Answered step by step

Verified Expert Solution

Question

1 Approved Answer

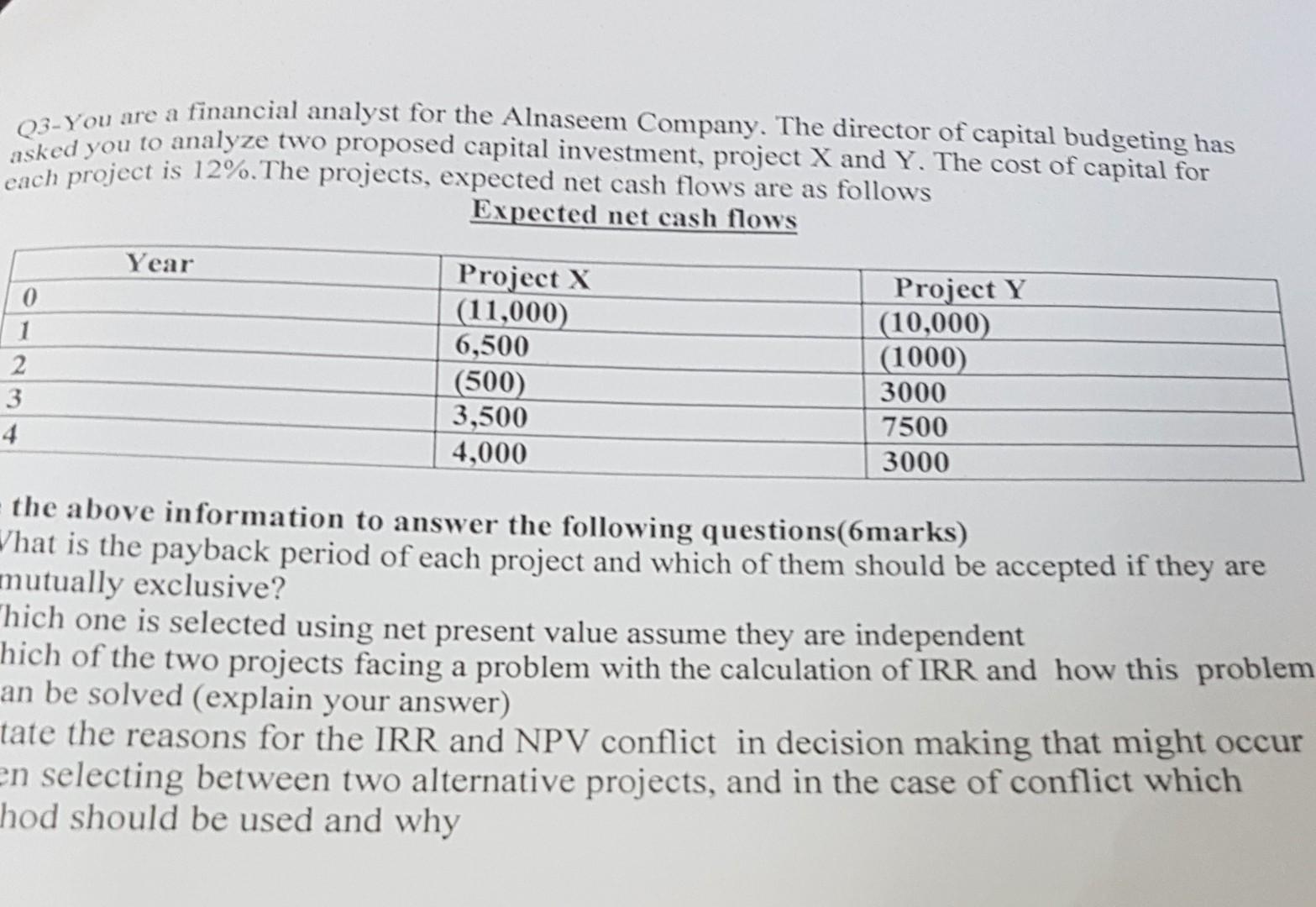

asked you to analyze two proposed capital investment, project X and Y. The cost of capital for Q3. You are a financial analyst for the

asked you to analyze two proposed capital investment, project X and Y. The cost of capital for Q3. You are a financial analyst for the Alnaseem Company. The director of capital budgeting has each project is 12%. The projects, expected net cash flows are as follows Expected net cash flows Year 0 1 2 3 4 Project x (11,000) 6,500 (500) 3,500 4,000 Project Y (10,000) (1000) 3000 7500 3000 the above information to answer the following questions(6marks) What is the payback period of each project and which of them should be accepted if they are mutually exclusive? "hich one is selected using net present value assume they are independent hich of the two projects facing a problem with the calculation of IRR and how this problem an be solved (explain your answer) tate the reasons for the IRR and NPV conflict in decision making that might occur en selecting between two alternative projects, and in the case of conflict which hod should be used and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started