Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Asian perpetual bond market fizzes to life by Don Weiland, published in the Financial Times on 7 June 2017. 1) Based on your own

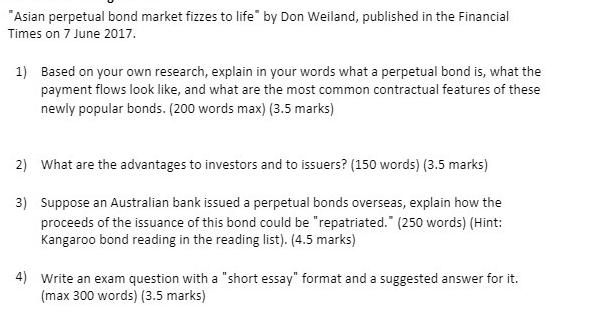

"Asian perpetual bond market fizzes to life" by Don Weiland, published in the Financial Times on 7 June 2017. 1) Based on your own research, explain in your words what a perpetual bond is, what the payment flows look like, and what are the most common contractual features of these newly popular bonds. (200 words max) (3.5 marks) 2) What are the advantages to investors and to issuers? (150 words) (3.5 marks) 3) Suppose an Australian bank issued a perpetual bonds overseas, explain how the proceeds of the issuance of this bond could be "repatriated." (250 words) (Hint: Kangaroo bond reading in the reading list). (4.5 marks) 4) Write an exam question with a "short essay" format and a suggested answer for it. (max 300 words) (3.5 marks)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 A perpetual bond is a type of bond that has no fixed maturity date and pays a coupon indefinitely hence its name perpetual Unlike traditional bonds with a specific maturity date perpetual bonds have ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started