Answered step by step

Verified Expert Solution

Question

1 Approved Answer

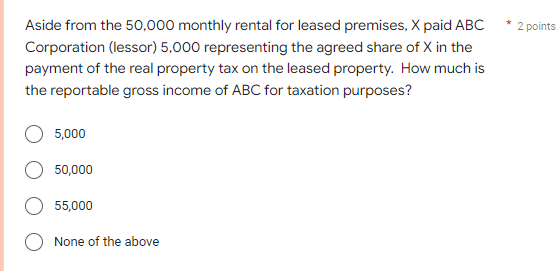

Aside from the 50,000 monthly rental for leased premises, X paid ABC Corporation (lessor) 5,000 representing the agreed share of X in the payment

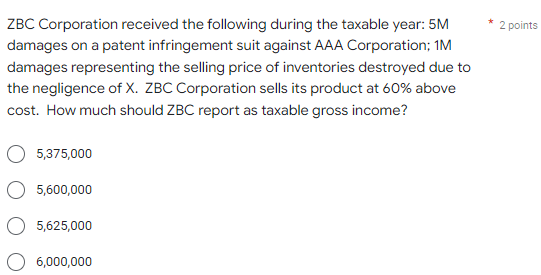

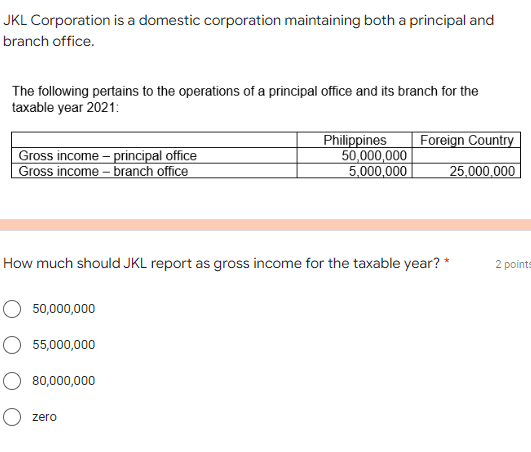

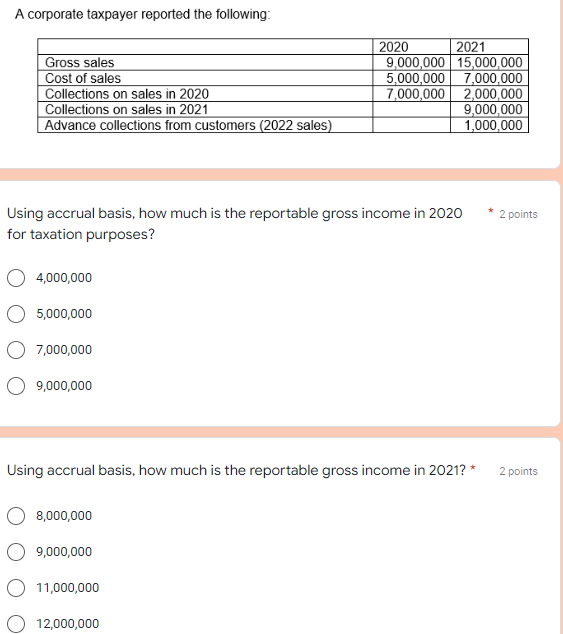

Aside from the 50,000 monthly rental for leased premises, X paid ABC Corporation (lessor) 5,000 representing the agreed share of X in the payment of the real property tax on the leased property. How much is the reportable gross income of ABC for taxation purposes? 5,000 50,000 55,000 None of the above * 2 points ZBC Corporation received the following during the taxable year: 5M damages on a patent infringement suit against AAA Corporation; 1M damages representing the selling price of inventories destroyed due to the negligence of X. ZBC Corporation sells its product at 60% above cost. How much should ZBC report as taxable gross income? O 5,375,000 5,600,000 O 5,625,000 6,000,000 * 2 points JKL Corporation is a domestic corporation maintaining both a principal and branch office. The following pertains to the operations of a principal office and its branch for the taxable year 2021: Gross income - principal office Gross income - branch office Philippines 50,000,000 5,000,000 Foreign Country 25,000,000 How much should JKL report as gross income for the taxable year?* O 50,000,000 55,000,000 O 80,000,000 O zero 2 points A corporate taxpayer reported the following: Gross sales Cost of sales Collections on sales in 2020 Collections on sales in 2021 Advance collections from customers (2022 sales) Using accrual basis, how much is the reportable gross income in 2020 for taxation purposes? 4,000,000 5,000,000 7,000,000 9,000,000 Using accrual basis, how much is the reportable gross income in 2021? * 8,000,000 9,000,000 2020 2021 9,000,000 15,000,000 5,000,000 7,000,000 7,000,000 2,000,000 9,000,000 1,000,000 11,000,000 12,000,000 2 points 2 points

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each question 1 ABC Corporation ABC Corporation received 50000 monthly rentals for l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started