Answered step by step

Verified Expert Solution

Question

1 Approved Answer

asked, based on your written report. See the Skills Appendix for advice on 1. Are the values shown necessarily the values you could get?

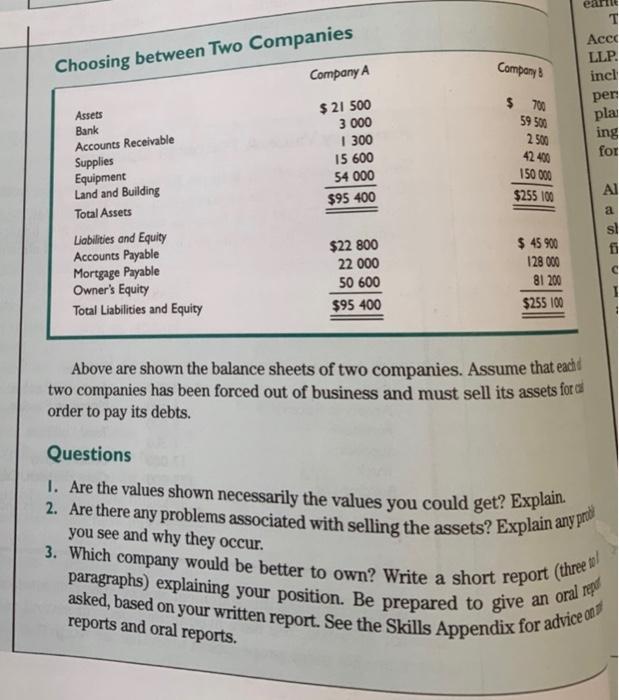

asked, based on your written report. See the Skills Appendix for advice on 1. Are the values shown necessarily the values you could get? Explain. 2. Are there any problems associated with selling the assets? Explain any prb 3. Which company would be better to own? Write a short report (three tol Choosing between Two Companies Company A Acce LLP. incl per pla ing for Company & $ 21 500 3 000 I 300 15 600 $ 700 59 500 2 500 42 400 Assets Bank Accounts Receivable Supplies Equipment Land and Building 54 000 150 000 Al $95 400 $255 100 Total Assets a Liabilities and Equity Accounts Payable Mortgage Payable Owner's Equity $ 45 900 $22 800 22 000 50 600 128 000 81 200 Total Liabilities and Equity $95 400 $255 100 Above are shown the balance sheets of two companies. Assume that each two companies has been forced out of business and must sell its assets for d order to pay its debts. Questions I. Are the values shown necessarily the values you could get? Explat you see and why they occur. reports and oral reports.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Values shown can be historical costs and may not be the actual realizable value of the assets etc ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started