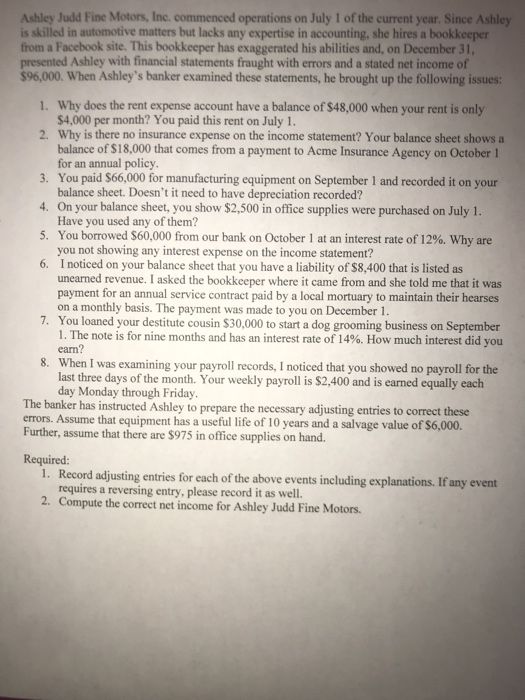

Ashley Judd Fine Motors, Inc. commenced operations on July 1 of the current year.Since Ashley is skilled in automotive matters but lacks any expertise in accounting, she hires a bookkeeper from a Facebook site. This bookkeeper has exaggerated his abilities and, on December 31 presented Ashley with financial statements fraught with errors and a stated net income of $96,000. When Ashley's banker examined these statements, he brought up the following issues: Why does the rent expense account have a balance of $48,000 when your rent is only $4,000 per month? You paid this rent on July 1. 1. 2. Why is there no insurance expense on the income statement? Your balance sheet shows a 3. You paid $66,000 for manufacturing equipment on September 1 and recorded it on your 4. On your balance sheet, you show $2,500 in office supplies were purchased on July 1 5. You borrowed $60,000 from our bank on October 1 at an interest rate of 12%. Why are 6. I noticed on your balance sheet that you have a liability of $8,400 that is listed as balance of $18,000 that comes from a payment to Acme Insurance Agency on October 1 for an annual policy balance sheet. Doesn't it need to have depreciation recorded? Have you used any of them? you not showing any interest expense on the income statement? unearned revenue. I asked the bookkeeper where it came from and she told me that it was payment for an annual service contract paid by a local mortuary to maintain their hearses on a monthly basis. The payment was made to you on December 1. 7. You loaned your destitute cousin $30,000 to start a dog grooming business on September I. The note is for nine months and has an interest rate of 14%. How much interest did you earn? When I was examining your payroll records, I noticed that you showed no payroll for the last three days of the month. Your weekly payroll is $2,400 and is earned equally each day Monday through Friday 8. The banker has instructed Ashley to prepare the necessary adjusting entries to errors. Assume that equipment has a useful life of 10 years and a salvage value of $6,000. Further, assume that there are $975 in office supplies on hand. correct these Required: 1. Record adjusting entries for each of the above events including explanations. If any event requires a reversing entry, please record it as well. Compute the correct net income for Ashley Judd Fine Motors. 2