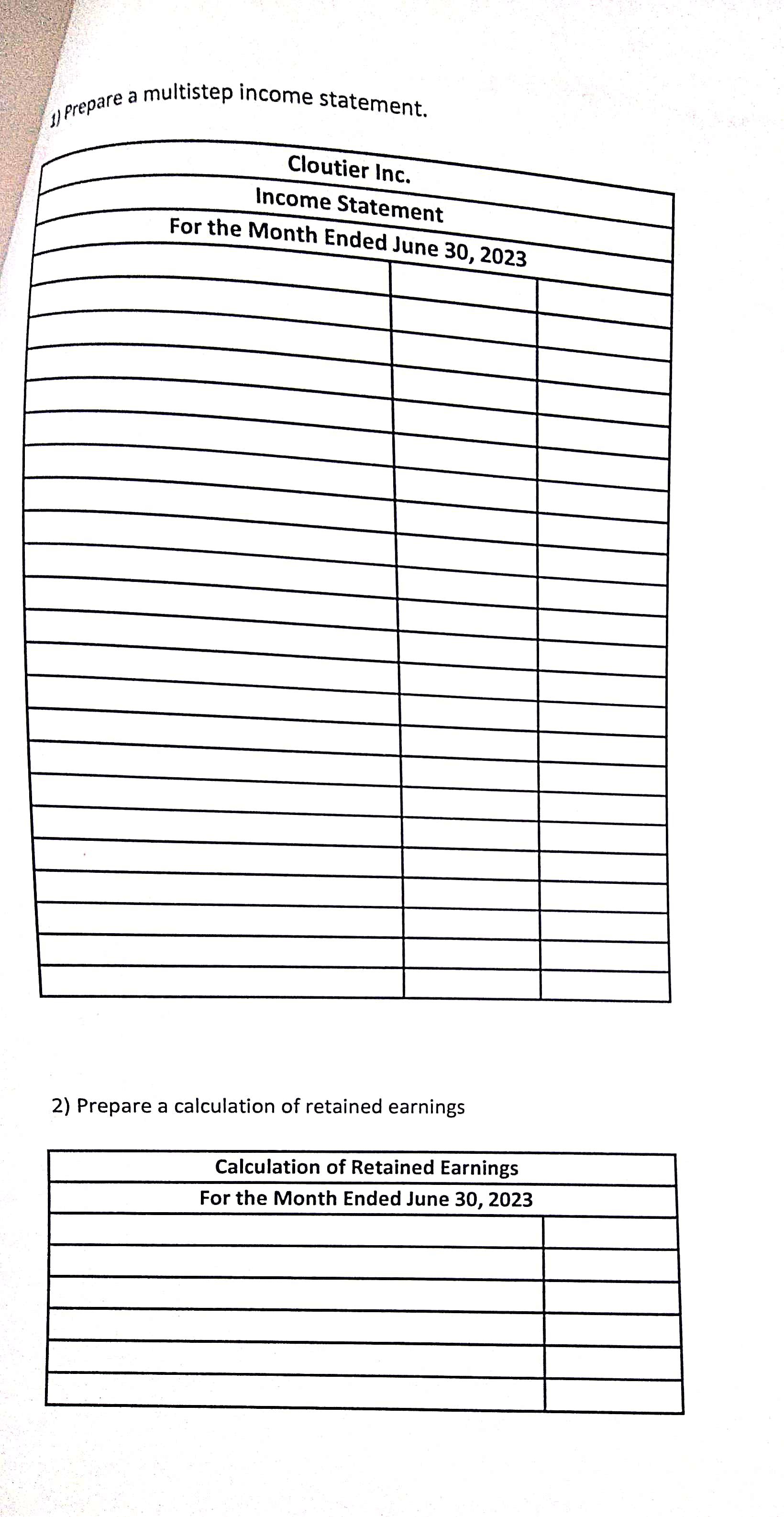

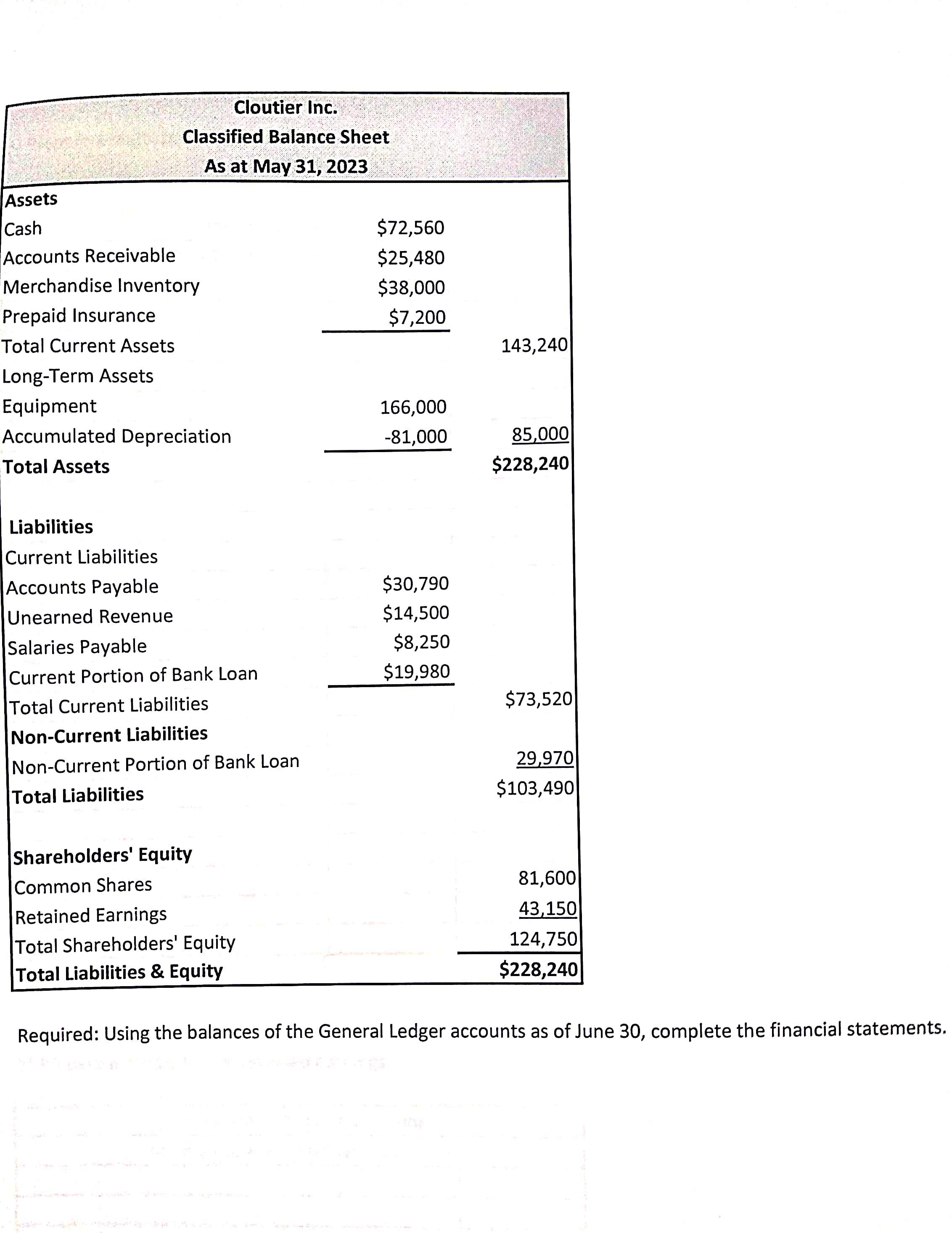

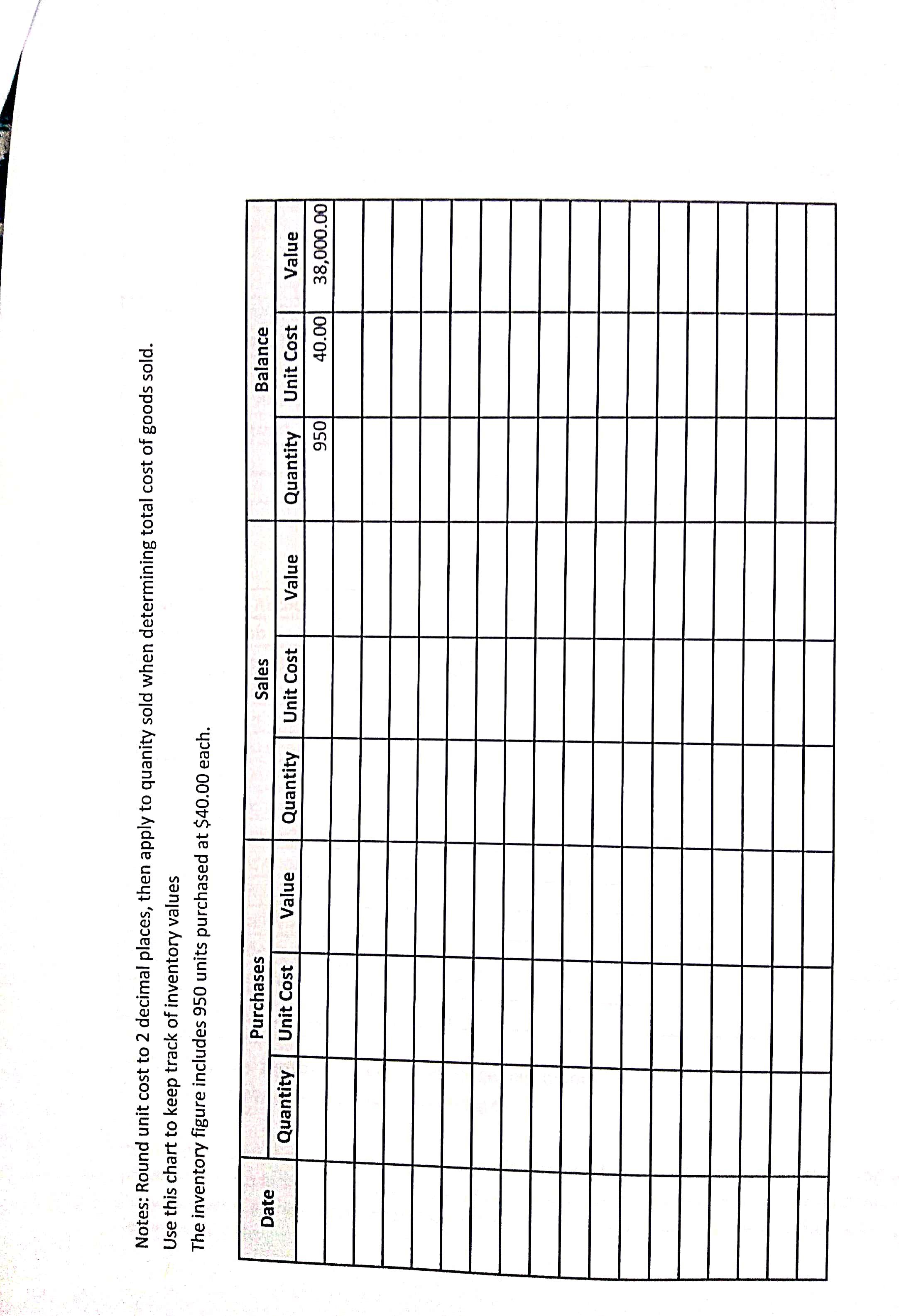

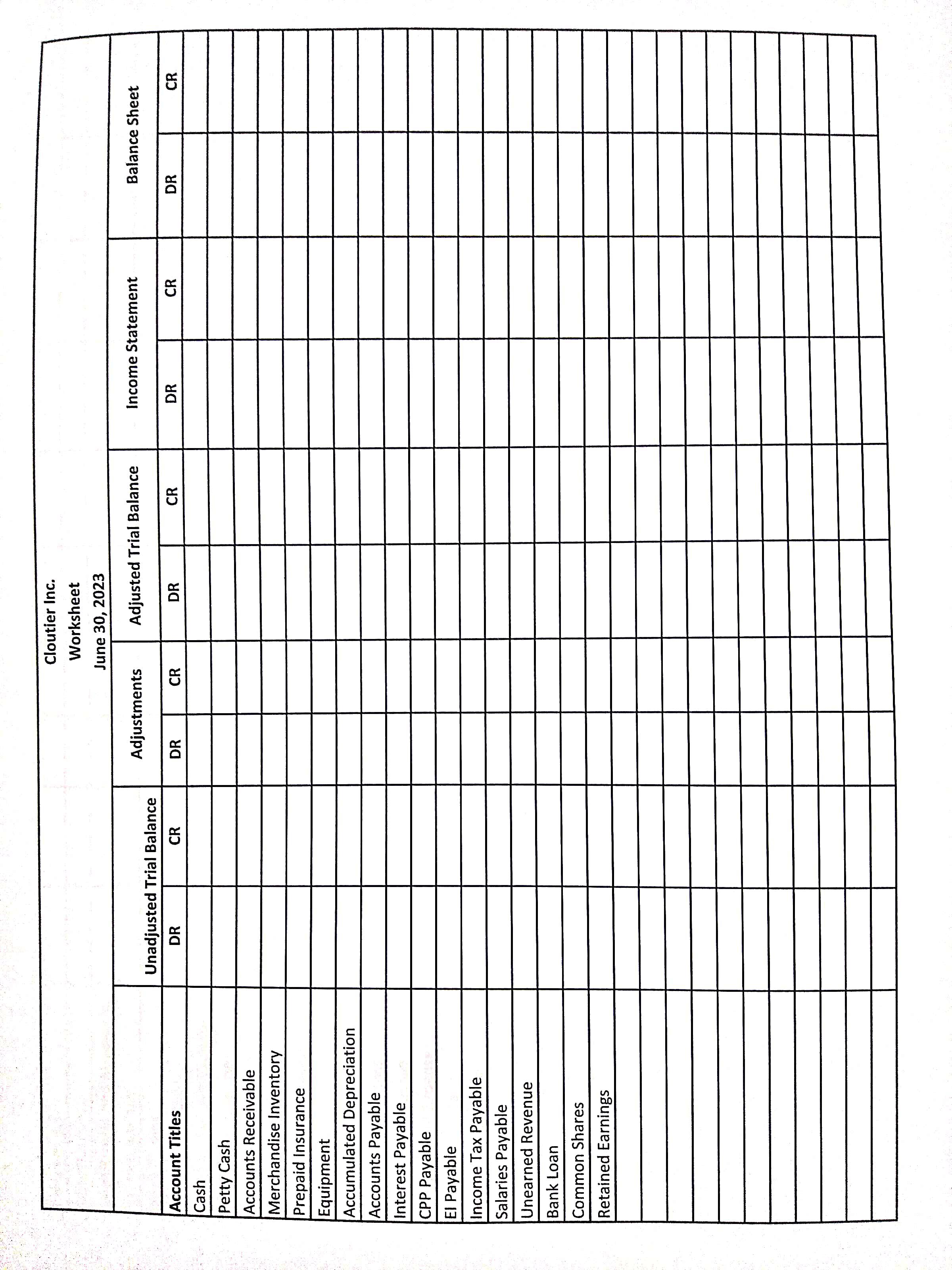

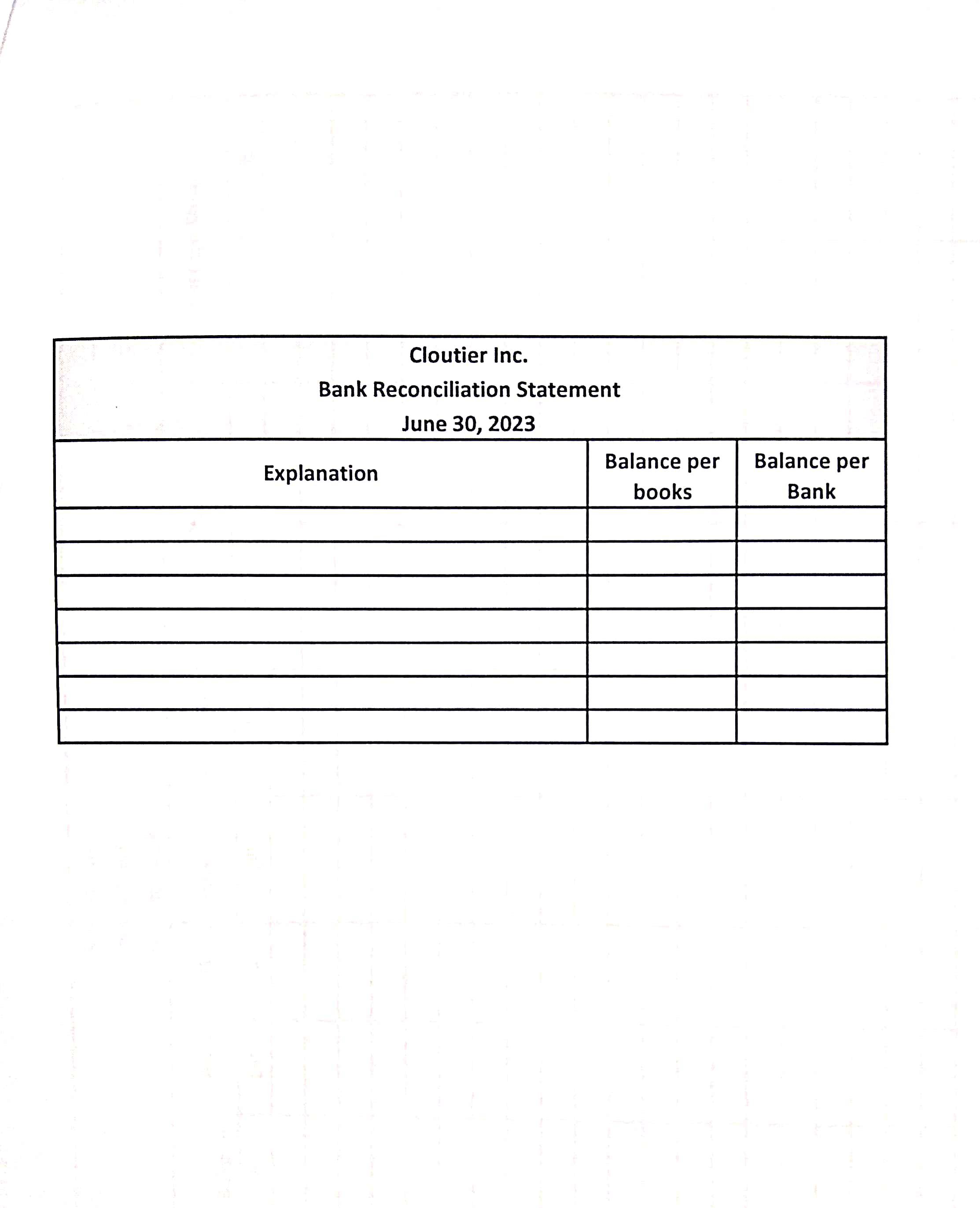

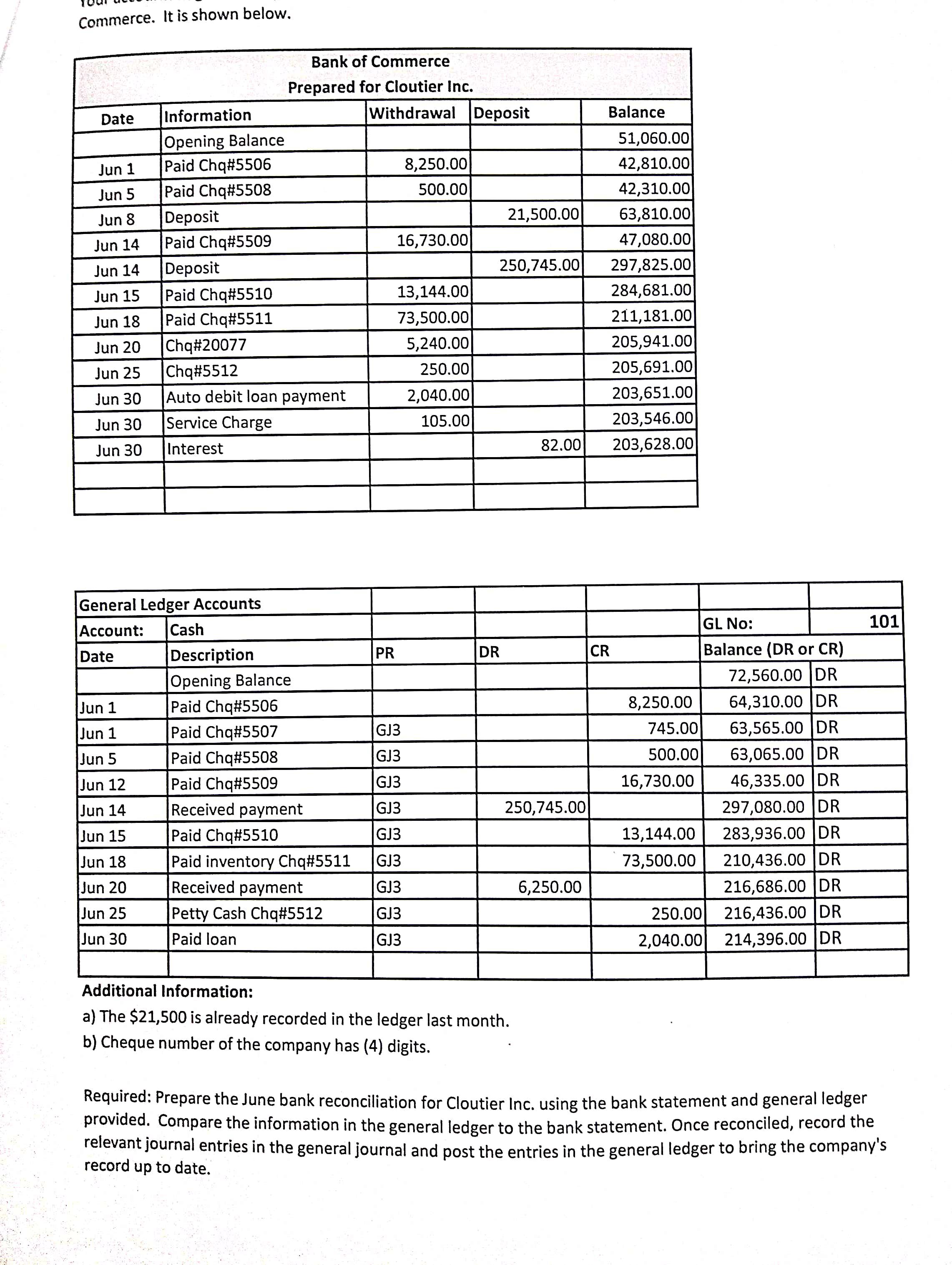

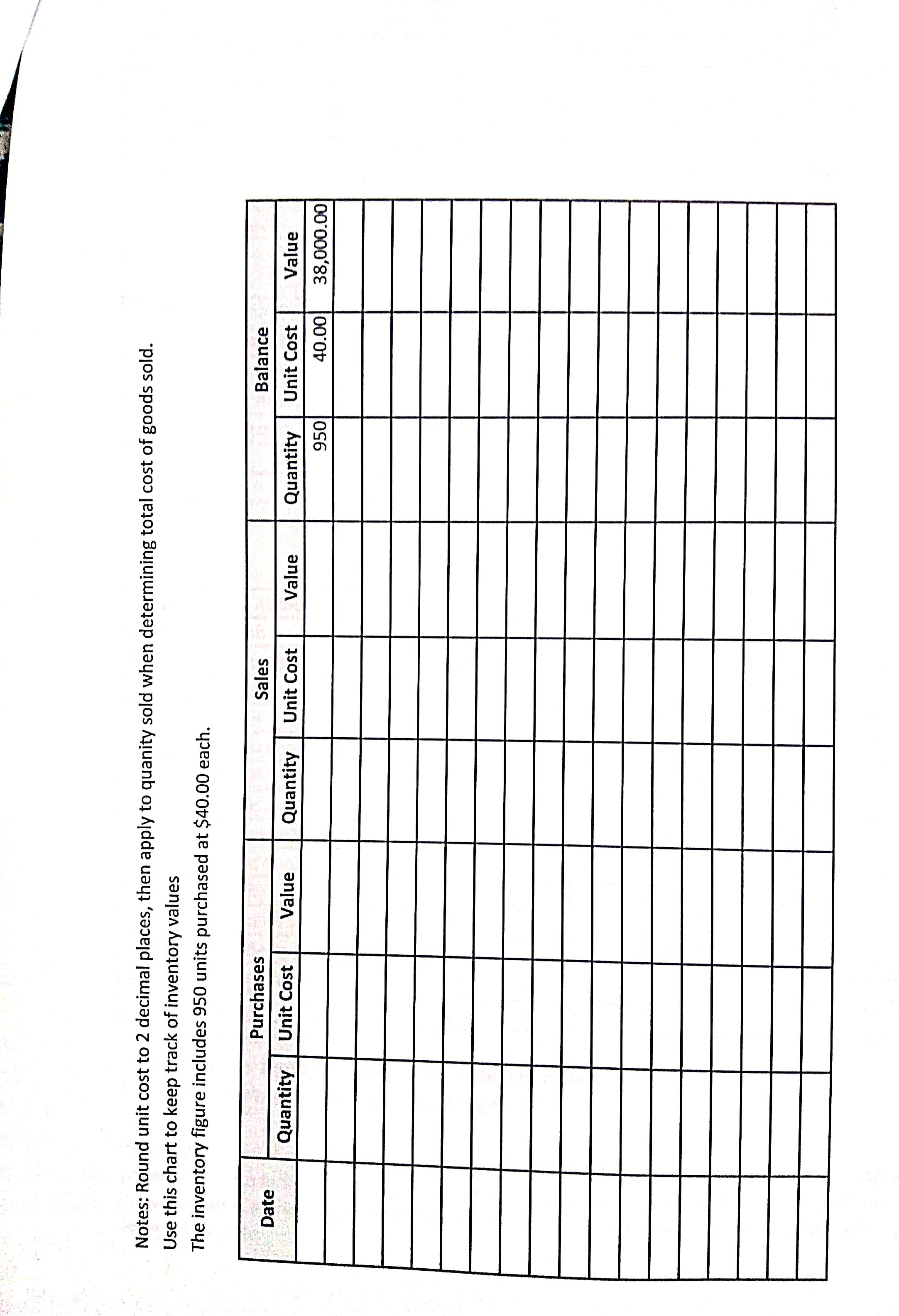

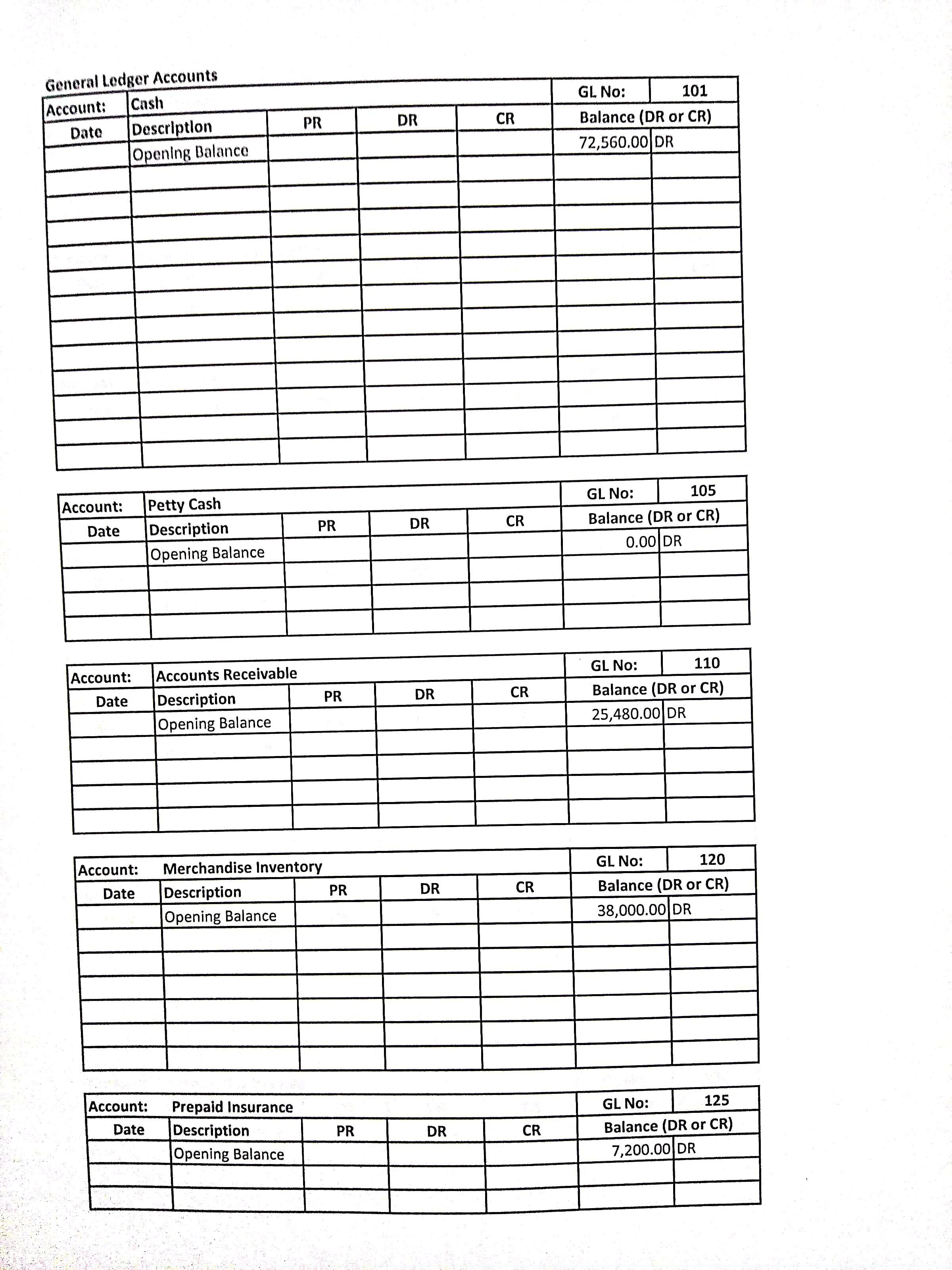

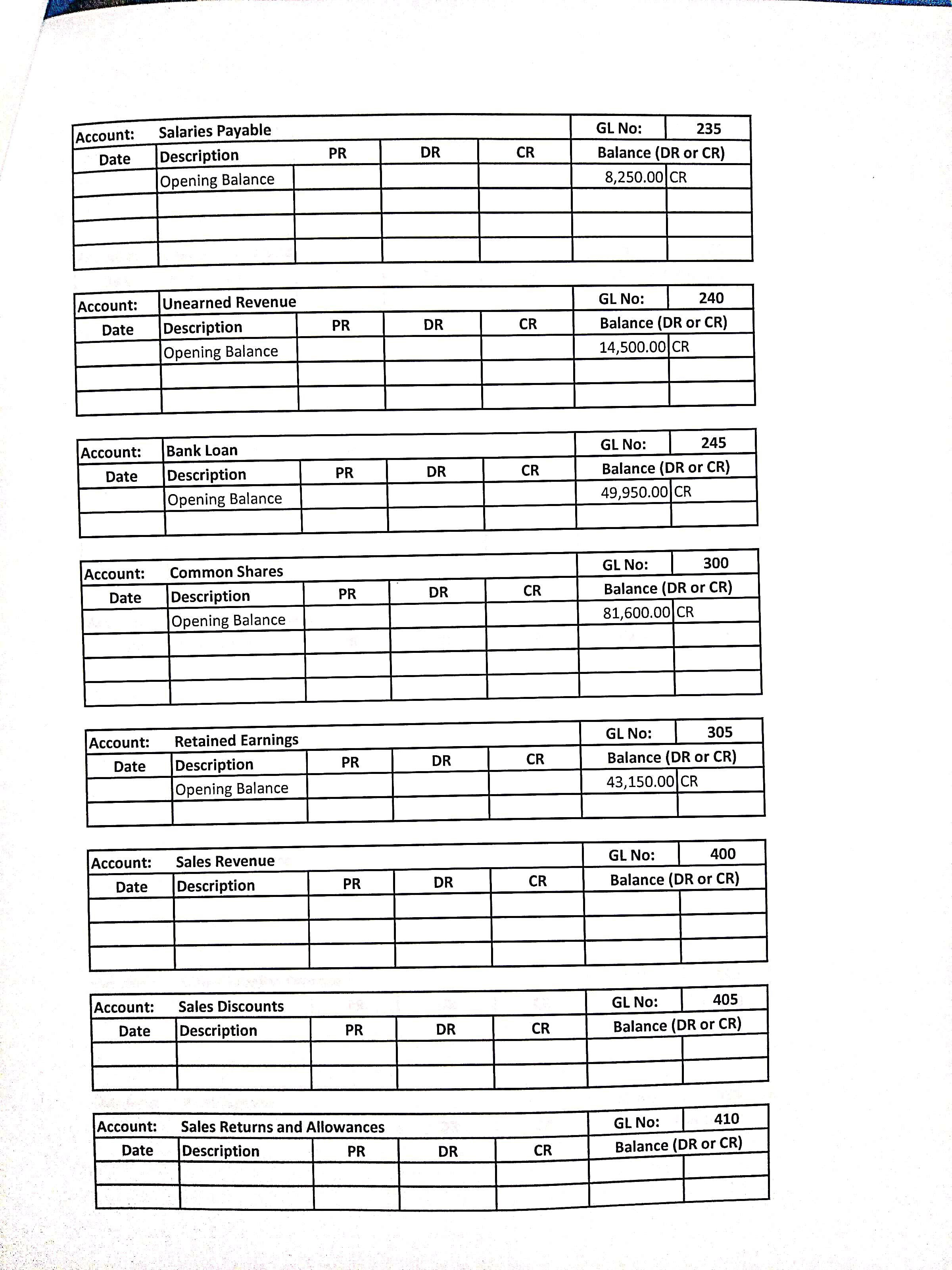

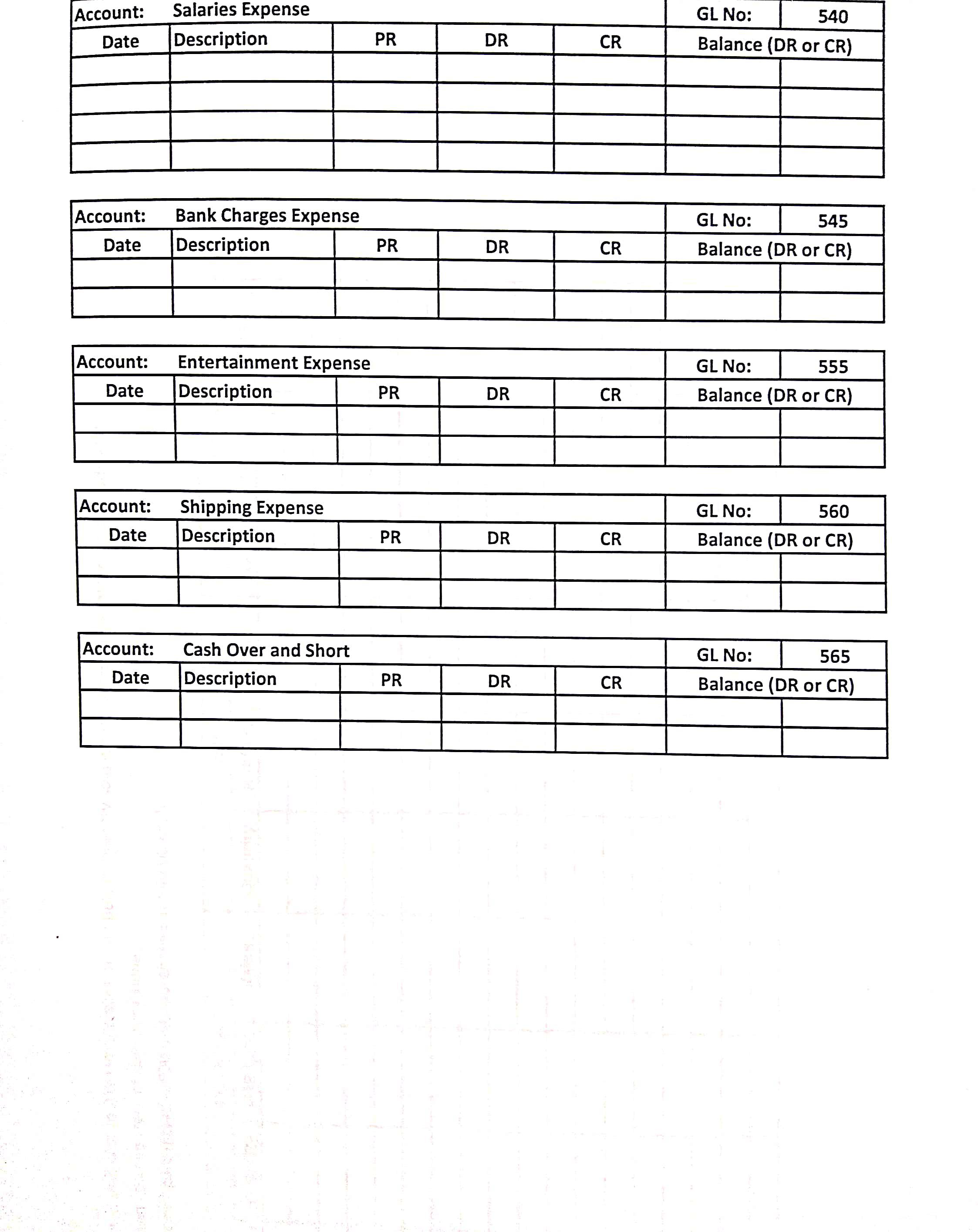

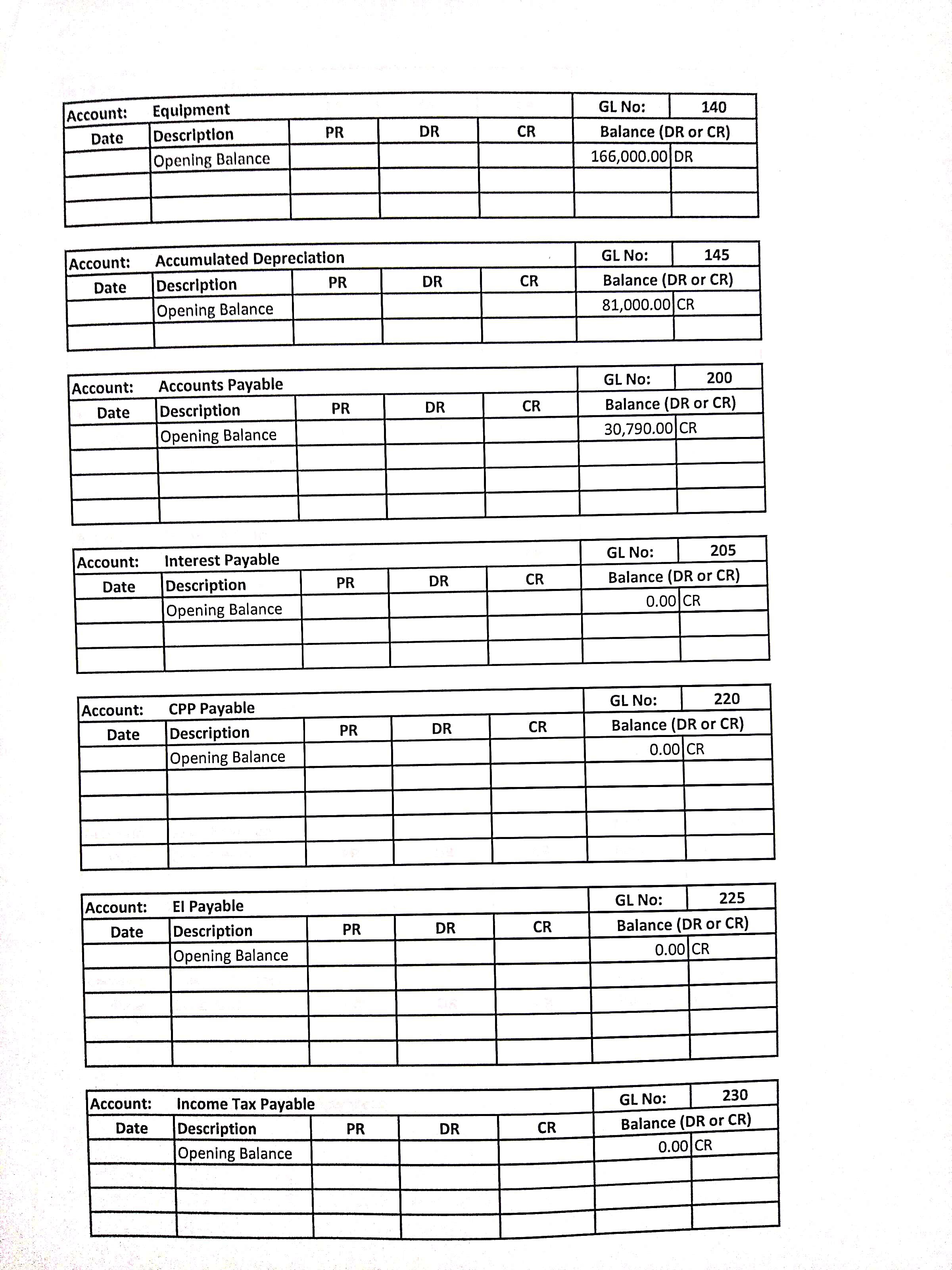

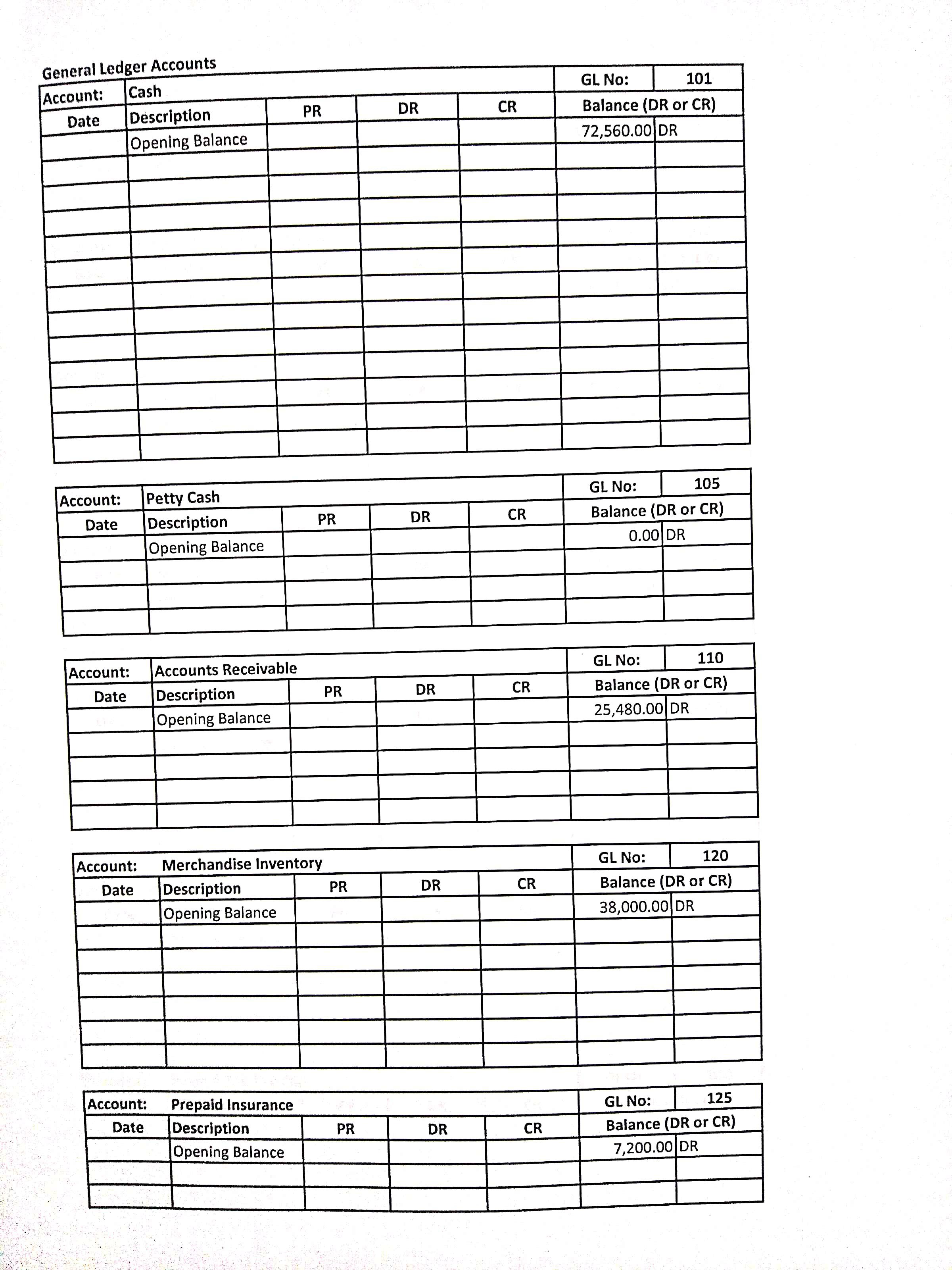

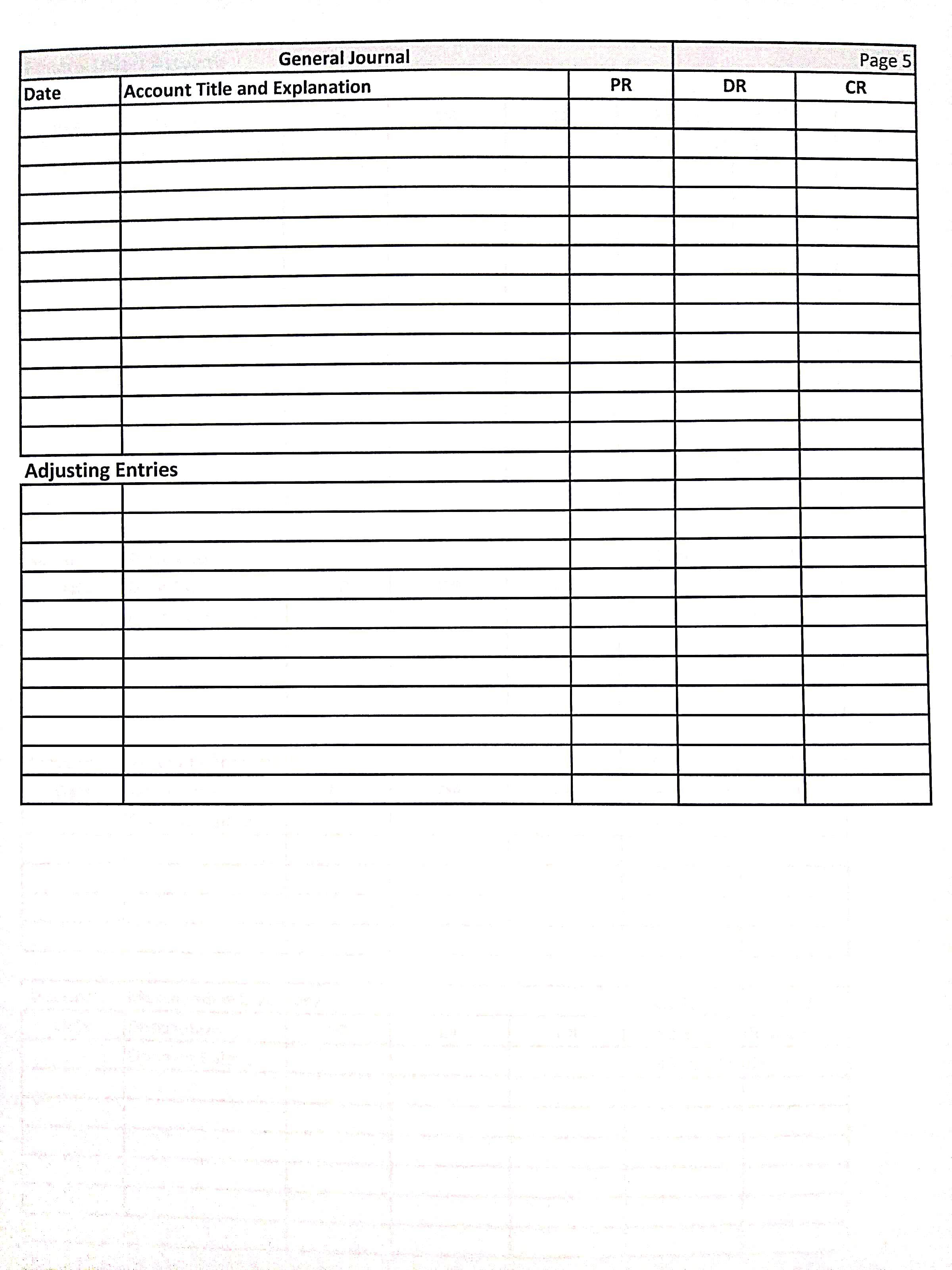

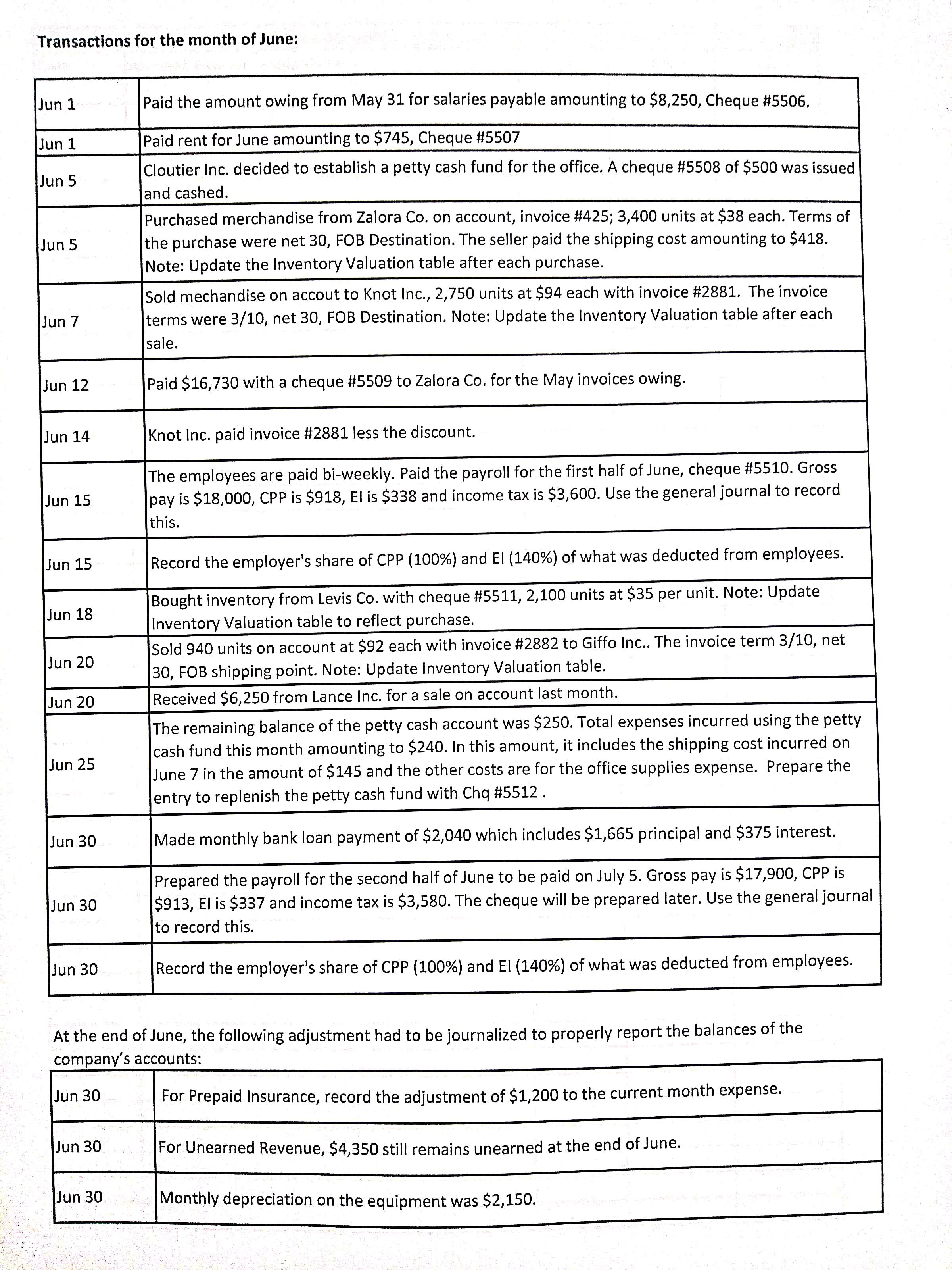

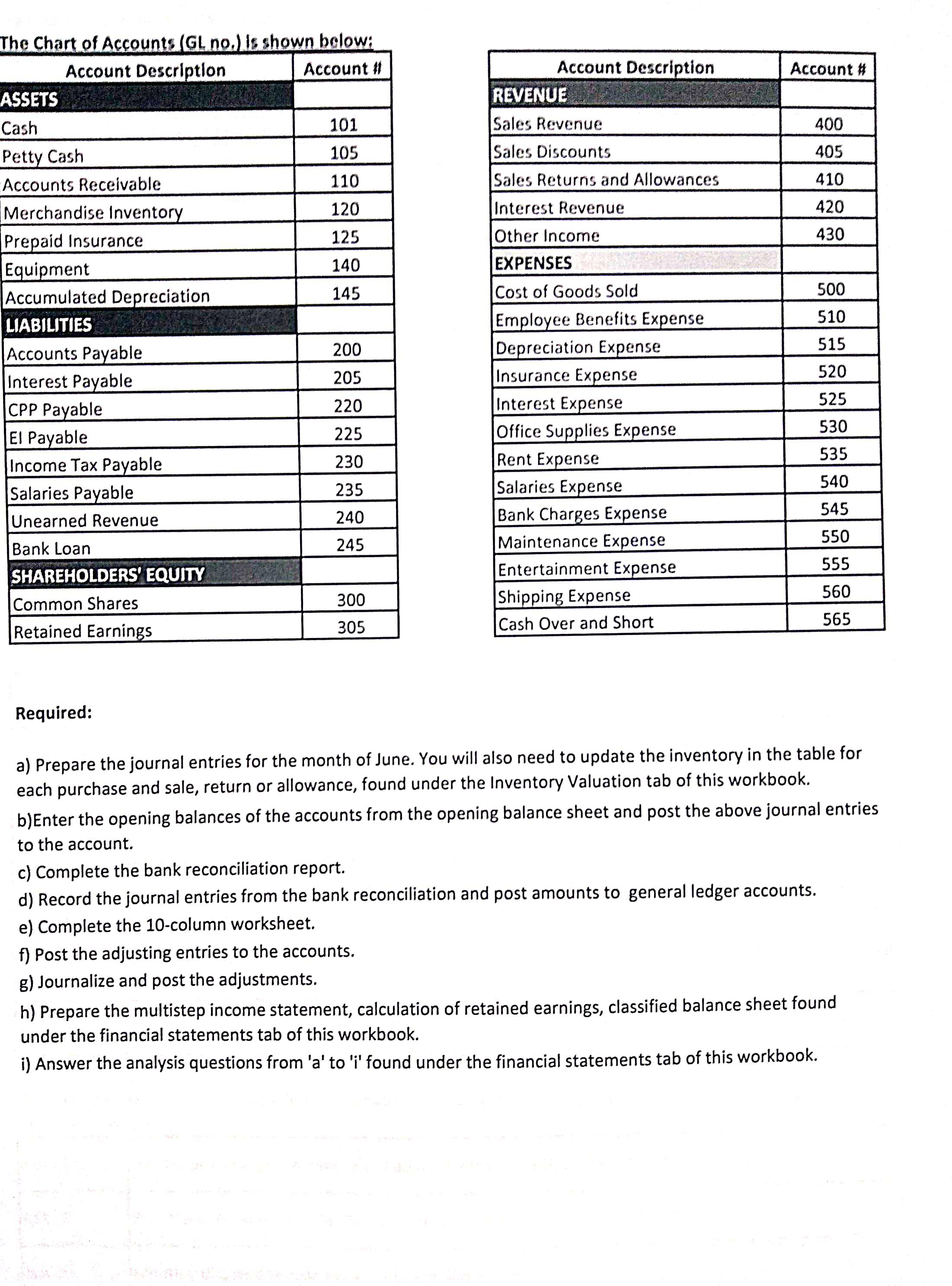

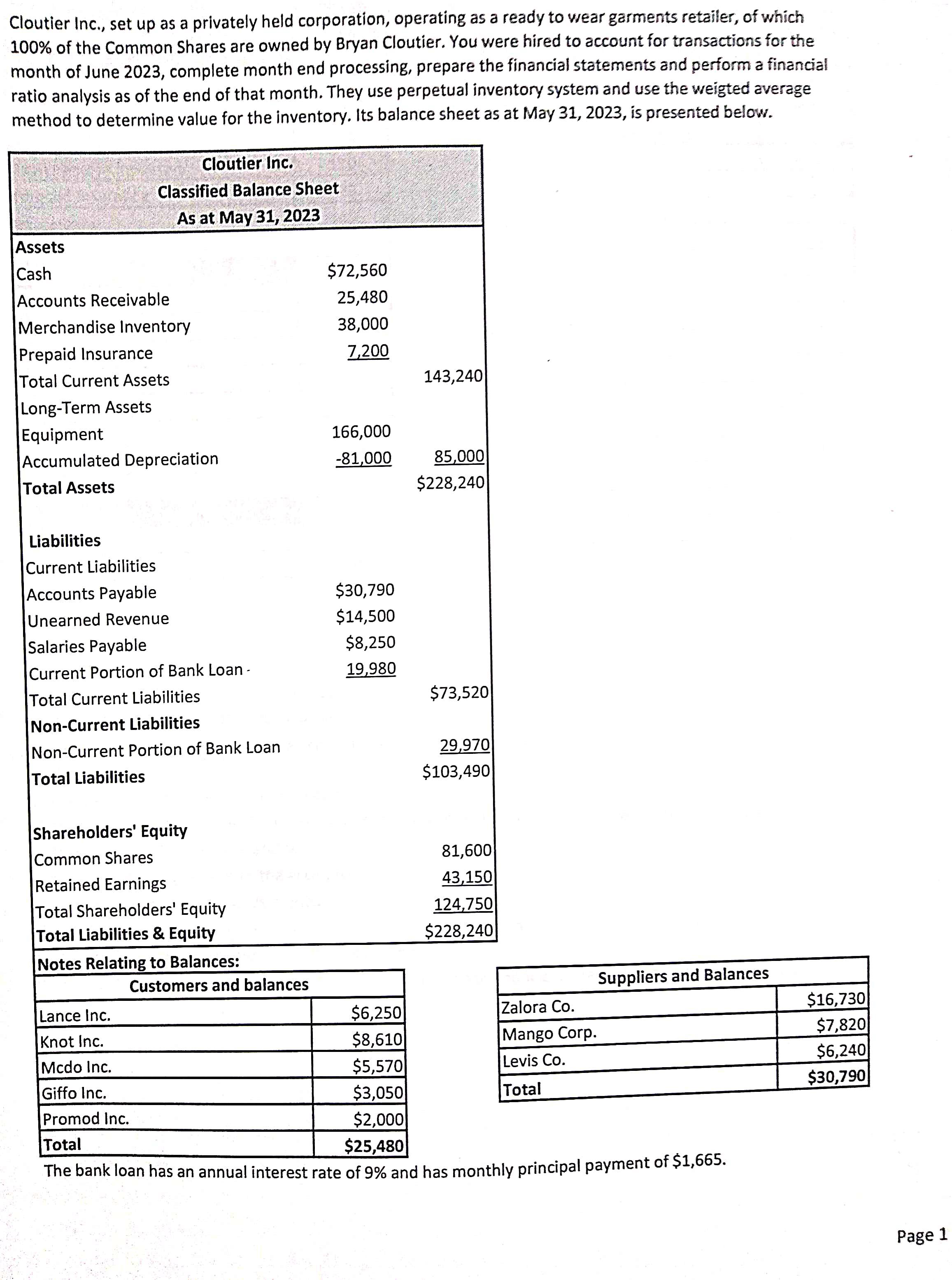

Ased on the information above, answer the following questions. a) Calculate the current ratio as at June 30, 2023. b) Does Cloutier Inc. have a good or bad current ratio? Explain why or why not. c) Calculate the inventory days on hand ratio as at June 30, 2023. (Since this is for the month, do not multiply by 365 in the formula. Instead multiply by 31 days.) d) Last month, the inventory days on hand ratio was 12 days. Has the ratio improved? Why or why not? e) Calculate the debt to equity ratio as at June 30, 2023. f) Calculate the gross profit margin as at June 30, 2023. g) Last month, the gross profit margin percentage was 63%. What could have caused this decrease in gross margin percentage? h) Calculate the inventory turnover as at June 30, 2023. i) If inventory turnover last month was 2.58 is the company holding on to inventory for a longer or shorter period of tim Prepare a classified balance sheet. Assume that $19,980 of the bank loan will be paid off in the 12 months. Cloutier Inc. Balance Sheet As at June 30, 2023 1) Prepare a multistep income statement. Cloutier Inc. Income Statement For the Month Ended June 30, 2023 2) Prepare a calculation of retained earnings Calculation of Retained Earnings For the Month Ended June 30, 2023 Assets Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Total Current Assets Long-Term Assets Equipment Accumulated Depreciation Total Assets Liabilities Current Liabilities Accounts Payable Unearned Revenue Classified Balance Sheet As at May 31, 2023 fa Cloutier Inc. Salaries Payable Current Portion of Bank Loan Total Current Liabilities Non-Current Liabilities Non-Current Portion of Bank Loan Total Liabilities Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities & Equity zsula, $72,560 $25,480 $38,000 $7,200 166,000 -81,000 $30,790 $14,500 $8,250 $19,980 143,240 85,000 $228,240 $73,520 29,970 $103,490 81,600 43,150 124,750 $228,240 Required: Using the balances of the General Ledger accounts as of June 30, complete the financial statements. Notes: Round unit cost to 2 decimal places, then apply to quanity sold when determining total cost of goods sold. Use this chart to keep track of inventory values The inventory figure includes 950 units purchased at $40.00 each. Date Purchases Quantity Unit Cost Value Quantity Sales Unit Cost Value Quantity 950 Balance Unit Cost 40.00 Value 38,000.00 Account Titles Cash Petty Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Interest Payable CPP Payable El Payable Income Tax Payable Salaries Payable Unearned Revenue Bank Loan Common Shares Retained Earnings Unadjusted Trial Balance DR CR Cloutier Inc. Worksheet June 30, 2023 Adjustments DR CR Adjusted Trial Balance DR CR Income Statement DR CR Balance Sheet DR CR Cloutier Inc. Bank Reconciliation Statement June 30, 2023 Explanation Balance per books Balance per Bank Commerce. It is shown below. Bank of Commerce Prepared for Cloutier Inc. Information Withdrawal Deposit Opening Balance Jun 1 Paid Chq#5506 8,250.00 500.00 21,500.00 Jun 5 Paid Chq#5508 Jun 8 Deposit Jun 14 Paid Chq#5509 Jun 14 Deposit Jun 15 16,730.00 W Paid Chq#5510 13,144.00 73,500.00 5,240.00 Jun 18 Paid Chq#5511 Jun 20 Chq#20077 Jun 25 Chq#5512 Jun 30 Auto debit loan payment 250.00 2,040.00 105.00 Jun 30 Service Charge Jun 30 Date Interest General Ledger Accounts Account: Cash Date Jun 1 Jun 1 Jun 5 Jun 12 Jun 14 Jun 15 Jun 18 Jun 20 Jun 25 Jun 30 Description Opening Balance Paid Chq#5506 Paid Chq#5507 Paid Chq#5508 Paid Chq#5509 Received payment Paid Chq#5510 Paid inventory Chq#5511 Received payment Petty Cash Chq#5512 Paid loan PR GJ3 GJ3 GJ3 GJ3 GJ3 GJ3 GJ3 GJ3 GJ3 51,060.00 42,810.00 42,310.00 63,810.00 47,080.00 250,745.00 297,825.00 284,681.00 211,181.00 205,941.00 205,691.00 203,651.00 203,546.00 203,628.00 DR 82.00 250,745.00 Additional Information: a) The $21,500 is already recorded in the ledger last month. b) Cheque number of the company has (4) digits. Balance 6,250.00 CR 8,250.00 745.00 500.00 16,730.00 GL No: Balance (DR or CR) 72,560.00 DR 64,310.00 DR 63,565.00 DR 63,065.00 DR 46,335.00 DR 297,080.00 DR 283,936.00 DR 210,436.00 DR 216,686.00 DR 250.00 216,436.00 DR 2,040.00 214,396.00 DR 13,144.00 73,500.00 101 Required: Prepare the June bank reconciliation for Cloutier Inc. using the bank statement and general ledger provided. Compare the information in the general ledger to the bank statement. Once reconciled, record the relevant journal entries in the general journal and post the entries in the general ledger to bring the company's record up to date. Notes: Round unit cost to 2 decimal places, then apply to quanity sold when determining total cost of goods sold. Use this chart to keep track of inventory values The inventory figure includes 950 units purchased at $40.00 each. Date Purchases Quantity Unit Cost Value Quantity Sales Unit Cost Value Quantity 950 Balance Unit Cost 40.00 Value 38,000.00 General Ledger Accounts Account: Cash Date Description Opening Balance Petty Cash Date Description Account: Account: Date Opening Balance Account: Accounts Receivable Description Opening Balance Account: Merchandise Inventory Date Description Opening Balance Prepaid Insurance Date Description PR Opening Balance PR PR PR PR DR DR DR DR DR CR CR CR CR CR GL No: 101 Balance (DR or CR) 72,560.00 DR GL No: 105 Balance (DR or CR) 0.00 DR GL No: 110 Balance (DR or CR) 25,480.00 DR GL No: 120 Balance (DR or CR) 38,000.00 DR 125 GL No: Balance (DR or CR) 7,200.00 DR Account: Date Account: Date Account: Date Account: Date Account: Date Account: Date Account: Salaries Payable Description Opening Balance Account: Unearned Revenue Description Opening Balance Bank Loan Description Opening Balance Common Shares Description Opening Balance Retained Earnings Description Opening Balance Sales Revenue Description Sales Discounts Date Description PR Date Description PR PR PR PR PR PR Sales Returns and Allowances PR DR DR DR DR DR DR DR DR CR CR CR CR CR CR CR CR GL No: 235 Balance (DR or CR) 8,250.00 CR GL No: 240 Balance (DR or CR) 14,500.00 CR GL No: 245 Balance (DR or CR) 49,950.00 CR GL No: 300 Balance (DR or CR) 81,600.00 CR GL No: 305 Balance (DR or CR) 43,150.00 CR GL No: 400 Balance (DR or CR) GL No: 405 Balance (DR or CR) GL No: 410 Balance (DR or CR) Account: Date Description Account: Salaries Expense Account: Date Description Bank Charges Expense Account: Entertainment Expense Date Description Shipping Expense Date Description Account: Cash Over and Short Date Description PR PR PR PR PR DR DR DR DR DR CR CR CR CR CR GL No: 540 Balance (DR or CR) GL No: 545 Balance (DR or CR) GL No: 555 Balance (DR or CR) GL No: 560 Balance (DR or CR) GL No: 565 Balance (DR or CR) Account: Date Account: Date Account: Date Account: Date Account: Date Account: Date Equipment Description Opening Balance Account: Accumulated Depreciation Description Opening Balance Accounts Payable Description Opening Balance Interest Payable Description Opening Balance CPP Payable Description Opening Balance El Payable Description Opening Balance Income Tax Payable Date Description PR Opening Balance PR PR PR PR PR PR DR DR DR DR DR DR DR CR CR CR CR CR CR CR GL No: 140 Balance (DR or CR) 166,000.00 DR GL No: 145 Balance (DR or CR) 81,000.00 CR GL No: 200 Balance (DR or CR) 30,790.00 CR GL No: 205 Balance (DR or CR) 0.00 CR GL No: 220 Balance (DR or CR) 0.00 CR 225 GL No: Balance (DR or CR) 0.00 CR GL No: 230 Balance (DR or CR) 0.00 CR General Ledger Accounts Account: Cash Date Description Opening Balance Account: Petty Cash Date Description Account: Opening Balance Accounts Receivable Date Description Account: Date Opening Balance PR Account: Merchandise Inventory Date Description Opening Balance Prepaid Insurance Description Opening Balance PR PR PR PR DR DR DR DR DR CR CR CR CR CR GL No: 101 Balance (DR or CR) 72,560.00 DR GL No: 105 Balance (DR or CR) 0.00 DR GL No: 110 Balance (DR or CR) 25,480.00 DR 120 GL No: Balance (DR or CR) 38,000.00 DR GL No: 125 Balance (DR or CR) 7,200.00 DR Date Account Title and Explanation Adjusting Entries General Journal AUR J PR DR te kalance Page 5 CR Transactions for the month of June: Jun 1 Jun 1 Jun 5 Jun 5 Jun 7 Jun 12 Jun 14 Jun 15 Jun 15 Jun 18 Jun 20 Jun 20 Jun 25 Jun 30 Jun 30 Jun 30 Jun 30 Paid the amount owing from May 31 for salaries payable amounting to $8,250, Cheque #5506. Paid rent for June amounting to $745, Cheque #5507 Cloutier Inc. decided to establish a petty cash fund for the office. A cheque # 5508 of $500 was issued and cashed. Jun 30 Purchased merchandise from Zalora Co. on account, invoice #425; 3,400 units at $38 each. Terms of the purchase were net 30, FOB Destination. The seller paid the shipping cost amounting to $418. Note: Update the Inventory Valuation table after each purchase. Sold mechandise on accout to Knot Inc., 2,750 units at $94 each with invoice #2881. The invoice terms were 3/10, net 30, FOB Destination. Note: Update the Inventory Valuation table after each sale. Paid $16,730 with a cheque #5509 to Zalora Co. for the May invoices owing. Knot Inc. paid invoice # 2881 less the discount. The employees are paid bi-weekly. Paid the payroll for the first half of June, cheque #5510. Gross pay is $18,000, CPP is $918, El is $338 and income tax is $3,600. Use the general journal to record this. Record the employer's share of CPP (100%) and EI (140%) of what was deducted from employees. Bought inventory from Levis Co. with cheque # 5511 , 2 ,100 units at $35 per unit. Note: Update Inventory Valuation table to reflect purchase. Sold 940 units on account at $92 each with invoice #2882 to Giffo Inc.. The invoice term 3/10, net 30, FOB shipping point. Note: Update Inventory Valuation table. Received $6,250 from Lance Inc. for a sale on account last month. At the end of June, the following adjustment had to be journalized to properly report the balances of the company's accounts: Jun 30 For Prepaid Insurance, record the adjustment of $1,200 to the current month expense. For Unearned Revenue, $4,350 still remains unearned at the end of June. The remaining balance of the petty cash account was $250. Total expenses incurred using the petty cash fund this month amounting to $240. In this amount, it includes the shipping cost incurred on June 7 in the amount of $145 and the other costs are for the office supplies expense. Prepare the entry to replenish the petty cash fund with Chq #5512. Made monthly bank loan payment of $2,040 which includes $1,665 principal and $375 interest. Prepared the payroll for the second half of June to be paid on July 5. Gross pay is $17,900, CPP is $913, El is $337 and income tax is $3,580. The cheque will be prepared later. Use the general journal to record this. Record the employer's share of CPP (100%) and El (140%) of what was deducted from employees. Monthly depreciation on the equipment was $2,150. The Chart of Accounts (GL no.) is shown below: Account Description Account # ASSETS Cash Petty Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Equipment Accumulated Depreciation LIABILITIES Accounts Payable Interest Payable CPP Payable El Payable Income Tax Payable Salaries Payable Unearned Revenue Bank Loan SHAREHOLDERS' EQUITY H Common Shares Retained Earnings Required: 101 105 110 120 125 140 145 200 205 220 225 230 235 240 245 300 305 Account Description REVENUE Sales Revenue Sales Discounts Sales Returns and Allowances Interest Revenue Other Income EXPENSES Cost of Goods Sold Employee Benefits Expense Depreciation Expense Insurance Expense Interest Expense Office Supplies Expense Rent Expense Salaries Expense Bank Charges Expense Maintenance Expense Entertainment Expense e) Complete the 10-column worksheet. f) Post the adjusting entries to the accounts. g) Journalize and post the adjustments. Shipping Expense Cash Over and Short Account # 400 405 410 420 430 a) Prepare the journal entries for the month of June. You will also need to update the inventory in the table for each purchase and sale, return or allowance, found under the Inventory Valuation tab of this workbook. 500 510 515 520 525 530 535 540 545 550 555 560 565 b) Enter the opening balances of the accounts from the opening balance sheet and post the above journal entries to the account. c) Complete the bank reconciliation report. d) Record the journal entries from the bank reconciliation and post amounts to general ledger accounts. h) Prepare the multistep income statement, calculation of retained earnings, classified balance sheet found under the financial statements tab of this workbook. i) Answer the analysis questions from 'a' to 'i' found under the financial statements tab of this workbook. Cloutier Inc., set up as a privately held corporation, operating as a ready to wear garments retailer, of which 100% of the Common Shares are owned by Bryan Cloutier. You were hired to account for transactions for the month of June 2023, complete month end processing, prepare the financial statements and perform a financial ratio analysis as of the end of that month. They use perpetual inventory system and use the weigted average method to determine value for the inventory. Its balance sheet as at May 31, 2023, is presented below. Assets Cash Cloutier Inc. Classified Balance Sheet As at May 31, 2023 Accounts Receivable Merchandise Inventory Prepaid Insurance Total Current Assets Long-Term Assets Equipment Accumulated Depreciation Total Assets Liabilities Current Liabilities Accounts Payable Unearned Revenue Salaries Payable Current Portion of Bank Loan - Total Current Liabilities Non-Current Liabilities Non-Current Portion of Bank Loan Total Liabilities Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities & Equity Notes Relating to Balances: Lance Inc. Knot Inc. Mcdo Inc. Giffo Inc. Customers and balances $72,560 25,480 38,000 7,200 166,000 -81,000 $30,790 $14,500 $8,250 19,980 143,240 85,000 $228,240 $73,520 29,970 $103,490 81,600 43,150 124,750 $228,240 IZalora Co. Mango Corp. Levis Co. Total Suppliers and Balances $6,250 $8,610 $5,570 $3,050 Promod Inc. $2,000 Total $25,480 The bank loan has an annual interest rate of 9% and has monthly principal payment of $1,665. $16,730 $7,820 $6,240 $30,790 Page 1 Ased on the information above, answer the following questions. a) Calculate the current ratio as at June 30, 2023. b) Does Cloutier Inc. have a good or bad current ratio? Explain why or why not. c) Calculate the inventory days on hand ratio as at June 30, 2023. (Since this is for the month, do not multiply by 365 in the formula. Instead multiply by 31 days.) d) Last month, the inventory days on hand ratio was 12 days. Has the ratio improved? Why or why not? e) Calculate the debt to equity ratio as at June 30, 2023. f) Calculate the gross profit margin as at June 30, 2023. g) Last month, the gross profit margin percentage was 63%. What could have caused this decrease in gross margin percentage? h) Calculate the inventory turnover as at June 30, 2023. i) If inventory turnover last month was 2.58 is the company holding on to inventory for a longer or shorter period of tim Prepare a classified balance sheet. Assume that $19,980 of the bank loan will be paid off in the 12 months. Cloutier Inc. Balance Sheet As at June 30, 2023 1) Prepare a multistep income statement. Cloutier Inc. Income Statement For the Month Ended June 30, 2023 2) Prepare a calculation of retained earnings Calculation of Retained Earnings For the Month Ended June 30, 2023 Assets Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Total Current Assets Long-Term Assets Equipment Accumulated Depreciation Total Assets Liabilities Current Liabilities Accounts Payable Unearned Revenue Classified Balance Sheet As at May 31, 2023 fa Cloutier Inc. Salaries Payable Current Portion of Bank Loan Total Current Liabilities Non-Current Liabilities Non-Current Portion of Bank Loan Total Liabilities Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities & Equity zsula, $72,560 $25,480 $38,000 $7,200 166,000 -81,000 $30,790 $14,500 $8,250 $19,980 143,240 85,000 $228,240 $73,520 29,970 $103,490 81,600 43,150 124,750 $228,240 Required: Using the balances of the General Ledger accounts as of June 30, complete the financial statements. Notes: Round unit cost to 2 decimal places, then apply to quanity sold when determining total cost of goods sold. Use this chart to keep track of inventory values The inventory figure includes 950 units purchased at $40.00 each. Date Purchases Quantity Unit Cost Value Quantity Sales Unit Cost Value Quantity 950 Balance Unit Cost 40.00 Value 38,000.00 Account Titles Cash Petty Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Interest Payable CPP Payable El Payable Income Tax Payable Salaries Payable Unearned Revenue Bank Loan Common Shares Retained Earnings Unadjusted Trial Balance DR CR Cloutier Inc. Worksheet June 30, 2023 Adjustments DR CR Adjusted Trial Balance DR CR Income Statement DR CR Balance Sheet DR CR Cloutier Inc. Bank Reconciliation Statement June 30, 2023 Explanation Balance per books Balance per Bank Commerce. It is shown below. Bank of Commerce Prepared for Cloutier Inc. Information Withdrawal Deposit Opening Balance Jun 1 Paid Chq#5506 8,250.00 500.00 21,500.00 Jun 5 Paid Chq#5508 Jun 8 Deposit Jun 14 Paid Chq#5509 Jun 14 Deposit Jun 15 16,730.00 W Paid Chq#5510 13,144.00 73,500.00 5,240.00 Jun 18 Paid Chq#5511 Jun 20 Chq#20077 Jun 25 Chq#5512 Jun 30 Auto debit loan payment 250.00 2,040.00 105.00 Jun 30 Service Charge Jun 30 Date Interest General Ledger Accounts Account: Cash Date Jun 1 Jun 1 Jun 5 Jun 12 Jun 14 Jun 15 Jun 18 Jun 20 Jun 25 Jun 30 Description Opening Balance Paid Chq#5506 Paid Chq#5507 Paid Chq#5508 Paid Chq#5509 Received payment Paid Chq#5510 Paid inventory Chq#5511 Received payment Petty Cash Chq#5512 Paid loan PR GJ3 GJ3 GJ3 GJ3 GJ3 GJ3 GJ3 GJ3 GJ3 51,060.00 42,810.00 42,310.00 63,810.00 47,080.00 250,745.00 297,825.00 284,681.00 211,181.00 205,941.00 205,691.00 203,651.00 203,546.00 203,628.00 DR 82.00 250,745.00 Additional Information: a) The $21,500 is already recorded in the ledger last month. b) Cheque number of the company has (4) digits. Balance 6,250.00 CR 8,250.00 745.00 500.00 16,730.00 GL No: Balance (DR or CR) 72,560.00 DR 64,310.00 DR 63,565.00 DR 63,065.00 DR 46,335.00 DR 297,080.00 DR 283,936.00 DR 210,436.00 DR 216,686.00 DR 250.00 216,436.00 DR 2,040.00 214,396.00 DR 13,144.00 73,500.00 101 Required: Prepare the June bank reconciliation for Cloutier Inc. using the bank statement and general ledger provided. Compare the information in the general ledger to the bank statement. Once reconciled, record the relevant journal entries in the general journal and post the entries in the general ledger to bring the company's record up to date. Notes: Round unit cost to 2 decimal places, then apply to quanity sold when determining total cost of goods sold. Use this chart to keep track of inventory values The inventory figure includes 950 units purchased at $40.00 each. Date Purchases Quantity Unit Cost Value Quantity Sales Unit Cost Value Quantity 950 Balance Unit Cost 40.00 Value 38,000.00 General Ledger Accounts Account: Cash Date Description Opening Balance Petty Cash Date Description Account: Account: Date Opening Balance Account: Accounts Receivable Description Opening Balance Account: Merchandise Inventory Date Description Opening Balance Prepaid Insurance Date Description PR Opening Balance PR PR PR PR DR DR DR DR DR CR CR CR CR CR GL No: 101 Balance (DR or CR) 72,560.00 DR GL No: 105 Balance (DR or CR) 0.00 DR GL No: 110 Balance (DR or CR) 25,480.00 DR GL No: 120 Balance (DR or CR) 38,000.00 DR 125 GL No: Balance (DR or CR) 7,200.00 DR Account: Date Account: Date Account: Date Account: Date Account: Date Account: Date Account: Salaries Payable Description Opening Balance Account: Unearned Revenue Description Opening Balance Bank Loan Description Opening Balance Common Shares Description Opening Balance Retained Earnings Description Opening Balance Sales Revenue Description Sales Discounts Date Description PR Date Description PR PR PR PR PR PR Sales Returns and Allowances PR DR DR DR DR DR DR DR DR CR CR CR CR CR CR CR CR GL No: 235 Balance (DR or CR) 8,250.00 CR GL No: 240 Balance (DR or CR) 14,500.00 CR GL No: 245 Balance (DR or CR) 49,950.00 CR GL No: 300 Balance (DR or CR) 81,600.00 CR GL No: 305 Balance (DR or CR) 43,150.00 CR GL No: 400 Balance (DR or CR) GL No: 405 Balance (DR or CR) GL No: 410 Balance (DR or CR) Account: Date Description Account: Salaries Expense Account: Date Description Bank Charges Expense Account: Entertainment Expense Date Description Shipping Expense Date Description Account: Cash Over and Short Date Description PR PR PR PR PR DR DR DR DR DR CR CR CR CR CR GL No: 540 Balance (DR or CR) GL No: 545 Balance (DR or CR) GL No: 555 Balance (DR or CR) GL No: 560 Balance (DR or CR) GL No: 565 Balance (DR or CR) Account: Date Account: Date Account: Date Account: Date Account: Date Account: Date Equipment Description Opening Balance Account: Accumulated Depreciation Description Opening Balance Accounts Payable Description Opening Balance Interest Payable Description Opening Balance CPP Payable Description Opening Balance El Payable Description Opening Balance Income Tax Payable Date Description PR Opening Balance PR PR PR PR PR PR DR DR DR DR DR DR DR CR CR CR CR CR CR CR GL No: 140 Balance (DR or CR) 166,000.00 DR GL No: 145 Balance (DR or CR) 81,000.00 CR GL No: 200 Balance (DR or CR) 30,790.00 CR GL No: 205 Balance (DR or CR) 0.00 CR GL No: 220 Balance (DR or CR) 0.00 CR 225 GL No: Balance (DR or CR) 0.00 CR GL No: 230 Balance (DR or CR) 0.00 CR General Ledger Accounts Account: Cash Date Description Opening Balance Account: Petty Cash Date Description Account: Opening Balance Accounts Receivable Date Description Account: Date Opening Balance PR Account: Merchandise Inventory Date Description Opening Balance Prepaid Insurance Description Opening Balance PR PR PR PR DR DR DR DR DR CR CR CR CR CR GL No: 101 Balance (DR or CR) 72,560.00 DR GL No: 105 Balance (DR or CR) 0.00 DR GL No: 110 Balance (DR or CR) 25,480.00 DR 120 GL No: Balance (DR or CR) 38,000.00 DR GL No: 125 Balance (DR or CR) 7,200.00 DR Date Account Title and Explanation Adjusting Entries General Journal AUR J PR DR bekalance Page 5 CR Transactions for the month of June: Jun 1 Jun 1 Jun 5 Jun 5 Jun 7 Jun 12 Jun 14 Jun 15 Jun 15 Jun 18 Jun 20 Jun 20 Jun 25 Jun 30 Jun 30 Jun 30 Jun 30 Paid the amount owing from May 31 for salaries payable amounting to $8,250, Cheque #5506. Paid rent for June amounting to $745, Cheque #5507 Cloutier Inc. decided to establish a petty cash fund for the office. A cheque # 5508 of $500 was issued and cashed. Jun 30 Purchased merchandise from Zalora Co. on account, invoice #425; 3,400 units at $38 each. Terms of the purchase were net 30, FOB Destination. The seller paid the shipping cost amounting to $418. Note: Update the Inventory Valuation table after each purchase. Sold mechandise on accout to Knot Inc., 2,750 units at $94 each with invoice #2881. The invoice terms were 3/10, net 30, FOB Destination. Note: Update the Inventory Valuation table after each sale. Paid $16,730 with a cheque #5509 to Zalora Co. for the May invoices owing. Knot Inc. paid invoice # 2881 less the discount. The employees are paid bi-weekly. Paid the payroll for the first half of June, cheque #5510. Gross pay is $18,000, CPP is $918, El is $338 and income tax is $3,600. Use the general journal to record this. Record the employer's share of CPP (100%) and El (140%) of what was deducted from employees. Bought inventory from Levis Co. with cheque # 5511 , 2 ,100 units at $35 per unit. Note: Update Inventory Valuation table to reflect purchase. Sold 940 units on account at $92 each with invoice #2882 to Giffo Inc.. The invoice term 3/10, net 30, FOB shipping point. Note: Update Inventory Valuation table. Received $6,250 from Lance Inc. for a sale on account last month. At the end of June, the following adjustment had to be journalized to properly report the balances of the company's accounts: Jun 30 For Prepaid Insurance, record the adjustment of $1,200 to the current month expense. For Unearned Revenue, $4,350 still remains unearned at the end of June. The remaining balance of the petty cash account was $250. Total expenses incurred using the petty cash fund this month amounting to $240. In this amount, it includes the shipping cost incurred on June 7 in the amount of $145 and the other costs are for the office supplies expense. Prepare the entry to replenish the petty cash fund with Chq #5512. Made monthly bank loan payment of $2,040 which includes $1,665 principal and $375 interest. Prepared the payroll for the second half of June to be paid on July 5. Gross pay is $17,900, CPP is $913, El is $337 and income tax is $3,580. The cheque will be prepared later. Use the general journal to record this. Record the employer's share of CPP (100%) and El (140%) of what was deducted from employees. Monthly depreciation on the equipment was $2,150. The Chart of Accounts (GL no.) is shown below: Account Description Account # ASSETS Cash Petty Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Equipment Accumulated Depreciation LIABILITIES Accounts Payable Interest Payable CPP Payable El Payable Income Tax Payable Salaries Payable Unearned Revenue Bank Loan SHAREHOLDERS' EQUITY H Common Shares Retained Earnings Required: 101 105 110 120 125 140 145 200 205 220 225 230 235 240 245 300 305 Account Description REVENUE Sales Revenue Sales Discounts Sales Returns and Allowances Interest Revenue Other Income EXPENSES Cost of Goods Sold Employee Benefits Expense Depreciation Expense Insurance Expense Interest Expense Office Supplies Expense Rent Expense Salaries Expense Bank Charges Expense Maintenance Expense Entertainment Expense e) Complete the 10-column worksheet. f) Post the adjusting entries to the accounts. g) Journalize and post the adjustments. Shipping Expense Cash Over and Short Account # 400 405 410 420 430 a) Prepare the journal entries for the month of June. You will also need to update the inventory in the table for each purchase and sale, return or allowance, found under the Inventory Valuation tab of this workbook. 500 510 515 520 525 530 535 540 545 550 555 560 565 b) Enter the opening balances of the accounts from the opening balance sheet and post the above journal entries to the account. c) Complete the bank reconciliation report. d) Record the journal entries from the bank reconciliation and post amounts to general ledger accounts. h) Prepare the multistep income statement, calculation of retained earnings, classified balance sheet found under the financial statements tab of this workbook. i) Answer the analysis questions from 'a' to 'i' found under the financial statements tab of this workbook. Cloutier Inc., set up as a privately held corporation, operating as a ready to wear garments retailer, of which 100% of the Common Shares are owned by Bryan Cloutier. You were hired to account for transactions for the month of June 2023, complete month end processing, prepare the financial statements and perform a financial ratio analysis as of the end of that month. They use perpetual inventory system and use the weigted average method to determine value for the inventory. Its balance sheet as at May 31, 2023, is presented below. Assets Cash Cloutier Inc. Classified Balance Sheet As at May 31, 2023 Accounts Receivable Merchandise Inventory Prepaid Insurance Total Current Assets Long-Term Assets Equipment Accumulated Depreciation Total Assets Liabilities Current Liabilities Accounts Payable Unearned Revenue Salaries Payable Current Portion of Bank Loan - Total Current Liabilities Non-Current Liabilities Non-Current Portion of Bank Loan Total Liabilities Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities & Equity Notes Relating to Balances: Lance Inc. Knot Inc. Mcdo Inc. Giffo Inc. Customers and balances $72,560 25,480 38,000 7,200 166,000 -81,000 $30,790 $14,500 $8,250 19,980 143,240 85,000 $228,240 $73,520 29,970 $103,490 81,600 43,150 124,750 $228,240 IZalora Co. Mango Corp. Levis Co. Total Suppliers and Balances $6,250 $8,610 $5,570 $3,050 Promod Inc. $2,000 Total $25,480 The bank loan has an annual interest rate of 9% and has monthly principal payment of $1,665. $16,730 $7,820 $6,240 $30,790 Page 1

Step by Step Solution

★★★★★

3.40 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

CloutierInc BalanceSheet Asof June302023 Assets CurrentAssets Cash andCashEquivalents AccountsReceivable Inventory PrepaidExpenses OtherCurrentAssets LongtermAssets PropertyPlant andEquipment Intangib...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started