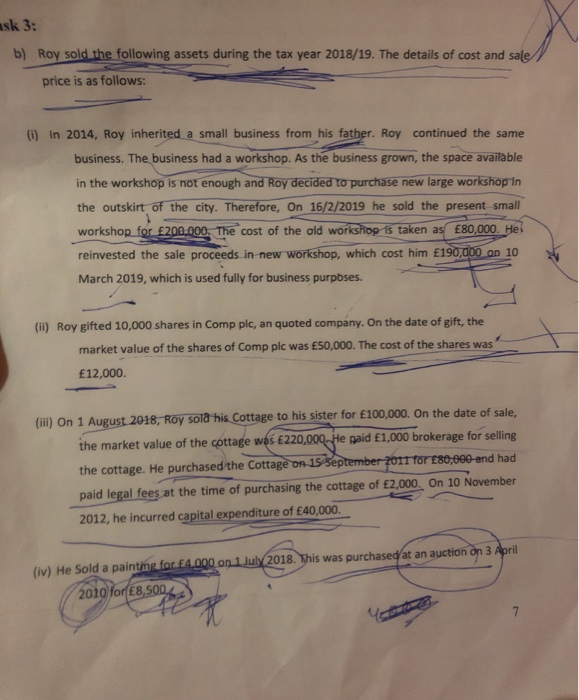

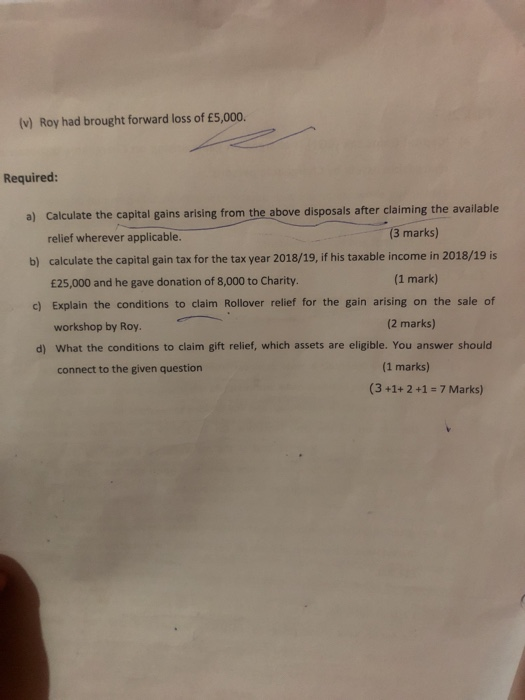

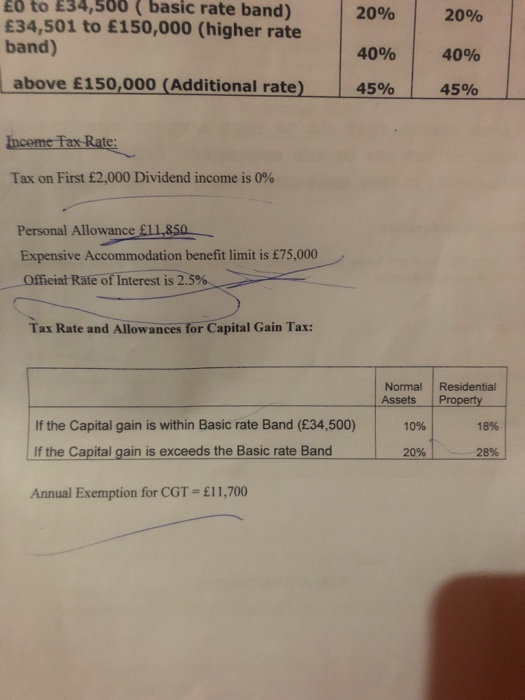

ask 3: b) Roy sold the following assets during the tax year 2018/19. The details of cost and sal price is as follows: () in 2014, Roy inherited a small business from his father. Roy continued the same business. The business had a workshop. As the business grown, the space available in the workshop is not enough and Roy decided to purchase new large workshop in the outskirt of the city. Therefore, On 16/2/2019 he sold the present small workshop for 200.000. The cost of the old workshop is taken as 80,000. He reinvested the sale proceeds in new workshop, which cost him 190,000 on 10 March 2019, which is used fully for business purposes. (11) Roy gifted 10,000 shares in Comp plc, an quoted company. On the date of gift, the market value of the shares of Comp plc was 50,000. The cost of the shares was 12,000. (IM) on 1 August 2018, Roy sold his Cottage to his sister for 100,000. On the date of sale, the market value of the cottage was 220,000. He paid 1,000 brokerage for selling the cottage. He purchased the Cottage on 15 September 2011 for 80,000 and had paid legal fees at the time of purchasing the cottage of 2,000. On 10 November 2012, he incurred capital expenditure of 40,000. (iv) He Sold a painting for 4.000 on 1 July 2018. This was purchased at an auction on 3 April 2010 for 8,500 ) (v) Roy had brought forward loss of 5,000. Required: a) Calculate the capital gains arising from the above disposals after claiming the available relief wherever applicable. (3 marks) b) calculate the capital gain tax for the tax year 2018/19, if his taxable income in 2018/19 is 25,000 and he gave donation of 8,000 to Charity. (1 mark) c) Explain the conditions to claim Rollover relief for the gain arising on the sale of workshop by Roy. (2 marks) d) What the conditions to claim gift relief, which assets are eligible. You answer should connect to the given question (1 marks) (3 +1+2 +1 = 7 Marks) 20% 20% 0 to 34,500 (basic rate band) 34,501 to 150,000 (higher rate band) above 150,000 (Additional rate) 40% 40% 45% 45% Income Tax Rate: Tax on First 2,000 Dividend income is 0% Personal Allowance 11,850 Expensive Accommodation benefit limit is 75,000 Official Rate of Interest is 2.5% Tax Rate and Allowances for Capital Gain Tax: Residential Normal Assets Property 10% 18% If the Capital gain is within Basic rate Band (34,500) If the Capital gain is exceeds the Basic rate Band 20% - 28% Annual Exemption for CGT = 11,700 ask 3: b) Roy sold the following assets during the tax year 2018/19. The details of cost and sal price is as follows: () in 2014, Roy inherited a small business from his father. Roy continued the same business. The business had a workshop. As the business grown, the space available in the workshop is not enough and Roy decided to purchase new large workshop in the outskirt of the city. Therefore, On 16/2/2019 he sold the present small workshop for 200.000. The cost of the old workshop is taken as 80,000. He reinvested the sale proceeds in new workshop, which cost him 190,000 on 10 March 2019, which is used fully for business purposes. (11) Roy gifted 10,000 shares in Comp plc, an quoted company. On the date of gift, the market value of the shares of Comp plc was 50,000. The cost of the shares was 12,000. (IM) on 1 August 2018, Roy sold his Cottage to his sister for 100,000. On the date of sale, the market value of the cottage was 220,000. He paid 1,000 brokerage for selling the cottage. He purchased the Cottage on 15 September 2011 for 80,000 and had paid legal fees at the time of purchasing the cottage of 2,000. On 10 November 2012, he incurred capital expenditure of 40,000. (iv) He Sold a painting for 4.000 on 1 July 2018. This was purchased at an auction on 3 April 2010 for 8,500 ) (v) Roy had brought forward loss of 5,000. Required: a) Calculate the capital gains arising from the above disposals after claiming the available relief wherever applicable. (3 marks) b) calculate the capital gain tax for the tax year 2018/19, if his taxable income in 2018/19 is 25,000 and he gave donation of 8,000 to Charity. (1 mark) c) Explain the conditions to claim Rollover relief for the gain arising on the sale of workshop by Roy. (2 marks) d) What the conditions to claim gift relief, which assets are eligible. You answer should connect to the given question (1 marks) (3 +1+2 +1 = 7 Marks) 20% 20% 0 to 34,500 (basic rate band) 34,501 to 150,000 (higher rate band) above 150,000 (Additional rate) 40% 40% 45% 45% Income Tax Rate: Tax on First 2,000 Dividend income is 0% Personal Allowance 11,850 Expensive Accommodation benefit limit is 75,000 Official Rate of Interest is 2.5% Tax Rate and Allowances for Capital Gain Tax: Residential Normal Assets Property 10% 18% If the Capital gain is within Basic rate Band (34,500) If the Capital gain is exceeds the Basic rate Band 20% - 28% Annual Exemption for CGT = 11,700