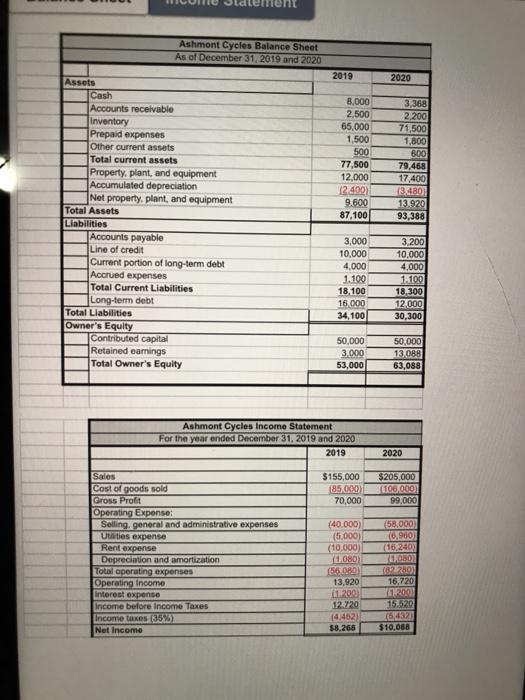

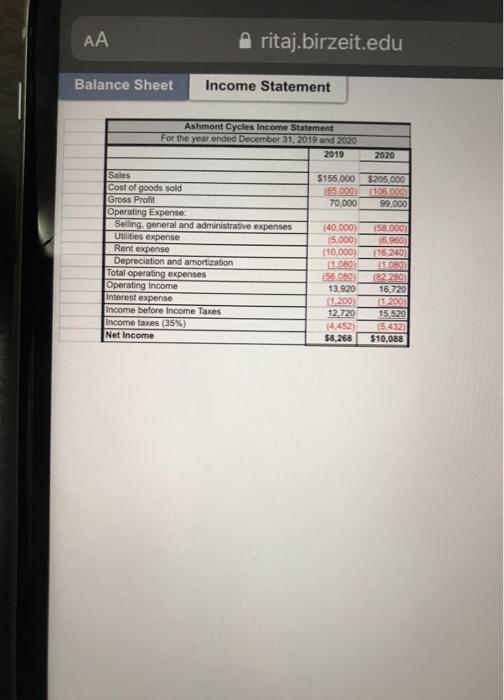

Ashmont Cycles Balance Sheet As of December 31, 2019 and 2020 2019 2020 8.000 2,500 65,000 1,500 500 77,500 12,000 12.400) 9.600 87,100 3,368 2.200 71,500 1.800 600 79,468 17,400 (3 480) 13.920 93,388 Assets Cash Accounts receivable Inventory Prepaid expenses Other current assets Total current assets Property, plant, and equipment Accumulated depreciation Net property, plant, and equipment Total Assets Liabilities Accounts payable Line of credit Current portion of long-term debt Accrued expenses Total Current Liabilities Long-term debt Total Liabilities Owner's Equity Contributed capital Retained earings Total Owner's Equity 3,000 10,000 4,000 1.100 18,100 16.000 34,100 3.200 10,000 4,000 1.100 18,300 12,000 30,300 50,000 3.000 53,000 50,000 13.088 63,088 Ashmont Cycles Income Statement For the year ended December 31, 2019 and 2020 2019 2020 $155,000 185.00 70,000 $205,000 (106.000) 99.000 Sales Cost of goods sold Gross Profit Operating Expense: Selling, general and administrative expenses Utaties expense Rent expense Depreciation and amortization Total operating expenses Operating Income Interest expense Income before Income Taxes Income takes (35%) Net Income (40.000) (5,000) (10,000) (1.080) (560) 13.920 1200 12.729 14,452) $8.265 (58,000) 16.960 (16.240) 1080 (2780) 16,720 200 15.520 6,4323 $10.088 AA ritaj.birzeit.edu Balance Sheet Income Statement Ashmont Cycles Income Statement For the year ended December 31, 2019 and 2020 2019 2020 $155.000 $205.000 185.000 105.000 70.000 99.000 Sales Cost of goods sold Gross Profit Operating Expense Selling, general and administrative expenses Utilities expense Rent expense Depreciation and amortization Total operating expenses Operating income Interest expense Income before Income Taxes Income taxes (35%) Net Income (40,000) 15.000 (10.000) 1.080 5608) 13.920 0-200 12720 (4.452) $8.268 (58.000) 6.960) (15.240) 1080) 182.280 16,720 0 2001 15520 (5.432) $10,088 2. Analyze the overall financial situation from a time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability. (2 marks)